The Evolution of Currency, Commerce and Future of Finance

Reflections

The story of currency and commerce is, at its core, the story of human civilization. Every shift in how societies exchange value—from bartering livestock to trading digital tokens—reveals a deeper shift in how they understand power, freedom, and equality. And every shift exposes the tension between the old world and the new world: one built on land, lineage, and survival; the other built on abstraction, algorithms, and scale.

The old world measured wealth in soil, seasons, and sovereignty. The new world measures it in data, derivatives, and digital footprints. Yet beneath both worlds lies a set of questions that remain unanswered, and perhaps deliberately unasked: Where in the world does 1 = 2? Can free speech and free thought—the governing basis and foundations of all education systems be taught in societies that are not free?

What is peace in an era where war drives markets? Who decides what is right or wrong? On what planet are people equal—from currency to the vote? In the old world where male voice dominates and female must produce two for the equivalence of one, based on gender and law, how is wealth controlled in the chain of command?

These questions are not philosophical indulgences. They are the invisible architecture of global finance.

Human trade began long before money existed. Early societies relied on barter—grain for tools, hides for pottery—an elegant system until communities grew large enough that trust and coincidence of wants became unreliable. This inefficiency pushed humanity toward commodity money: shells, salt, spices, metals. These items held intrinsic value and could be stored, transported, and standardized. Marketplaces emerged as the first commercial hubs, where traders became diplomats and commerce became culture.

As civilizations expanded, so did the sophistication of their financial systems. Mesopotamia developed early accounting; Egypt built grain banks; China introduced standardized bronze coins and later the world’s first paper money. The Lydians minted the first regulated coinage, while Greek and Roman empires spread monetary systems across continents. Currency became not only a medium of exchange but a tool of empire—proof that money has always been political.

In the old world, war was fought for land, water, and survival, continued until today, foreigners are not allowed profitability from investment into the stock market, unless born in climate passport. In the new world, war is fought for markets, minerals, and digital dominance. Old world war protected the tribe integrity. New world war protects the supply chain. The battlefield changed, but the economic logic did not: conflict reallocates resources, resets power, and redefines value.

Evolution of the Passport - Old World Sovereignty:

How Sponsorship Systems Shape Identity, Mobility, and Long‑Term Stability**

Across the Middle East, millions of migrant workers live under a structure known as the Kafala system—a sponsorship model that ties a person’s legal identity, residency, and mobility directly to a private employer. While often described as a cultural or religious practice, the modern Kafala system is not rooted in Islamic law. Instead, it is a state‑engineered labor framework that has profound implications for human freedom, economic mobility, and long‑term stability. This system reveals a deeper global truth: when a person’s passport is controlled by someone else, their future is no longer their own creating an environment of fear.

Islamic Law vs. the Modern Kafala System

Traditional Islamic kafala was a moral guarantee, a voluntary act of community responsibility. It was never intended to control a person’s movement, employment, or identity.

The modern Kafala system, however, functions very differently:

- It binds a worker’s immigration status to an employer.

- It restricts job changes without permission.

- It often involves confiscation of passports.

- It limits the right to exit the country.

- It creates dependency rather than protection.

This structure has been widely criticized by international organizations, human rights groups, and scholars for creating conditions that resemble indentured labor.

Passport Control: The Core Mechanism of Power

In most Kafala‑based states, the employer—not the government—controls the worker’s:

- passport

- residency permit

- ability to travel

- ability to change jobs

- access to legal recourse

This means the employer effectively holds the worker’s identity.

Without a passport, a person cannot:

- leave the country

- open a bank account

- access many public services

- secure independent housing

- protect their assets

- assert their rights

The passport becomes a tool of control, and the worker becomes dependent on the sponsor for every aspect of life.

The Long‑Term Impact on Stability and Identity

1. No Path to Permanence

Most Gulf states do not offer:

- permanent residency

- citizenship pathways

- long‑term security

Even after decades of contribution, a worker can be removed at any time. This creates a life lived in permanent uncertainty.

2. Economic Limitations

Because workers cannot freely:

- change employers

- negotiate wages

- start businesses

- own property

- invest independently

their ability to build long‑term wealth is severely restricted.

3. Identity Fragmentation

When a person’s legal existence depends on an employer, identity becomes conditional.

This erodes:

- autonomy

- dignity

- psychological stability

- the sense of belonging

The result is a life lived in limbo—neither fully included nor fully free.

The Search for Alternative Passport Systems

When a person’s freedom is restricted by a sponsorship system, they naturally seek alternative forms of sovereignty.

This often includes:

- second citizenship

- residency‑by‑investment programs

- passports from stable, rights‑based nations

- legal structures that protect wealth from state interference

These are not luxuries—they are survival strategies.

A secure passport provides:

- freedom of movement

- access to global markets

- the ability to own property

- the right to start businesses

- protection from arbitrary detention or deportation

- the ability to build and protect wealth

In short, a stable passport restores the freedoms that the Kafala system restricts.

Why People Pursue New Sovereign Identities

The modern global economy rewards mobility.

When mobility is restricted, opportunity is restricted.

A second passport becomes:

- a shield against exploitation

- a tool for economic independence

- a gateway to global education and employment

- a safeguard for family stability

- a foundation for long‑term wealth creation

It is not simply a travel document—it is a freedom document.

The Global Push for Reform

Some Gulf states have begun reforming the Kafala system:

- Qatar has removed exit permits and introduced a minimum wage.

- Saudi Arabia has announced major changes to allow job mobility.

- The UAE has implemented new labor laws that reduce employer control.

However, enforcement remains inconsistent, and many workers still experience severe restrictions.

The core issue remains unresolved: freedom cannot exist when identity is controlled by another party.

A New Understanding of Freedom and Sovereignty

The Kafala system highlights a universal truth:

freedom is inseparable from mobility, identity, and economic autonomy.

When a person cannot:

- hold their own passport

- choose their own employer

- leave a country freely

- protect their own assets

they are not fully free.

This is why individuals living under restrictive systems seek new forms of sovereignty—new passports, new residencies, new legal identities—to reclaim the basic rights that should never have been negotiable.

Conclusion: The Passport as a Human Right

In a globalized world, the passport has become one of the most powerful determinants of:

- opportunity

- safety

- wealth

- dignity

- freedom

The Kafala system exposes how fragile these rights can be when tied to employer control.

It also reveals why so many individuals pursue alternative citizenships and global mobility pathways.

Ultimately, the pursuit of a stable passport is the pursuit of:

- autonomy

- security

- economic possibility

- the right to build a life without interference

It is the pursuit of freedom itself.

Islamic finance introduced a counter‑logic. By prohibiting interest (riba), emphasizing ethical investment, and requiring asset‑backed transactions, it created stability in a world shaped by tribal alliances and early globalization. It rejected the idea that money should multiply without labour, risk, or real economic activity. In doing so, it challenged the rise and fall of interest—the cycle that has built and collapsed empires, inflated and destroyed currencies, enriched and impoverished nations. Today, as countries confront debt crises and inflation, the principles of Islamic finance echo with renewed relevance: stability is not an accident; it is a design.

Commerce evolved alongside currency, and nowhere is this more visible than in the transition from pioneer economies to modern retail. In early settler societies, economic life began with working the land. Families produced what they consumed—grain, vegetables, livestock, dairy—and bartered the surplus. Agriculture was not merely an industry; it was survival, identity, and the foundation of local economies. Food and beverage production followed the rhythms of the seasons, and price was determined by scarcity, weather, and the physical labour required to bring goods to market.

This is also where the ancestral cry “get off my land” originates. It is not simply territorial. It is economic. Land was life, livelihood, lineage, and legacy. To lose land was to lose identity, autonomy, and the ability to feed one’s family. In the old world, land was the first currency. In the new world, land is collateral.

As communities grew, the general store emerged as the commercial heart of rural life. It was a place where farmers traded eggs for nails, butter for cloth, or grain for tools. The general storekeeper extended credit through handwritten ledgers—an early form of consumer finance based on trust, reputation, and community standing. Prices reflected transportation costs, supply limitations, and the risks of frontier commerce. The store was not simply a retailer; it was a banker, a post office, a news hub, and a social institution.

Industrialization transformed this landscape. Railways connected rural producers to urban markets. Agriculture shifted from subsistence to commercial scale. Food and beverage production industrialized, creating new price dynamics driven by machinery, fertilizers, and global supply chains. Department stores and catalog companies democratized access to goods, while early mass marketing reshaped consumer behaviour. The late 20th century brought big‑box retail—Walmart, Costco, Home Depot—where scale became the competitive advantage and global supply chains reshaped local economies. Prices fell, selection expanded, and commerce became a science of logistics.

The 21st century ushered in digital commerce: and the rise of omnichannel marketing. Commerce became borderless. Data replaced foot traffic. Algorithms replaced salespeople. Financial vehicles evolved in parallel: ledgers became bank loans; cash became credit cards; credit cards became digital wallets; investment moved from local markets to global stock exchanges, venture capital, and crypto assets. The marketplace that once required a wagon and a dirt road now exists in the palm of a hand.

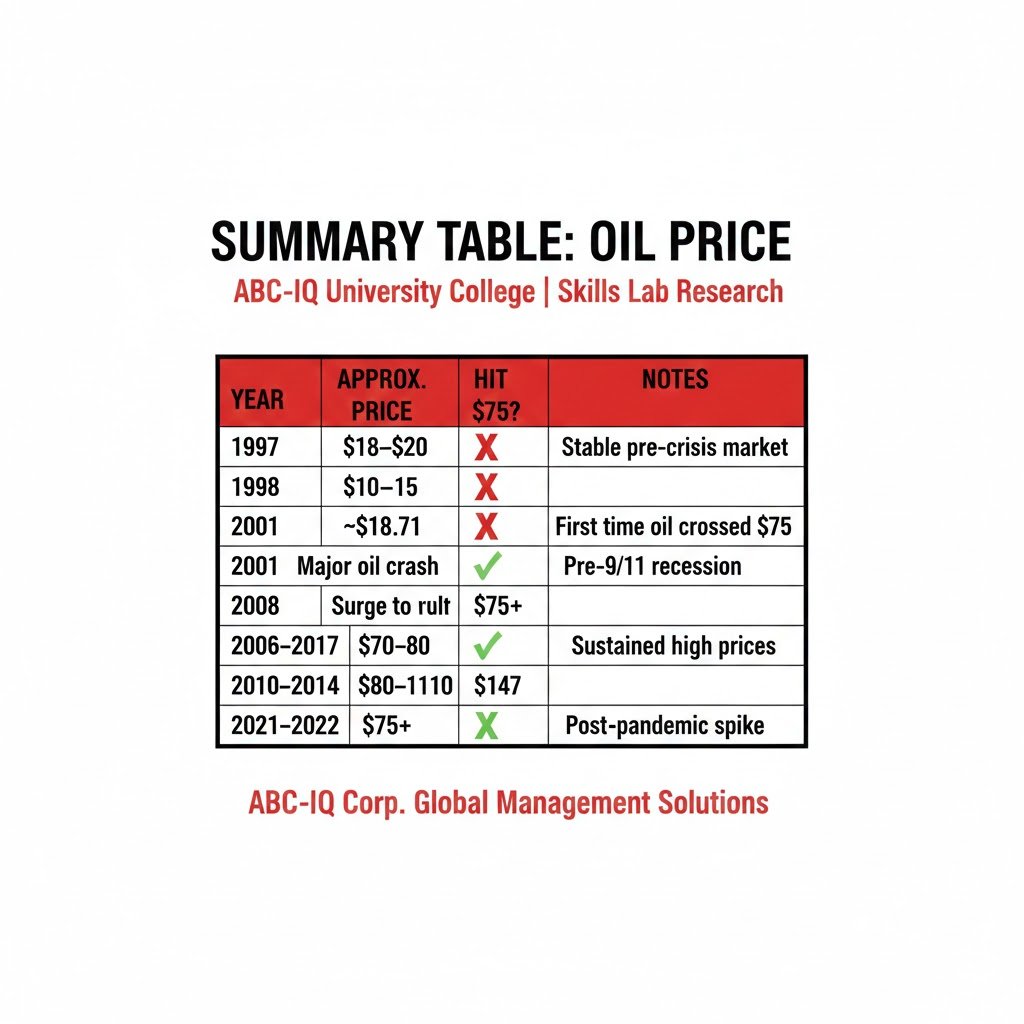

Yet even as commerce expanded, the world remained tethered to the geopolitics of energy. Oil became the backbone of the global economy, and with it came a new form of economic determinism: peace equals trade, war equals profit. Oil prices rise with conflict. Currencies fall with instability. Military presence secures trade routes, energy supplies, and geopolitical influence. The purpose of the modern military is no longer solely territorial defense—it is economic stabilization, market protection, and digital infrastructure security. In a globalized world, war is not only a political act but a financial instrument.

Media amplifies this dynamic. Narratives shape markets. Headlines move currencies. Information—controlled, curated, or censored—becomes a form of economic power. This raises another foundational question: Does free media exist when governments and corporations control access to technology? The answer determines not only political freedom but financial freedom. Markets thrive on transparency; societies thrive on truth. When information becomes a commodity, both become fragile.

Amid these global forces, the definition of value itself is shifting. For centuries, wealth was measured in land, metals, and later industrial output. Today, value is increasingly tied to knowledge, health, and human potential. This is where cannabis efficacy enters the economic narrative—not as a cultural debate, but as a medical and financial reality. Modern pharmacology has demonstrated that cannabinoids can reduce inflammation, support neurological function, improve sleep, and alleviate chronic pain. Research on myelin regeneration and neuroprotection suggests potential applications for degenerative diseases. In economic terms, cannabis represents a transition from chemical‑heavy pharmaceuticals to plant‑based medicine, from punitive drug policy to regulated health innovation, from underground markets to taxable industries. Its efficacy challenges old world assumptions about medicine, morality, and economic control.

The evolution of currency and commerce is therefore not only a story of markets—it is a story of cultural transformation. As societies move from petroleum to green energy, from fiat currency to digital assets, from industrial economies to knowledge economies, the central question becomes: What kind of world are we building? A world where peace drives prosperity, or one where conflict remains the engine of financial growth. A world where information is free, or one where media is a gatekeeper. A world where medicine is accessible, or one where efficacy is overshadowed by politics. A world where equality is a principle, or one where currency determines citizenship.

The future of currency, finance, and trade will be shaped by artificial intelligence, automation, digital currencies, climate‑driven economic restructuring, and shifting geopolitical power. But beneath these forces lies a deeper truth: the value of money reflects the values of society. If peace becomes the foundation of economic policy, markets will stabilize. If freedom of thought becomes the foundation of education, innovation will accelerate. If equitable access to medicine—including cannabis—becomes the foundation of health systems, human potential will expand.

The evolution of currency is ultimately the evolution of humanity and economic equity. And the next chapter will be written not by markets alone, but by the answers we choose to give to the questions that have followed us since the beginning: What is freedom. What is equality. What is peace. And what is the true purpose of an economy? Who owns the earth?

Reflections from 150 solutions roadmap 2030 - 2050.

ABC-IQ Extension School

Manual: Developing Leadership Capacity through Emotional Intelligence

ABC-IQ School of Business Level 4

Mind Science Subject Companion Tools

Action Research