There’s a quiet violence in the way poverty is legislated—not through dramatic welfare repeals, but through technical adjustments buried in fiscal code. This second tier of changes operates on a different register than Part I’s blunt cuts. Here, the strategy is disappearance by algorithm: small recalibrations to formulas, thresholds, and verification systems that collectively shrink the pool of the "deserving poor." When heating costs are excluded from food stamp calculations for non-elderly households, when Medicaid checks shift from annual to biannual, when Pell Grants vanish for students below half-time enrollment—these aren’t budget measures. They’re death by a thousand spreadsheets.

The brilliance (and brutality) of this approach is its deniability. Unlike dramatic welfare slashes that make headlines, these changes operate through procedural suffocation:

- A 5% state contribution mandate for food assistance guarantees red states will tighten eligibility (as seen with TANF)

- Moving hospital funding deadlines to future years avoids immediate outcry

- Six-month Medicaid checks don’t cut benefits—they ensure people lose them through paperwork attrition

The New Poverty Math

- The Inflation Illusion: Freezing the Child Tax Credit at $2,000 post-2028 while ending used EV credits means working families lose twice—less cash, higher transport costs

- The Student Debt Bait-and-Switch: Counting only certain repayment plans toward PSLF creates a bureaucratic minefield where 72% of applicants already fail

- The Hospital Hunger Games: Redefining "rural" spacing requirements will collapse safety-net hospitals just as private equity vultures circle

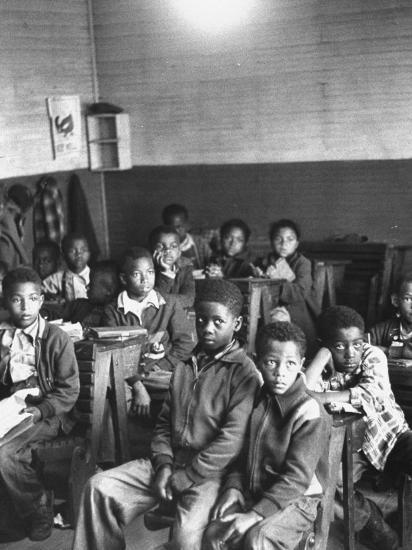

Paradoxes for the Discussion in the AP African American Studies Classroom:

- Why does a "National Accuracy Clearinghouse" for food aid recipients exist while corporate subsidy audits remain voluntary?

- How can oil companies deduct legal settlements but poor families can’t deduct cooling costs in a climate crisis?

- Why must Medicaid recipients reprove eligibility twice yearly while PPP loan recipients faced zero income verification?

Teaching the Subtext

Have students:

- Map the Delay Tactics: Chart how deferred effective dates (2027, 2028, 2029) correlate with election cycles

- Play Bureaucracy Survivor: Assign roles (single parent, caseworker, hospital CFO) to navigate the new rules—who collapses first?

This is governance by stealth dispossession—where poverty isn’t solved but administrated into invisibility. The lesson isn’t in the cuts themselves, but in the asymmetry: the poor face accelerating surveillance while corporations enjoy expanding discretion.

The Quiet Takeaway

These changes reveal the central fiction of modern austerity: that the state is shrinking. In truth, it’s being repurposed—less a safety net than a sieve, meticulously designed to separate the "deserving" from the disposable. And as always, the sorting algorithm wears a neutral face: not "racist," just "fiscally responsible." Not "cruel," just "accurate." That’s how disappearance works best—when no one notices it’s happening.