There's something incredibly liberating about the knowledge that you're in control of your finances. I've learned that some seasons in life are actually predictable, and it's up to us to prepare for them. One of the most valuable tools in my financial toolbox is something called "sinking funds." If you're not familiar with the term, let's dive into what sinking funds are and why I believe in preparing for life's seasons, one dollar at a time.

Sinking Funds: A Lifeline for Financial Planning

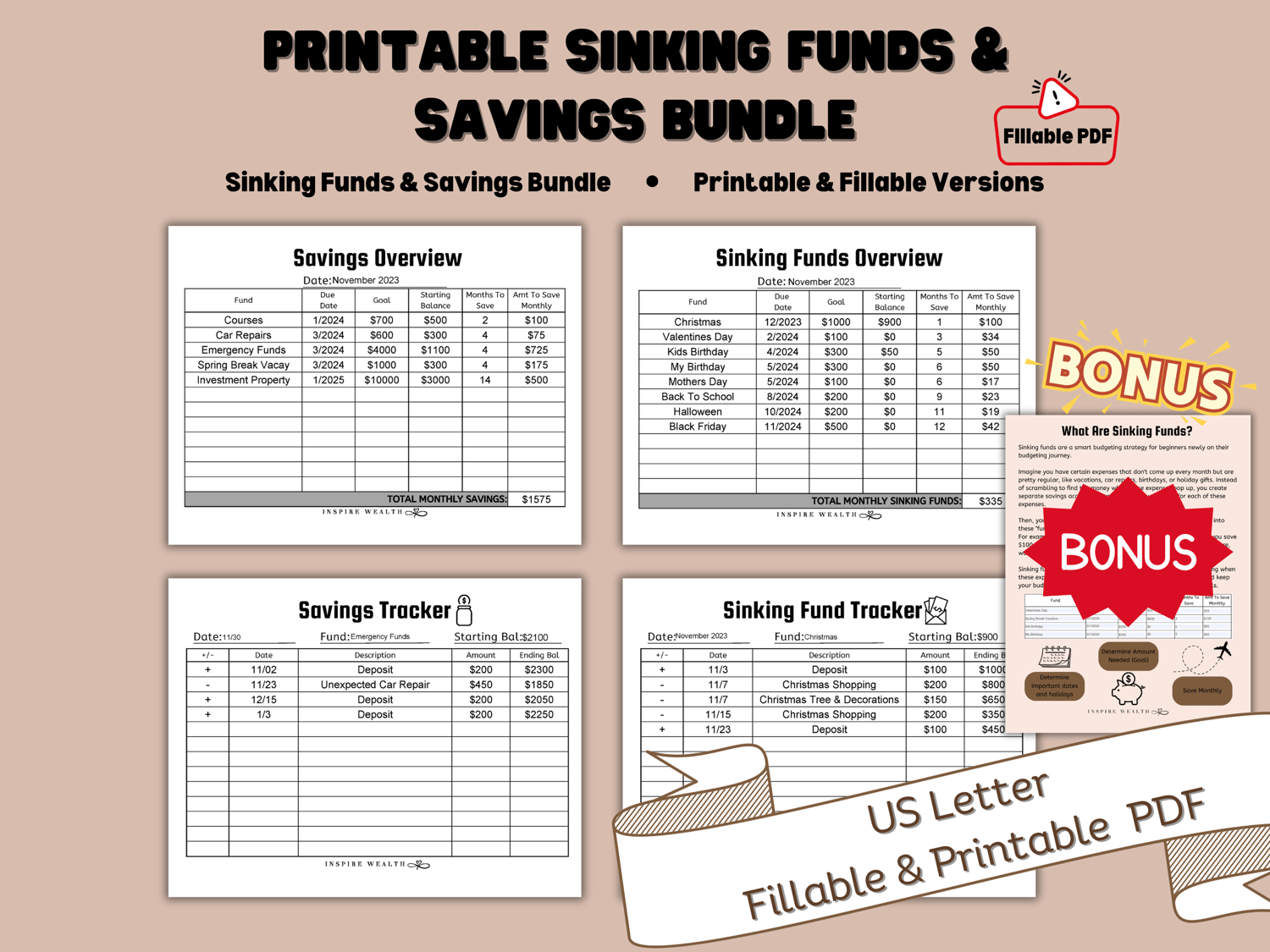

Sinking funds are, in essence, mini savings accounts created for specific, foreseeable expenses. These could be annual bills, seasonal expenses, or upcoming events. Instead of being caught off guard when these financial obligations come knocking, sinking funds empower you to be ready, without straining your monthly budget.

Why Sinking Funds Matter?

Well, let's break it down:

- Predictable Expenses: Life is full of expenses that we know are coming, whether it's the annual car insurance bill, holiday gifts, or back-to-school shopping. Sinking funds help you allocate a portion of your income toward these costs over time.

- Budgeting Made Easier: By saving a little each month, you ensure that these larger, intermittent expenses won't disrupt your monthly budget. It's about spreading out the financial impact over the course of a year.

- Peace of Mind: When you have sinking funds in place, you're better prepared for life's financial surprises. That sense of financial control can alleviate stress and anxiety.

- Avoiding Debt: Without sinking funds, many people resort to credit cards or loans to cover unexpected expenses. Sinking funds help you steer clear of unnecessary debt.

Starting Your Sinking Funds Journey

So, how can you get started with sinking funds? It's simpler than you might think:

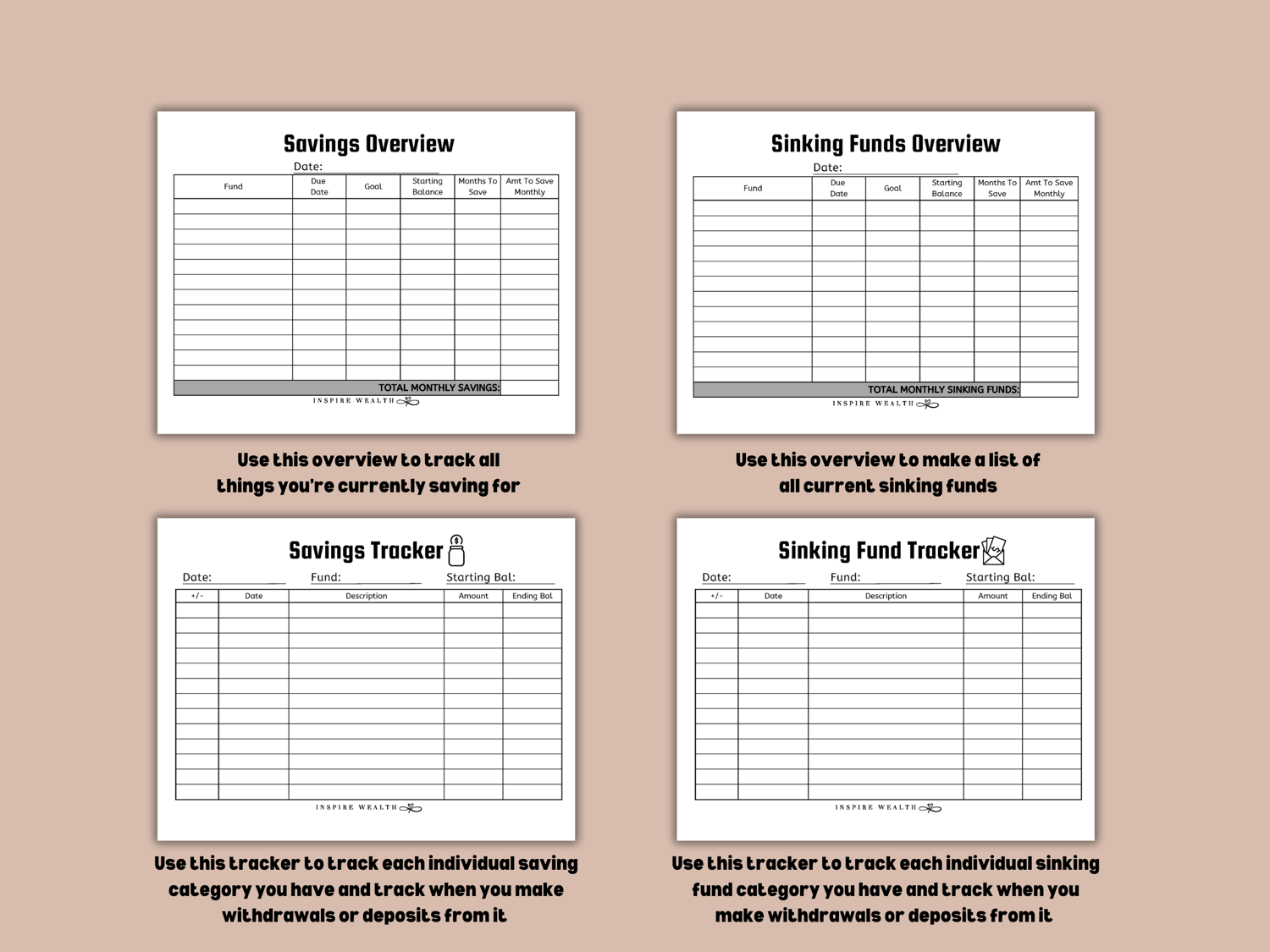

- Identify Your Sinking Fund Categories: Take a look at your life and identify those predictable expenses. Common sinking fund categories include car repairs, medical expenses, holidays, birthdays, vacations, and home maintenance.

- Set Realistic Goals: Determine how much you'll need for each category. It's all about breaking it down into monthly contributions that you can comfortably afford.

- Automate Your Savings: The beauty of sinking funds is that they're easy to set up. You can automate your savings by creating separate savings accounts for each category or simply by earmarking a portion of your current savings or checking account.

- Stay Committed: Consistency is key. Stay committed to contributing to your sinking funds each month, no matter how small the amount may seem.

PRO TIP

Here's a little trick I've found handy – cash envelopes. When you're saving for a specific sinking fund, consider using an envelope to physically set aside the money. It's a tangible way to see your progress and prevents you from accidentally dipping into those funds for other purposes. Plus, it's a visual reminder of your financial goals.

As someone who values the power of financial preparation, sinking funds have become my secret weapon in maintaining financial stability. They're like little financial life vests that keep me afloat when life's inevitable expenses surface. I hope that by sharing this financial strategy, you too can find peace and security in the knowledge that you're prepared for the seasons of life, one dollar at a time.