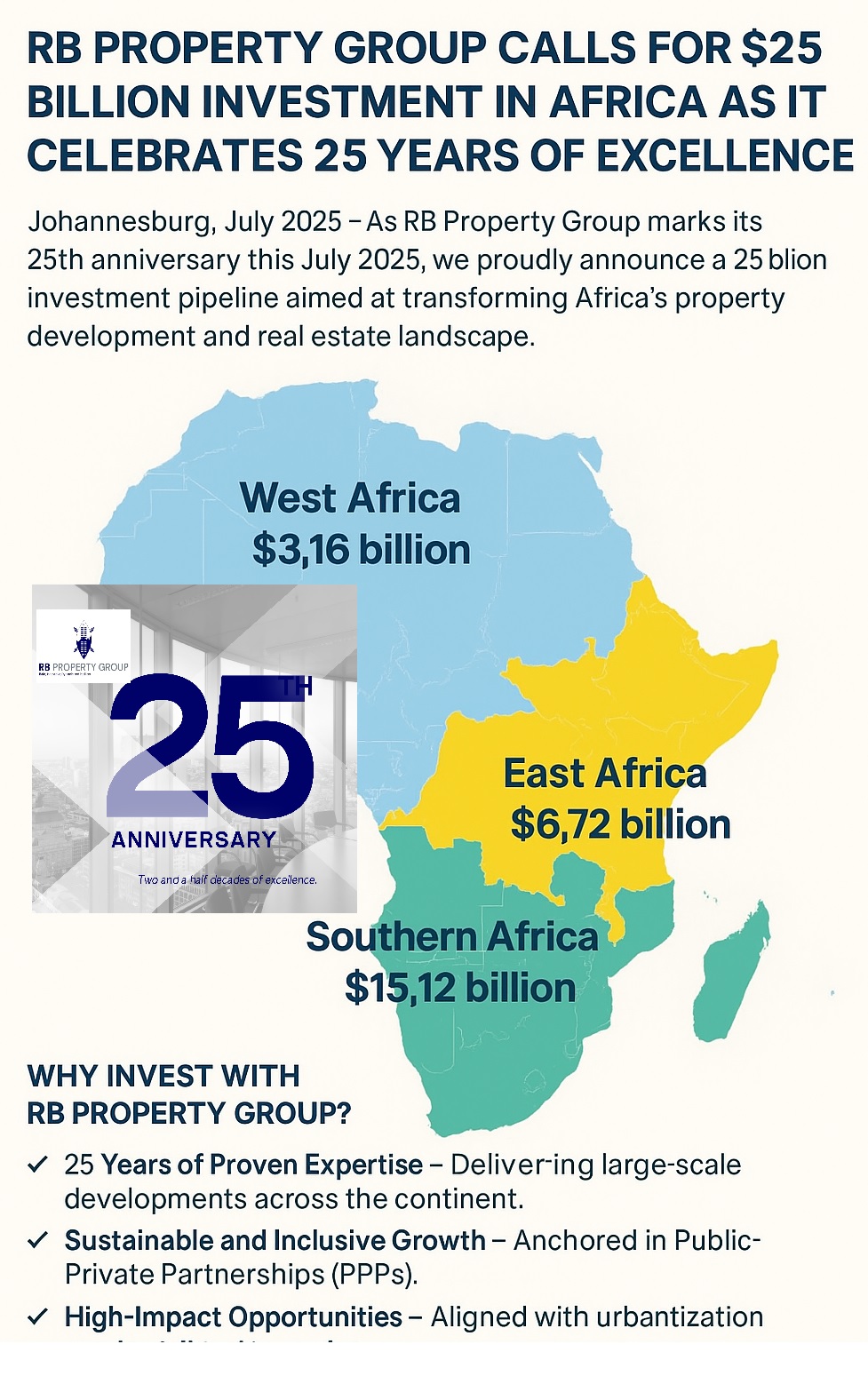

RB Property Group Calls for $25 Billion Investment in Africa as It Celebrates 25 Years of Excellence

Johannesburg, July 2025 – As RB Property Group marks its 25th anniversary this July 2025, we proudly announce a $25 billion investment pipeline designed to unlock Africa’s urban, industrial, and economic potential. We are calling on global investors, banks, development finance institutions, and private developers to partner with us in delivering bankable, high-return projects across the continent.

A Bold Pipeline Across Africa’s Regions

Region Budget (USD) West Africa $3,160,000,000 East Africa $6,715,004,325 Southern Africa $15,124,995,675 Total $25,000,000,000 These investments target affordable housing, industrial parks, mixed-use precincts, student accommodation, and commercial developments, aligning with Africa’s growth trajectory.

Africa’s Growth Story: The Case for Investment

1. Demographic Advantage

Africa is the youngest continent in the world, with an average age of just 19 years. By 2050, one in four people globally will be African. This young, urbanizing population drives demand for housing, retail, education, and industrial infrastructure, making Africa the fastest-growing real estate market globally.

2. High Demand Across Asset Classes

- Housing: Africa faces a housing backlog exceeding 50 million units, with over 70% of urban residents living in informal or inadequate housing.

- Industrial: Rapid trade expansion under the African Continental Free Trade Area (AfCFTA) fuels demand for logistics hubs, warehousing, and industrial parks.

- Retail & Commercial: With a rising middle class, modern retail space is projected to grow by over 50% in the next decade, and Grade-A office space demand is increasing in key cities.

- Mixed-Use Precincts: Integrated developments combining residential, retail, commercial, and hospitality are emerging as prime investment opportunities in Africa’s major cities.

3. Infrastructure Gap and Bankable Projects

Africa requires an estimated $130–170 billion annually for infrastructure development, but only $68 billion is currently funded, leaving a significant gap. RB Property Group’s $25 billion pipeline presents ready-to-implement, bankable projects that align with national development plans and are structured for Public-Private Partnerships (PPPs).

Expected Returns on Investment (ROI)

RB Property Group projects competitive, above-market returns across asset classes:

- Affordable Housing & Student Accommodation: 12–15% annual ROI, driven by high occupancy rates and government-backed subsidies.

- Industrial & Logistics Parks: 15–18% ROI, supported by strong demand for distribution hubs under AfCFTA.

- Retail & Commercial Developments: 10–14% ROI, with growing demand for Grade-A retail and office space.

- Mixed-Use Precincts: 16–20% ROI, benefiting from integrated living, working, and leisure spaces in high-density cities.

25 Years, $25 Billion – A Commitment to Africa’s Future

For 25 years, RB Property Group has delivered transformative property developments across the continent. Our projects drive inclusive economic growth, job creation, SMME empowerment, and sustainable urban regeneration.

With this $25 billion pipeline, we aim to:

✅ Create thousands of jobs across construction, manufacturing, and services sectors.

✅ Empower SMMEs through supply chain participation.

✅ Transform urban spaces into world-class, sustainable precincts.

✅ Unlock housing and infrastructure deficits, meeting the needs of Africa’s youthful population.

Join Us in Building Africa’s Future

📩 For Investment Enquiries:

Email: info@rbpropertygroup.co.za

Website: www.rbpropertygroup.co.za

Together, let’s shape Africa’s cities, communities, and economic future.