Art of Becoming Worthless

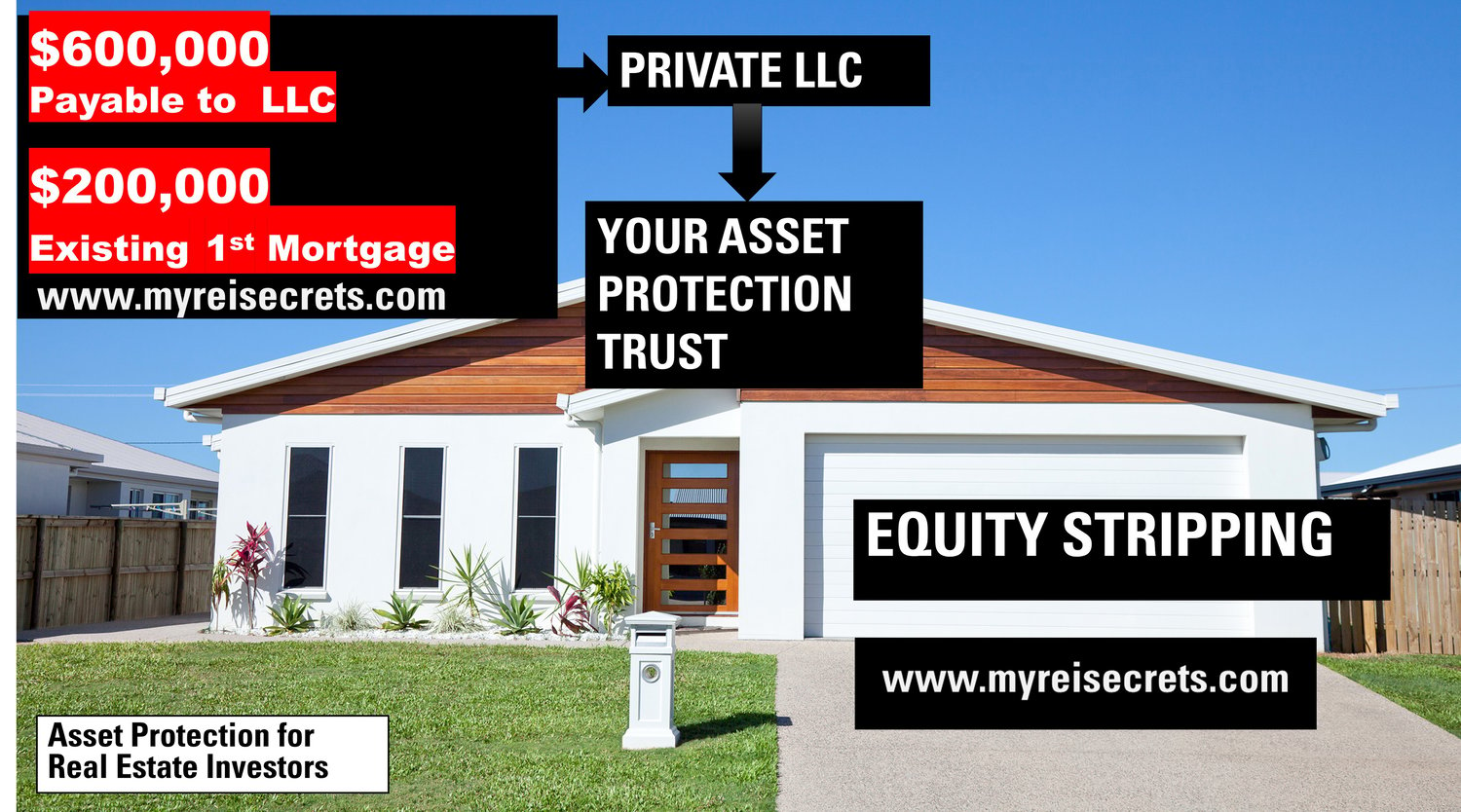

Equity stripping is a financial strategy that involves reducing the equity in a property or asset, often with the goal of protecting it from potential creditors or legal claims. This strategy is sometimes used by individuals or businesses to shield their assets from creditors, judgments, or lawsuits. However, it's essential to note that using equity stripping in an unethical or illegal manner can lead to legal consequences.

Here are some key aspects of equity stripping:

1. Definition: Equity stripping is the process of encumbering or reducing the equity value of an asset, such as a home, real estate property, or business, to make it less attractive or accessible to creditors or claimants.

2. Methods of Equity Stripping:

- Mortgage Refinancing: One common method is refinancing a property to take out a new mortgage or home equity loan. This can reduce the owner's equity by increasing the debt secured by the property.

- Asset Transfers: Transferring ownership of assets to a family member or a trust can also be used to reduce one's equity in those assets.

- Liens and Encumbrances: Placing liens or encumbrances on an asset can reduce its equity value. This may involve taking out loans or lines of credit secured by the asset.

- Complex Financial Structures: Some individuals or businesses may use complex financial structures to obfuscate ownership and control of assets, making it difficult for creditors to access them.

3. Legal and Ethical Considerations:

- Equity stripping can be legal if it is done in compliance with the law and for legitimate purposes, such as asset protection or estate planning.

- However, using equity stripping to defraud creditors or evade legal responsibilities is illegal and can lead to severe penalties.

4. Asset Protection and Estate Planning:

- Some people use equity stripping as part of a broader asset protection or estate planning strategy to safeguard their assets from potential creditors, lawsuits, or estate taxes.

- It's crucial to consult with legal and financial professionals when considering equity stripping as part of your asset protection or estate planning strategy to ensure it's done legally and ethically.

5. Risks and Downsides:

- Equity stripping can reduce your control over assets and limit your financial flexibility.

- It may also result in higher interest rates or fees if you take on additional debt.

- Misusing equity stripping strategies can lead to legal consequences and damage your financial reputation.

In summary, equity stripping is a financial strategy used to reduce the equity value of assets for various purposes, including asset protection and estate planning. However, it should be approached with caution and in compliance with the law to avoid legal issues and financial risks. Consulting with legal and financial professionals is highly advisable when considering equity stripping as part of your financial planning.