An instructor-led course helping you build fully explicit market valuation models.

Two weeks: Mondays and Wednesdays, 10am-12noon

Cohort One: 6th-15th October 2025

Useful for valuers but also useful for investors updating DCF models to better forecast growth and return.

CPD: 16 hours

Course Content

Standards

I've been through the valuation standards (RICS, IVSC) with a fine tooth comb. I'll demonstrate everything with working models.

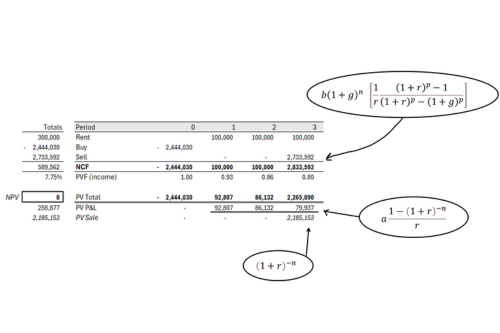

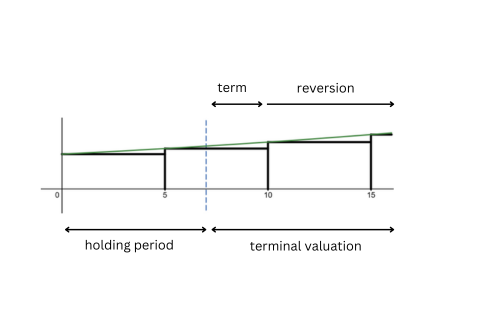

Mathematics

Stop fretting over the maths. I'll show you how to work with income formula and apply your knowledge in every real estate scenarios.

Reconciliation

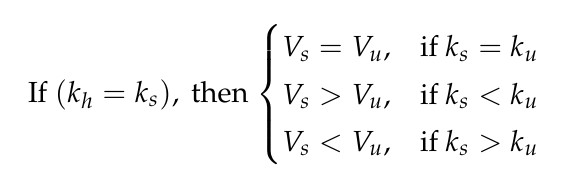

Can you defend an explicit valuation model? I'll show you how to reconcile implicit and explicit so you can use any model with confidence.

Modelling

And finally, build a sensible cash flow model. I'll show you how to build a cash flow appropriate for market valuations.

Build a DCF Valuation

I will explain the anatomy of DCF models in Excel so you can interrogate, build and adjust them quickly.

Reconcile Valuations

What happens when you compare implicit and explicit valuations? Instill confidence in your clients with models that work perfectly.

Model Risk

What happens when you change the holding period? Demonstrate to clients you can provide mathematically robust models in any given scenario.

Spot Mispricing

What happens when your client's model doesn't add up? Show your forensic skill and correctly apply rental growth and investment return.

A true learning experience..

Guided Online Lessons

Each week there are around three hours of engaging, interactive guided lessons with videos, infographics, exercises and written material designed especially for this course.

Dowloadable Models

All excel files, code and formula are downloadable for review and practice. I will also provide you with adaptable templates that you can put to use right away.

4 x two-hour Webinars

Instructor led training, live modelling sessions and discussion all facilitated by me, Natalie Bayfield.

10am-12noon Monday and Wednesday over 2 weeks (6th -15th October 2025)

Book Today

Be one of the first fully equipped with the very latest thinking in real estate valuation.

Secure your place on this brand new, limited edition, course.

Natalie Bayfield

I am your instructor and author of Fully Explicit Discounted Cash Flows a paper that discovered:

a) why typical explicit investor models don't reconcile

b) why there might be systematic mispricing as a result, and crucially

c) how to build models that work

I have combined this forensic knowledge with 30 years experience teaching and consulting on Real Estate Financial Modelling (University of Cambridge, Bayes Business School, Bayfield Training) to create a suite of comprehensive models, guidance and notes. I will also lead the four two-hour webinars to give you hands on experience building perfectly working models.