Multi-Dimensional Comparative Intelligence Report-Leading Retailers In South Africa

Why Read This

I used to skim reports like this. Too academic. Too abstract. Too late to matter.

Then I ran out of excuses.

When margins started slipping and competitors somehow stayed ahead of pricing shifts, I realized I’d been reacting—not leading. The data was there. I just hadn’t seen it translated into strategic choices.

This isn’t theory.

It’s an operational document for leadership.

If you’re making board-level decisions—or if your job depends on interpreting government signals before they hit your supply chain or pricing model—this will matter more than your next product meeting.

What you do before the budget locks in determines whether you’re in defense or control. Most wait. I won’t again.

What’s Inside (and Operationally Useful)

- Comparative Intelligence Matrix: See how top retailers diverge in strategy—who’s built a buffer, and who’s exposed.

- Scenario Model Design: Pre-built fiscal impact models for different government pathways.

- Strategic Advantage Map: Pinpoint which companies can turn fiscal moves into pricing or loyalty wins.

- Consumer Shift Nuances: AI-augmented insight into inflation vs. behavior vs. brand elasticity.

- Boardroom-Ready Recommendations: Cut through ambiguity—what to act on now, what to monitor, and what to shelve.

- Unmatched Value Propositions: Identify real margins beyond cost-cutting—insight-level plays most retailers miss.

Who It’s For

Retail & FMCG Executives

Protect margin. Understand consumer spending before it shifts. Align ops to strategic forecasts.

Strategic Planners & Boards

Ground decision scenarios in intelligence, not assumptions.

Investors & Analysts

Anticipate post-budget market dynamics faster than quarterly cycles reveal them.

Policymakers & Treasury Analysts

See how the private sector actually interprets and reacts to fiscal design.

Why Now

This budget season isn’t just numbers—it’s a directional signal for the next 18 months.

Fiscal signals from Q1–Q2 2025 have already begun to affect pricing agility, cost absorption strategies, and category prioritization.

If you wait for clarity, you’ve already missed the shift.

This report decodes the implications before they become headlines.

Format & Price

- Format: PDF

- Price: $1250

This isn’t an expense.

It’s what one wrong pricing round or inventory misfire would cost tenfold.

This report was built to protect high-stakes margin decisions—not to fill a folder.

If You’re Like Me…

You’ve seen too many reports that state the obvious. This one didn’t.

It changed how I saw timing, nuance, and competitive movement.

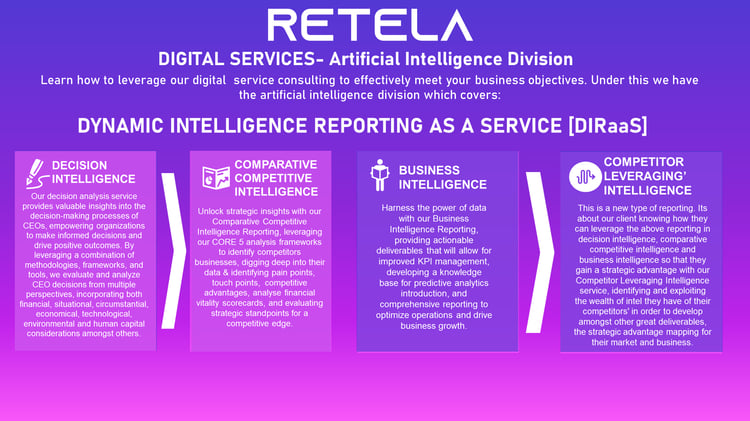

Retela’s work forced me to reframe what I considered a “decision-ready” insight. It’s layered, unapologetically strategic, and it speaks to how real businesses operate under pressure.

This is not a forecast. It’s an operating manual.

If you’re still making strategy without this kind of intelligence, you’re gambling more than you think.