Volatility 75 index strategy pdf

On Sale

$18.00

$18.00

This Is The Most Profitable Vix75 Strategy!

Unlock the secrets of the Volatility 75 Index with our comprehensive strategy book. Contact Us On WhatsApp To Get 50% of your purchase today!

The best volatility 75 index strategy for 2024

Welcome to the ultimate guide for mastering the Volatility 75 Index, one of the most intriguing and potentially lucrative markets in the world of trading. If you're a trader or investor looking not just to survive but to thrive in high-volatility markets, you've arrived at the perfect destination. Our strategy book is your definitive resource for unlocking the strategies and techniques you need to succeed.This is what the Vix75 book covers

Our Volatility 75 strategy book is the culmination of years of dedicated research and hands-on experience in the world of VIX-based markets. In this comprehensive guide, you'll find in-depth knowledge about:1. What moves Vix75 and Jump 75:

Understanding the factors that influence Vix75 and Jump 75 is essential because it enables traders to make informed decisions. Factors like market sentiment, geopolitical events, and economic data can significantly impact these indices. Knowing what moves them allows traders to anticipate and react to market shifts.2. Characteristic Behavior of These Instruments:

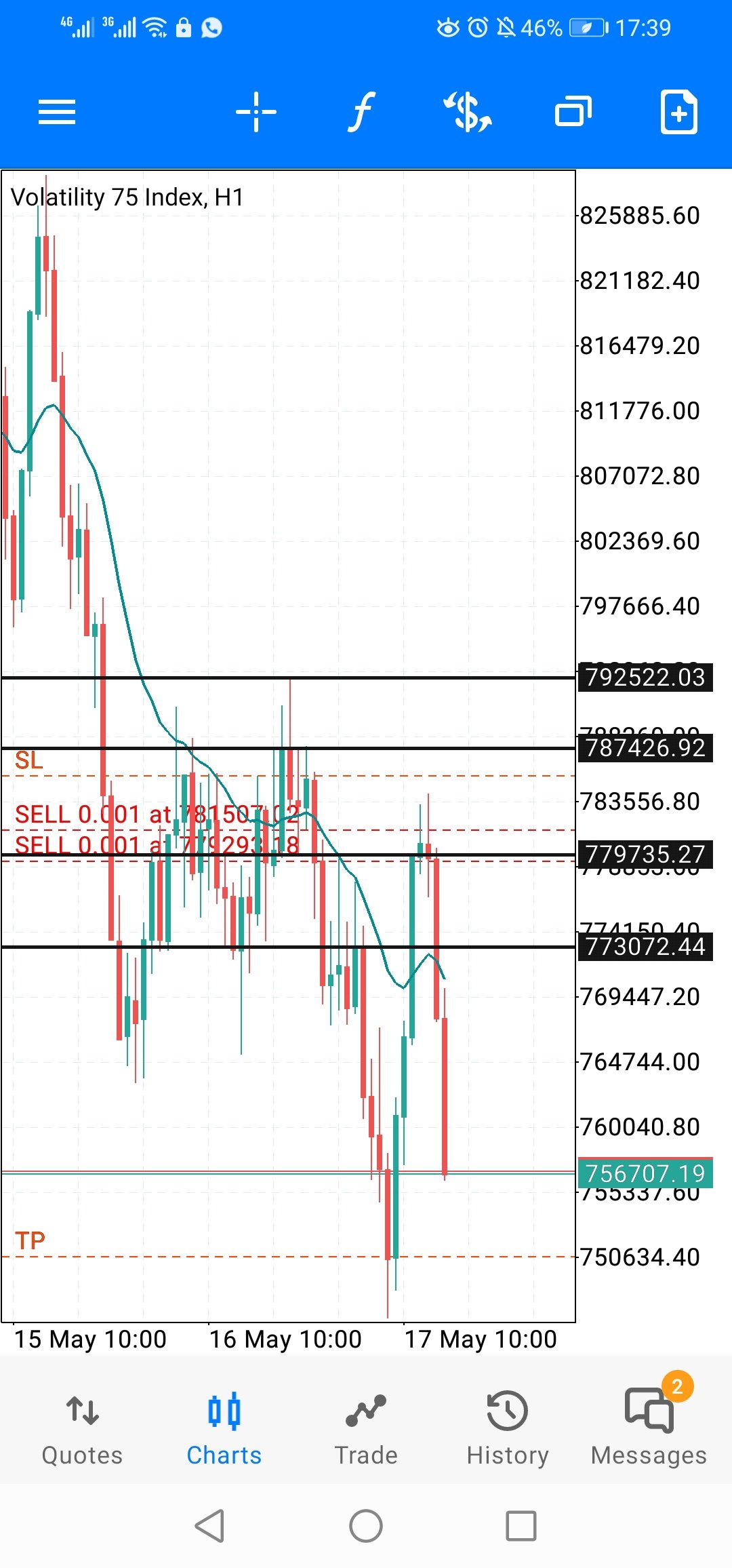

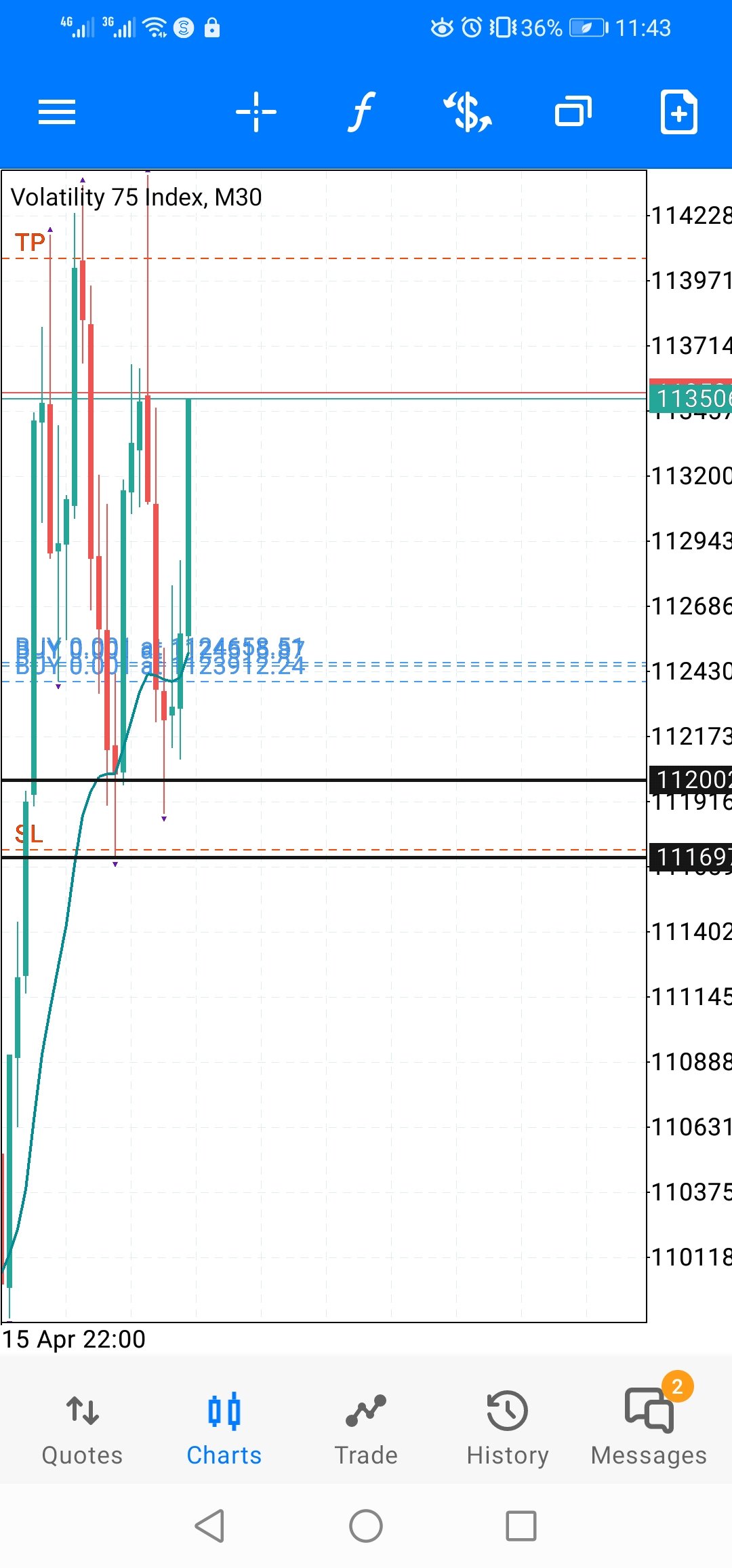

Each instrument has its unique characteristics. Vix75 and Jump 75, for example, exhibit high volatility and rapid price movements. Recognizing their behavior helps traders adapt their strategies to the specific challenges and opportunities these instruments present.3. Time Frames Used and the Reasons Thereof:

Selecting the right time frame is crucial because it affects the accuracy of your analysis and trade execution. Shorter time frames, like 1-minute or 5-minute, are suitable for day traders, while longer time frames, such as daily or weekly, are preferred by swing traders and investors. Choosing the appropriate time frame aligns with your trading style and goals.4. Best Sessions to Trade These Instruments In:

The timing of your trades matters. Knowing the best sessions to trade these instruments can improve your chances of success. For example, Vix75 is often more active during the U.S. trading session due to its correlation with the S&P 500. Recognizing when these indices are most active can lead to better trading opportunities.5. Main Strategy:

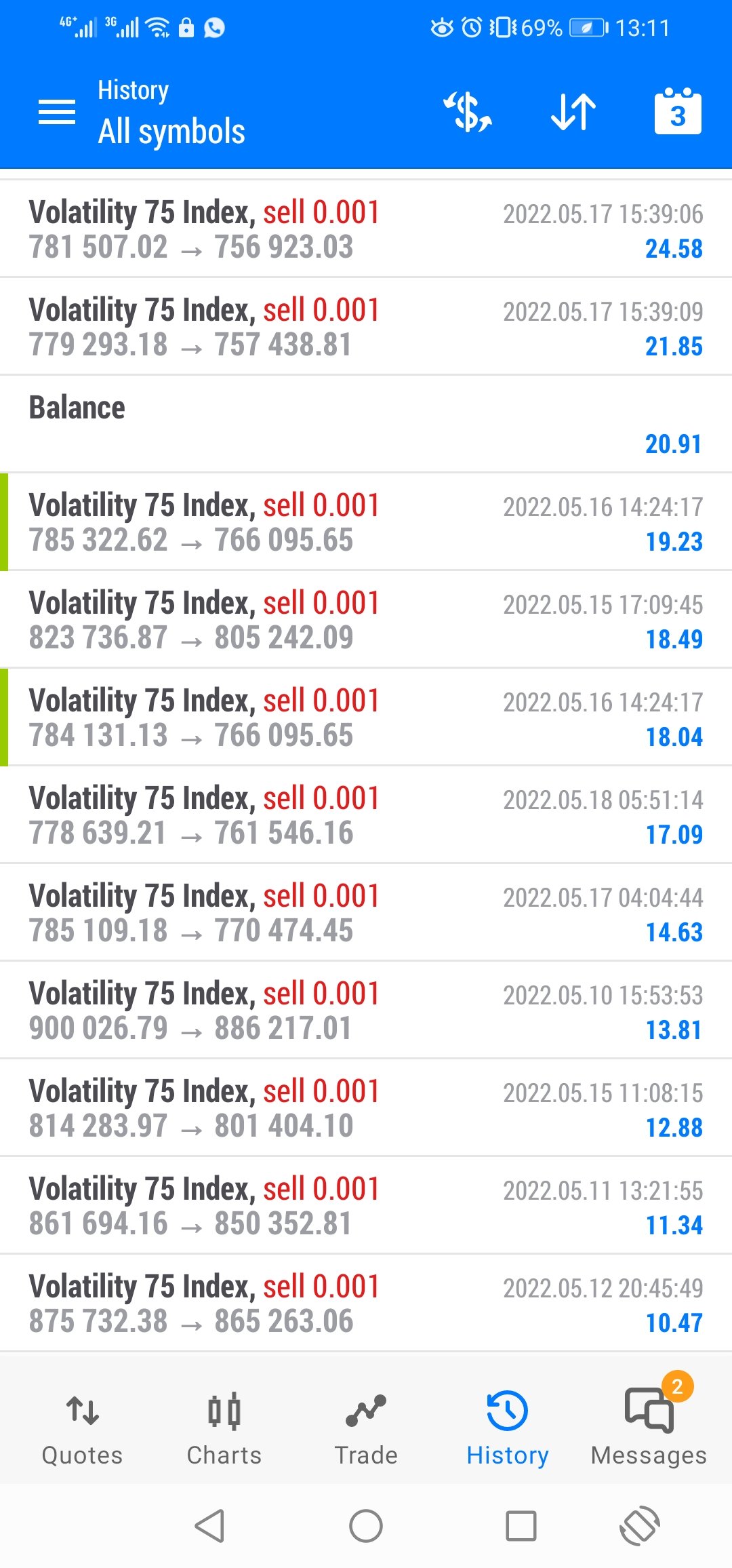

Your main trading strategy is the backbone of your success. A detailed strategy that covers entry criteria, stop loss, take profit areas, and exit criteria is crucial for consistency and risk management. Without a well-defined strategy, you're essentially trading blindly, which can lead to significant losses.6. Indicators Used with Their Settings and Price Action Tools:

Indicators and price action tools are your analytical aids. These tools provide valuable insights into market conditions, trends, and potential entry and exit points. Knowing which indicators to use, their settings, and how to combine them is the foundation of a robust trading system.7. How to Spot Invalidated Trades:

Recognizing when a trade setup is invalidated is essential for risk management. Not all trades will go as planned, and knowing when to cut your losses and exit a trade that isn't working is vital to preserving your capital.8. Management of Running Trades:

Managing open positions involves making decisions on whether to trail stops, take partial profits, or exit a trade entirely. Effective trade management can turn potential losses into gains and maximize profits.9. Live Market Application in Detail:

Real-time application of your strategy is where theory meets practice. Learning how to adapt your strategy to the ever-changing market conditions is crucial for long-term success.10. How to Combine Everything and Let It Work for You:

The ability to integrate all aspects of your trading strategy, from technical analysis to risk management, is what ultimately makes a trader successful. Combining all elements and executing them consistently is the key to achieving your trading goals.Benefits of the Volatility 75 index Strategy Book:

Confidence in High-Volatility Markets:

Our strategy book equips you with the knowledge and skills required to navigate the Volatility 75 Index with unwavering confidence, no matter how turbulent the market becomes. This newfound confidence will empower you to tackle high-volatility markets with poise.Risk Mitigation:

The strategies we've outlined help you minimize risk and safeguard your capital. This means you can trade without the constant fear of substantial losses, giving you peace of mind even during market uncertainty.Suitable for All Levels:

We've designed our book to cater to traders of all levels, whether you're just starting your trading journey or looking to refine your strategies. Our easy-to-follow guidance ensures that traders, regardless of their current expertise, will find value in our strategies.Practical and Actionable:

The strategies we present aren't theoretical concepts; they are actionable techniques that you can apply immediately. We understand that traders want results, and we're committed to providing you with the tools to achieve them.What else comes with the Vix75 Strategy Book?

- VIDEOS OF LIVE MARKET APPLICATION

- Psychology needed when trading these 2 instruments.

- Tips for growing your small account using this strategy

- Free lifetime mentorship from our best traders

- Customized quiz to check your readiness!

Master the Volatility 75 Index and maximize your profits. Get your copy of the strategy book now and embark on a journey to trading success. Your future in trading awaits you, and we're here to guide you every step of the way. Join us in this exciting journey to trading mastery and enjoy the fruits of your trading labor.

CONTACT US NOW TO GET YOUR 50% OFF!