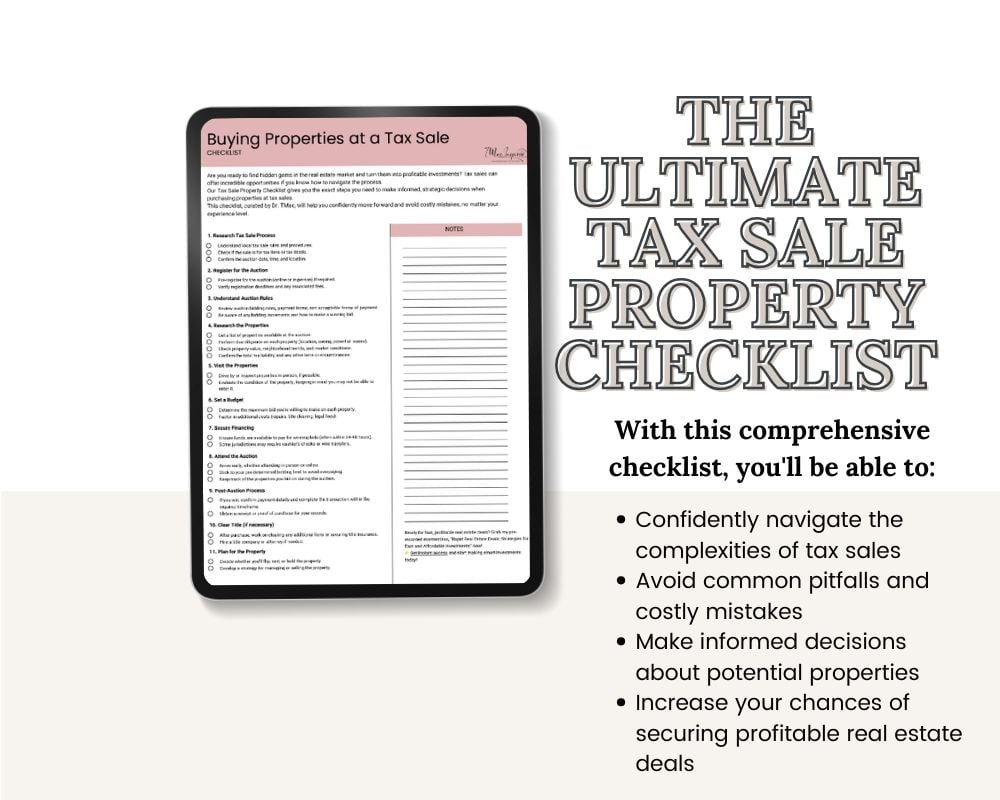

The Ultimate Tax Sale Property Checklist

Avoid Costly Mistakes and Make Informed Decisions When Buying Properties at Tax Sales

Are you ready to unlock the potential of tax sales and discover hidden real estate gems? Purchasing properties at tax sales can be a lucrative investment strategy, but it requires careful planning and execution to avoid costly mistakes. This comprehensive checklist, curated by Dr. TMac, will guide you through every step of the process, empowering you to make informed decisions and maximize your chances of success.

This checklist provides a step-by-step roadmap, covering critical aspects such as:

- Researching the Tax Sale Process

- Registering for the Auction

- Researching the Properties

- Understanding Auction Rules

- Setting a Budget

- Visiting the Properties

- Securing Financing

- Attending the Auction

- Post-Auction Process

With this comprehensive checklist, you'll be able to:

- Confidently navigate the complexities of tax sales

- Avoid common pitfalls and costly mistakes

- Make informed decisions about potential properties

- Increase your chances of securing profitable real estate deals

Don't miss out on this opportunity to master the art of tax sale investing!