Uniswap is a decentralized exchange (DEX) protocol running on the Ethereum blockchain, allowing users to swap cryptocurrencies and create trading pairs without the need for intermediaries.

Developed by Hayden Adams in 2018, Uniswap quickly became one of the most popular DeFi platforms on the Ethereum blockchain.

Features of Uniswap

️🏅Decentralized and Automated: Uniswap operates entirely decentralized and is governed by smart contracts. There's no third-party interference in confirming transactions.

️🏅Trading Pairs: Users can create trading pairs between any two cryptocurrencies on Uniswap, such as ETH/USDT, DAI/USDC, and many others.

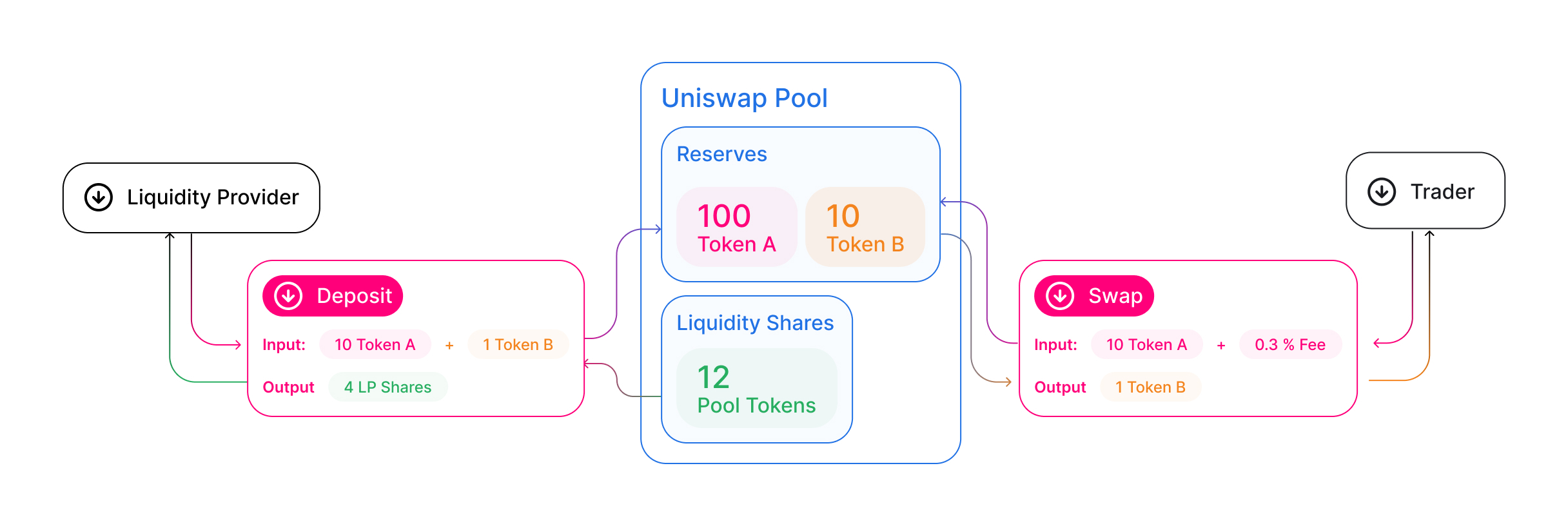

️🏅Constant Product Market Maker: Uniswap utilizes the Constant Product Market Maker model to determine prices and the amount of currency in each trading pair. This means each pair maintains a constant product of reserves. When users make trades, the value of each trading pair is adjusted accordingly.

️🏅Transaction Fees: Uniswap uses a fixed transaction fee system, depending on the size and value of the transaction. Users pay fees for adding liquidity to trading pairs or when executing trades.

📌📌📌 Trade cryptocurrencies at reputable exchanges: Best crypto exchanges

How Uniswap works?

🌈Uniswap operates based on an Automated Market Maker (AMM) model. Users can follow these steps to use Uniswap:

- Connect Wallet: To use Uniswap, users need to connect their wallet to the protocol through cryptocurrency wallets like MetaMask or Trust Wallet.

- Select Trading Pair: After connecting the wallet, users choose the trading pair they wish to participate in. For example, ETH/USDT.

- Execute Trade: Users can choose to buy or sell either of the currencies in the selected trading pair. Uniswap calculates the exchange rate based on the AMM model and executes the trade instantly.

- Manage Liquidity: To participate in trading on Uniswap and earn rewards from transaction fees, users can add their funds to trading pairs to become liquidity providers.

Evaluate the advantages and disadvantages of Uniswap

Advantages of Uniswap

- Decentralization: Uniswap operates on a decentralized model, leveraging smart contracts on the Ethereum blockchain. This eliminates the need for intermediaries and enhances security by reducing single points of failure.

- Accessibility: Anyone with an Ethereum wallet can access Uniswap, making it inclusive and globally available for trading cryptocurrencies.

- No Listing Requirements: Unlike traditional exchanges, Uniswap allows users to create new trading pairs easily without needing approval from central authorities. This fosters innovation and supports a wide range of tokens.

- Constant Product Market Maker (CPMM): Uniswap's CPMM model ensures liquidity for all trading pairs, maintaining prices through an algorithmic approach that adjusts prices based on supply and demand.

- Transparency: All transactions on Uniswap are transparent and verifiable on the Ethereum blockchain, enhancing trust among users.

Disadvantages of Uniswap

- High Gas Fees: Due to its operation on Ethereum, Uniswap transactions can incur high gas fees during periods of network congestion, making it costly for smaller trades.

- Impermanent Loss: Liquidity providers may experience impermanent loss when the price ratio of the tokens in a pair changes significantly compared to when they deposited them, affecting potential returns.

- Limited Token Support: While Uniswap supports a wide range of tokens, it primarily operates within the Ethereum ecosystem, limiting access to tokens from other blockchains unless wrapped or bridged.

- Front-Running Risk: Automated trading bots can exploit transaction information before it's confirmed on the blockchain, potentially impacting the execution price for traders.

🔴🔴Learn more about cryptocurrency:

⏩⏩ [https://azcoin.notion.site/What-is-Farfetch-Is-it-legal-in-Vietnam-b201570ba74940e291ee18ba4819ab5e]

Where to buy and sell UNI tokens?

🌈To buy or sell the UNI token, you can use several cryptocurrency exchanges that support trading UNI. Here are some popular options:

- Coinbase Pro: Coinbase Pro is a well-known cryptocurrency exchange that supports trading UNI against major fiat currencies and other cryptocurrencies.

- Binance: Binance is one of the largest cryptocurrency exchanges globally, offering a wide range of trading pairs for UNI, including BTC, ETH, USDT, and more.

- Kraken: Kraken is another reputable exchange that supports UNI trading pairs, providing liquidity and a secure platform for trading.

- Huobi: Huobi is a global cryptocurrency exchange that offers UNI trading pairs against various cryptocurrencies and fiat currencies.

Conclusion

Uniswap stands out as one of the most advanced DeFi platforms, offering high flexibility and no reliance on third-party intermediaries for users. With the AMM model and simplicity in creating trading pairs, Uniswap has become a popular choice within the crypto community.