Business valuation services are an integral part of the corporate world, playing a crucial role in various aspects of financial decision-making. Whether you're looking to buy or sell a business, seeking funding, planning for retirement, or navigating legal issues, understanding the true worth of a business is essential. Business valuation services are the gateway to this knowledge, offering a blend of art and science to determine the value of a company. In this 800-word exploration, we will delve into the intricacies of business valuation services, understanding why they are so vital in the world of commerce. Alibaba.com

The Purpose of Business Valuation Services

Business valuation services are designed to answer one fundamental question: What is a business worth? This seemingly simple question holds immense significance in diverse scenarios:

- Mergers and Acquisitions (M&A): When companies merge or acquire other businesses, knowing the value of the target company is critical. Business valuation services provide an objective assessment of the target's worth, allowing informed negotiations and decisions.

- Investment and Funding: Entrepreneurs seeking capital for their ventures need to present an accurate and compelling valuation of their business to potential investors or lenders.

- Estate Planning: In the context of estate planning and inheritance, knowing the value of a family-owned business is vital for distributing assets equitably among heirs.

- Exit Strategy: Business owners planning to sell their enterprises need to have a clear understanding of their business's value to negotiate favorable deals.

- Legal Disputes: In litigation, business valuation services play a pivotal role in determining the value of a business involved in a dispute.

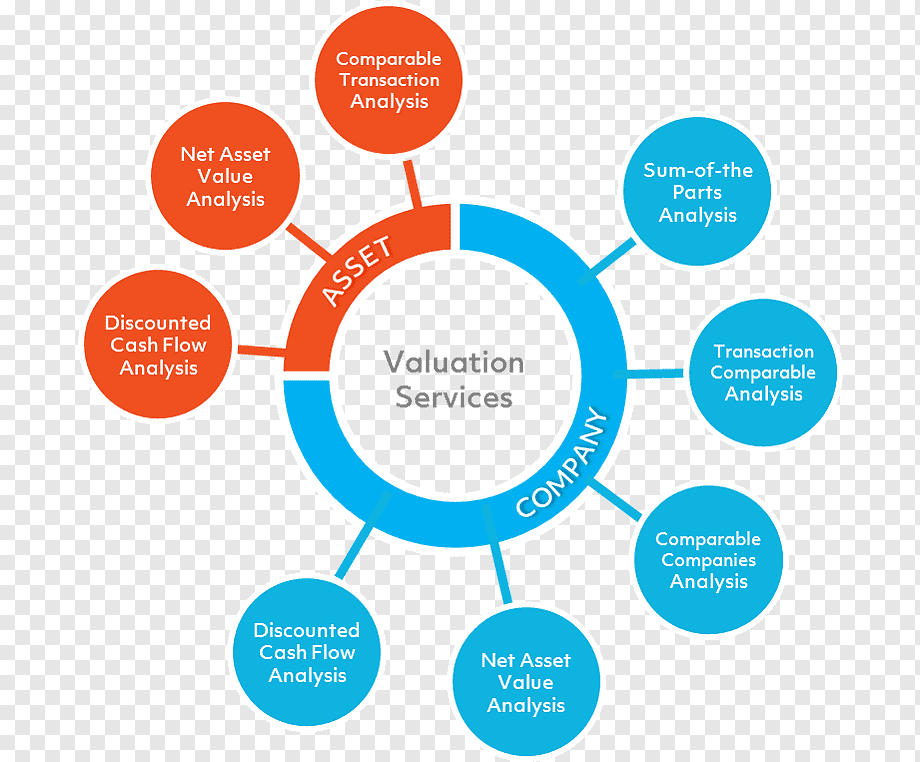

The Methods of Business Valuation

Business valuation service is a multifaceted field with numerous methods employed, depending on the nature of the business and the purpose of the valuation. Some commonly used methods include:

- Asset-Based Valuation: This method calculates a business's worth by tallying the value of its tangible and intangible assets minus liabilities. It is particularly useful for businesses with significant assets, such as manufacturing companies.

- Income-Based Valuation: Income-based valuation methods focus on a business's future income-generating potential. The Discounted Cash Flow (DCF) method, for instance, estimates the present value of expected future cash flows. It is often used for tech startups and service-based companies with less tangible assets.

- Market-Based Valuation: This approach compares the business to similar companies in the market that have been sold recently. It relies on market multiples to estimate a business's worth.

- Earnings Multiplier Valuation: This method uses a multiple of the company's earnings (such as EBITDA or revenue) to estimate its value. It is a straightforward method for valuing businesses, primarily in the context of mergers and acquisitions.

- Real Options Valuation: In cases where a business holds valuable options, such as the potential to expand into new markets or launch new products, the real options valuation method is used. It accounts for these strategic options and their potential value.

The Art in Business Valuation

Beyond the numbers and formulas, there is an art to business valuation services. Several qualitative factors can significantly influence the valuation process:

- Market Knowledge: Valuators need a deep understanding of the industry and market in which the business operates. Market dynamics, trends, and competitive forces all play a crucial role in determining value.

- Risk Assessment: Valuation professionals must assess the risks associated with the business. Market risk, competition, management quality, and economic conditions all impact the valuation.

- Company-Specific Factors: Each business has unique qualities, such as brand reputation, customer relationships, and intellectual property, that are challenging to quantify but contribute to its value.

- Management Assessment: The competence and experience of a business's management team can significantly affect its future performance. This is another subjective aspect that valuers must consider.

- Future Projections: Estimating future cash flows is inherently uncertain. The art of business valuation lies in crafting reasonable and defensible assumptions about a company's future performance.

The Science in Business Valuation

While art plays a significant role, business valuation services also heavily rely on scientific methodologies. This is to ensure objectivity and credibility in the valuation process:

- Data Analysis: Valuators collect and analyze a vast amount of financial and non-financial data to make informed decisions about a business's value.

- Modeling and Forecasting: Valuation professionals use mathematical models and financial projections to estimate future cash flows and assess the impact of different variables on a business's value.

- Discounting and Risk Assessment: In methods like DCF, valuers apply discount rates to account for the time value of money and assess the risk associated with the business.

- Comparable Analysis: Market-based valuations require thorough research and analysis of comparable businesses, which is a structured and data-driven process.

- Regulatory Compliance: Valuation services often need to adhere to specific regulatory standards, such as the Uniform Standards of Professional Appraisal Practice (USPAP) in the United States, to ensure a rigorous and consistent approach.

Challenges in Business Valuation

Despite the methods and processes available, business valuation services face several challenges:

- Subjectivity: Many aspects of business valuation are subjective. This subjectivity can lead to differing valuations by different professionals.

- Uncertainty: Predicting the future performance of a business is inherently uncertain, and small changes in assumptions can lead to significantly different valuations.

- Lack of Data: Some businesses, particularly startups, may lack a substantial financial history, making it challenging to apply traditional valuation methods.

- Market Fluctuations: Valuations can be affected by economic conditions, market trends, and changes in the competitive landscape, making them dynamic rather than static assessments.

- Legal and Regulatory Complexity: The legal and regulatory landscape in different jurisdictions can be complex and affect the valuation process, especially in cases of litigation or taxation.

Conclusion

Business valuation services are both an art and a science, requiring a delicate balance of qualitative assessments and quantitative analysis. They serve as an essential tool for various stakeholders in the business world, aiding in critical decisions related to mergers, acquisitions, investments, and legal matters. While there are inherent challenges and uncertainties in the process, the importance of understanding a business's true value cannot be overstated. Ultimately, business valuation services provide the foundation for informed and strategic decision-making in the ever-evolving landscape of commerce. Visit official website grizzb.com