Options Pop website gives you simple options buy alerts that have a high probability of moving up in price in the next 2 to 9 days or less... plus trader training to help you get the best results.

Why Investors Buy Options...

- In the stock and option's market, the biggest profits come from owning Call or Put options.

- The reason is because buying options have high risk and high reward.

- Call Option buyers make the most money when the stock rises in price.

- Put Option buyers make the most money when the stock drops in price.

Options Pop website uses just one simple strategy

- Buy Call or Put Options on certain stocks and sell them within 2 to 9 days or less !

- The Option Buyer's Advantage...

- It’s the power of leverage!

Traders use options because they want a huge return in exchange for a little investment.

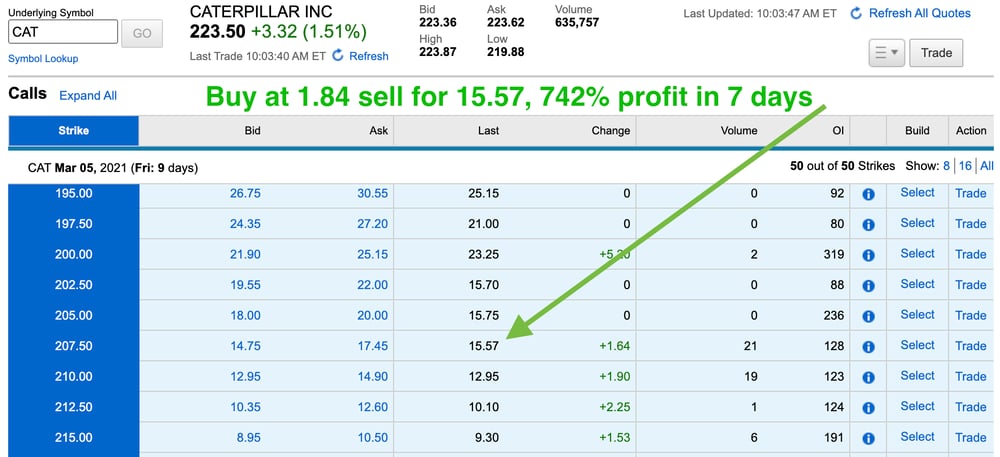

Here’s an example…

Let’s say you discovered Tesla (stock ticker symbol TSLA ) was great to trade because the stock was about to make a big move up and you bought 100 shares of the stock.

If each share is trading at $120 a share, it would cost you $12,000 to buy 100 shares of TSLA.

Now let’s say that right after you buy TSLA it jumps up in price by thirteen dollars ($13.00 ) per share.

When the price of the stock went up thirteen dollars per share, you made $13.00 on each of your 100 shares for a gain of 10.8%

Let’s start over and say you want to use options on TSLA instead. An “option” gives you the right… but not the obligation… to buy shares of the stock.

Let’s say you buy a Call option on TSLA for $2.25. Each option contract equals 100 shares of stock, so one contract would cost you $225.00.

Staying with the example, when the stock price of TSLA jumped up by thirteen dollars in one day…. the price of the TSLA Call options went from $2.25 to $15.50. Your gain here is 588% compared to 10.8%.

588% Return On One Trade In 24 Hours!

That's an options "pop."

It's the power of leverage and it’s the main reason why so many traders prefer trading options rather than stocks.

The Disadvantages To Buying Options...

1. If you buy an option, your biggest risk is that the underlying stock does not move in your direction... or moves against your direction. In which case, the value of the option you bought goes down.

2. If you buy an option and the stock stays in a narrow price range through the option's expiration, the option will expire worthless.

That's why the underlying stock you bought an option on MUST move in your direction with 2 to 10 days. Otherwise the option will go down in price. Maybe to zero.

What is the risk?

That is a great question and the straight answer... is you risk 100% of the money you use to make the trade.

These can be high risk trades.

Only trade with money you can afford to lose.

You need to know that up front because your max loss is the amount you use to make the trade and you can limit that loss using a stop loss order.

Our goal is to select stocks that have a high probability of moving up or down in 2 to 9 days or less, and alerting you to the best options to use on that stock.

Here's How Options Pop website Works...

- Options Pop uses technical analysis to find stocks that have a high probability of moving up or down in 2 to 9 days or less.

- Once the program identifies a stock, it then selects the Call or Put options and the exact strike prices that can go up in price.

- You get an email and text alert every Wednesday to the best Call or Put Options to buy, including the stock symbol, which options and strike prices to buy and at what price.

- Once an options Buy alert has been sent by text and email to our subscribers, we post the trade in the private Member's Only area of the website for you.

This way...

You get option alerts that have a high probability

of moving up in price within the next 9 days or less.

Options Pop does all the hard work for you!

- Identifies Put Or Call Options About To Move Up or Down

- Creates A Buy Alert and Emails It To Members

- Posts Alert In Member's Area

- Free Options Trader Training

We give you the exact stock option, strike prices, expiration date and the price to buy it for.

You receive these alerts by email and text message plus they are posted in the Member’s area of the website.

#stocks #stockoptions #calloptions #putoptions