Discover How UK-Based Structural Engineers Can Work with German Clients: Invoicing, VAT, and OSS Guide.

Are you a UK-based Structural Engineer looking to work with German clients? Whether you're freelancing or running a firm, the opportunity to deliver engineering services internationally — especially in Germany — is growing.

But post-Brexit, the rules around invoicing, VAT, and compliance can feel unclear.

In this SEO-friendly guide, we’ll explain:

- Whether UK engineers can legally work with German clients

- How to issue compliant invoices from the UK to Germany

- When and how to register for the EU’s VAT One-Stop Shop (OSS) scheme

- How to handle reverse charge VAT rules for German-based clients

Let’s dive in.

🌍 Can UK Structural Engineers Work with Clients in Germany?

Yes — UK Structural Engineers can work remotely or internationally with German clients, including:

- B2B consulting and design services

- Remote structural calculations, CAD drawings, and reports

- Short-term site visits or inspections (with proper visa arrangements)

🔒 Regulatory Note: To sign off on official construction documents in Germany, the role of “Tragwerksplaner” (licensed structural planner) may apply. UK engineers can often consult or collaborate, but may need a local licensed partner for legal approvals.

🧾 Can a UK Engineer Invoice German Clients?

Yes, you can invoice German-based clients directly from the UK, but the VAT treatment depends on whether you're dealing with a business (B2B) or an individual (B2C).

🧑💼 For B2B Clients in Germany:

- Use the Reverse Charge Mechanism:

- Do not add UK VAT

- Include your UK VAT number and the client’s EU VAT number

- Add this mandatory note:

“Reverse charge: VAT to be accounted for by the recipient under Article 196 of the EU VAT Directive.”

✅ This allows the German company to self-account for the VAT — no UK VAT is applied.

🧑 For B2C Clients in Germany:

If you're supplying services to German individuals (not businesses):

- If your total EU-wide B2C sales are below €10,000/year, you can:

- Charge UK VAT

- Include it on your invoice under UK rules

- If you exceed €10,000/year in EU sales, you must:

- Register for VAT in Germany or

- Use the Non-Union OSS (One-Stop Shop) for simplified VAT reporting

🔁 What Is the One-Stop Shop (OSS) Scheme?

The OSS (One-Stop Shop) is an EU VAT system designed for non-EU businesses (like those in the UK) that sell digital or electronic services to EU consumers.

Key OSS Benefits:

- File a single EU VAT return each quarter

- Pay VAT on all B2C EU sales through one EU member state

- Avoid registering for VAT in every EU country

📌 For Structural Engineers, OSS only applies to electronically delivered services (e.g., plans, digital files) sold to B2C clients in the EU.

🛠️ How to Register for OSS as a UK Structural Engineer

Since the UK is now a non-EU country, you'll need to register under the Non-Union OSS scheme.

Step-by-Step:

- Choose an EU country to register through (e.g., Ireland, Netherlands, Estonia)

- Appoint a VAT intermediary in that country (this is required for non-EU businesses)

- Submit documentation (UK business registration, VAT details, bank info)

- Start filing quarterly OSS returns, covering all your B2C digital sales in the EU

💡 Search for “OSS intermediary for UK business [country]” to find a representative.

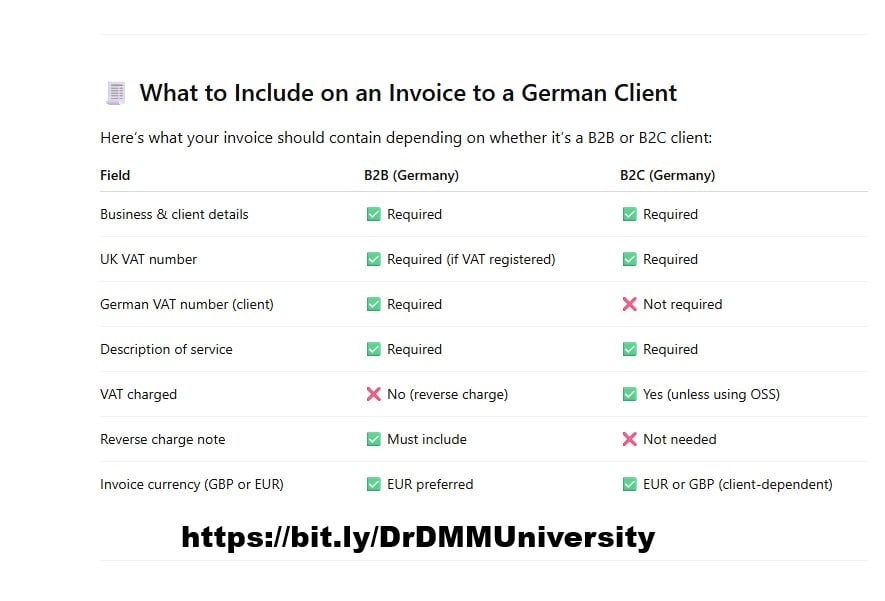

🧾 What to Include on an Invoice to a German Client

Here’s what your invoice should contain depending on whether it’s a B2B or B2C client:

Field: B2B (Germany) B2C (Germany)Business & client details✅ Required✅ RequiredUK VAT number✅ Required (if VAT registered)✅ RequiredGerman VAT number (client)✅ Required❌ Not required Description of service✅ Required✅ Required VAT charged❌ No (reverse charge)✅ Yes (unless using OSS) Reverse charge note✅ Must include❌ Not needed Invoice currency (GBP or EUR)✅ EUR preferred✅ EUR or GBP (client-dependent)

🌐 Example Reverse Charge Invoice Wording (English + German)

“Reverse charge: VAT to be accounted for by the recipient under Article 196 of the EU VAT Directive.”

„Steuerschuldnerschaft des Leistungsempfängers gemäß Artikel 196 der EU-Mehrwertsteuerrichtlinie.“

🔐 Compliance Tips for UK Engineers Selling to Germany

- ✅ Use cloud invoicing tools like Xero, QuickBooks, or Zoho Books for compliant reverse charge invoices.

- ✅ Verify your client’s VAT number with the EU VIES tool

- ✅ Ensure your Professional Indemnity Insurance includes cross-border coverage

- ✅ Keep detailed records of all B2C sales to track when you approach the €10,000 OSS threshold

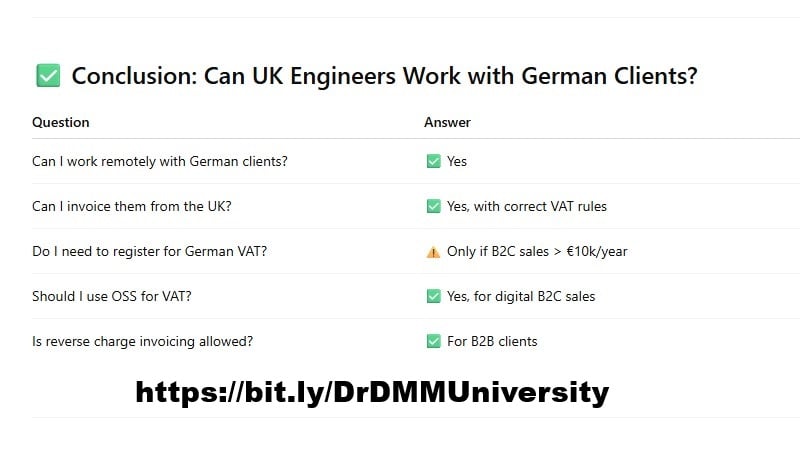

✅ Conclusion: Can UK Engineers Work with German Clients?

Question Answer: Can I work remotely with German clients?✅ Yes, Can I invoice them from the UK?✅ Yes, with correct VAT rules, Do I need to register for German VAT?⚠️ Only if B2C sales > €10k/year, Should I use OSS for VAT?✅ Yes, for digital B2C sales, Is reverse charge invoicing allowed?✅ For B2B clients

🚀 Next Steps

If you're serious about expanding your structural engineering practice into Germany or the wider EU, now’s the time to:

- Set up a compliant invoicing system

- Register for OSS if needed

- Consider collaborating with German engineers for larger projects

🔗 Want to simplify all this?

We’ve created:

- Best Books of All Time, 4 Must Reads for Home based and Business Owners

- Proven Strategies for Achieving Rapid Success and Sustainable Growth

- A Step-by-Step Guide to Transforming Your Business into a Thriving Enterprise

- How To Become An Expert in Your Niche: Dr DMM University

- Best Business Growth and Business Success

- Facebook Masterclass: Scale, Engage & Convert

👉 Click here to download: https://bit.ly/DrDMMUniversity

Found this useful? Share it with your network or contact us for help expanding into the EU market.

Follow Dr DMM University