So far in this series, we have seen how metal money was imposed on societies by states, and how it was replaced with paper and wooden money. In this blog, we shall see how that paper money evolved into electronic money, created by private banks…

The tally stick, and the paper money which evolved from it, could be created by any individual at any time. If that person was deemed trustworthy, it was accepted as currency, backed by the state, and used to buy and sell items.

In the early 1800s, several goldsmiths took advantage of this situation; creating massive amounts of paper money, and becoming wealthy beyond their wildest dreams. This story forms the base of my new novel, ‘Money Power Love’.

Money Power Love

In printing so much money, those goldsmiths created a bubble. When that bubble finally burst, it caused the economy to crash. The state was forced to step in and save the free market; passing ‘The Bank Charter Act’, in 1844, and making it illegal for anyone but the state to produce paper money.

By this time those goldsmiths had evolved into bankers; forming the high street banks we’re all familiar with today. Their hands may have been tied by the law, but their nature remained unchanged. So, when technology evolved, they took their opportunity, and invented a new form of money: Electronic money.

Electronic money is the money we use to make purchases with credit cards, online or in shops. It’s the money which shifts from one account to another when we make bank transfers; when we establish businesses or buy homes. Whilst we may use cash to buy small items, most large transactions in the 21st century use this form of currency.

Electronic money (SOURCE: Flickr)

The process with which this money is created is so simple the mind is repelled…

When a bank issues a loan, be it a business loan or a mortgage, it simply increase the balance in the recipient’s account. That’s it! No gold is moved from one vault to another, no cash is transferred in wheelbarrows across town. The lending bank simply credits the applicant’s account with the money they requested. The recipient then transfers that money; perhaps when purchasing a home, or perhaps when buying inventory or a new office for their business. The electronic money takes on a life of its own, circulating around the economy just like notes and coins.

It sounds absurd. If you were to tell the average person on the street that bankers create new, electronic money whenever they issue a loan, they would probably think you were mad! So please don’t take my word for it. Here’s what the experts have had to say:

“The essence of the contemporary monetary system is creation of money, out of nothing, by private banks.” - Martin Wolf, Financial Times

“Banks extend credit by simply increasing the borrowing customer’s current account…That is, banks extend credit by creating money.” - Paul Tucker, Deputy Governor of the Bank of England

“When banks make loans, they create additional deposits for those that have borrowed the money.” - Bank of England, Quarterly Bulletin, Volume 47 Number 3

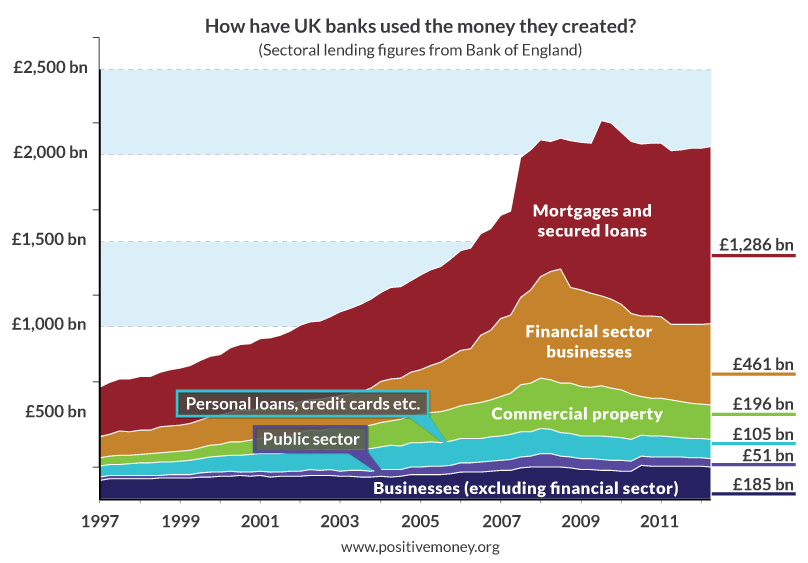

In the UK, a whopping 97% of money is electronic money, created by private banks. Over half of this money is created when issuing mortgages:

Electronic money creation (SOURCE: Positive Money)

This has led to an enormous amount of inflation in house prices. Let’s use an example to explain…

Imagine a simplified economy in which everyone has £10,000 saved up to spend on a house, and every bank is prepared to issue mortgages worth £90,000. In this situation, everyone who wishes to buy a home will have £100,000 to spend. As a result, you’d expect most houses to cost about £100,000; no-one would be able to spend more, and sellers would have very little incentive to charge less.

Now imagine that the banks decided to up their mortgage lending. Overnight, they decide to lend £190,000 to every applicant. Everyone now has £200,000 to spend, and so the price of most houses would double to £200,000…

This is what has happened over the course of the last few decades.

In 1970, the average house cost about £4,500 and the average worker earned about £1,500 a year; they could save up three years’ worth of wages and have enough money to buy an average house. These days, the average house in the UK costs about £240,000, and the average worker earns about £27,000; they would have to save nine years’ worth of wages if they wish to buy the average house.

A part of the reason for this increase in house prices is supply-side: We’re only building half the number of houses we were building in the 1970s. But the major reason is demand-side: Over the course of this period, banks have discovered electronic money, pumped it into the housing market, reaped billions of pounds in interest payments, and created a bubble which has pushed house prices beyond the reach of the average youngster.

We see a similar situation in the stock market.

Private banks have created new, electronic money to be spent on shares. As a result, the price of those shares has increased; making wealthy people even wealthier, without producing anything valuable for society.

Less than ten percent of electronic money is created when issuing loans to new businesses, to help them get started, or to existing businesses, to help them to expand.

This may be an efficient system for the banks themselves, who reap enormous profits, safe in the knowledge that the state will bail them out whenever things go wrong, but it’s incredibly inefficient for everyone else. Just imagine if all that electronic money was spent helping businesses to expand, creating new jobs, and building new homes. Just imagine if that money was spent by the state, building social housing, providing free university places, or better pensions.

Some might say we need a 21st century Bank Charter Act, to bring about such an end result…

The ebook version of Money Power Love is available from this website, here.

Physical copies are available from Amazon, Barnes & Noble, Watestones, and all good online retailers…

Also in this blog series...

1. “STATES CREATED MARKETS. MARKETS REQUIRE STATES. EACH REQUIRES THE OTHER.”

2. THE EVOLUTION OF MONEY: FROM GOLD COINS, TO TALLY STICKS, TO PAPER NOTES

SOURCES

1) “Quarterly Bulletin 2007 Q3” by the Bank of England

2) Positive Money

Comments ()