Imagine this: You’ve poured your heart and soul into building an amazing product or service. You launch a customer satisfaction survey, eagerly awaiting glowing reviews and insightful feedback. The results come back, and... they’re fine. Good, even! Everyone says they’re "satisfied," "likely to recommend," and "happy." You feel a swell of pride. But then, you look at your sales numbers, your retention rates, your engagement metrics, and they tell a different story. A story that doesn't quite align with the rosy picture painted by your survey.

What gives? Are your customers deliberately misleading you? Are they holding back their true feelings? The uncomfortable truth is, yes, in a way, they are. They're not doing it out of malice or spite, but often due to a complex web of psychological factors, survey design flaws, and contextual pressures. This isn't about blaming your customers; it's about understanding them better. It's about recognizing why customers lie in surveys – or more accurately, why their responses might not always reflect their deepest truths or actual behaviors – and learning how to truly decipher what they're really telling you.

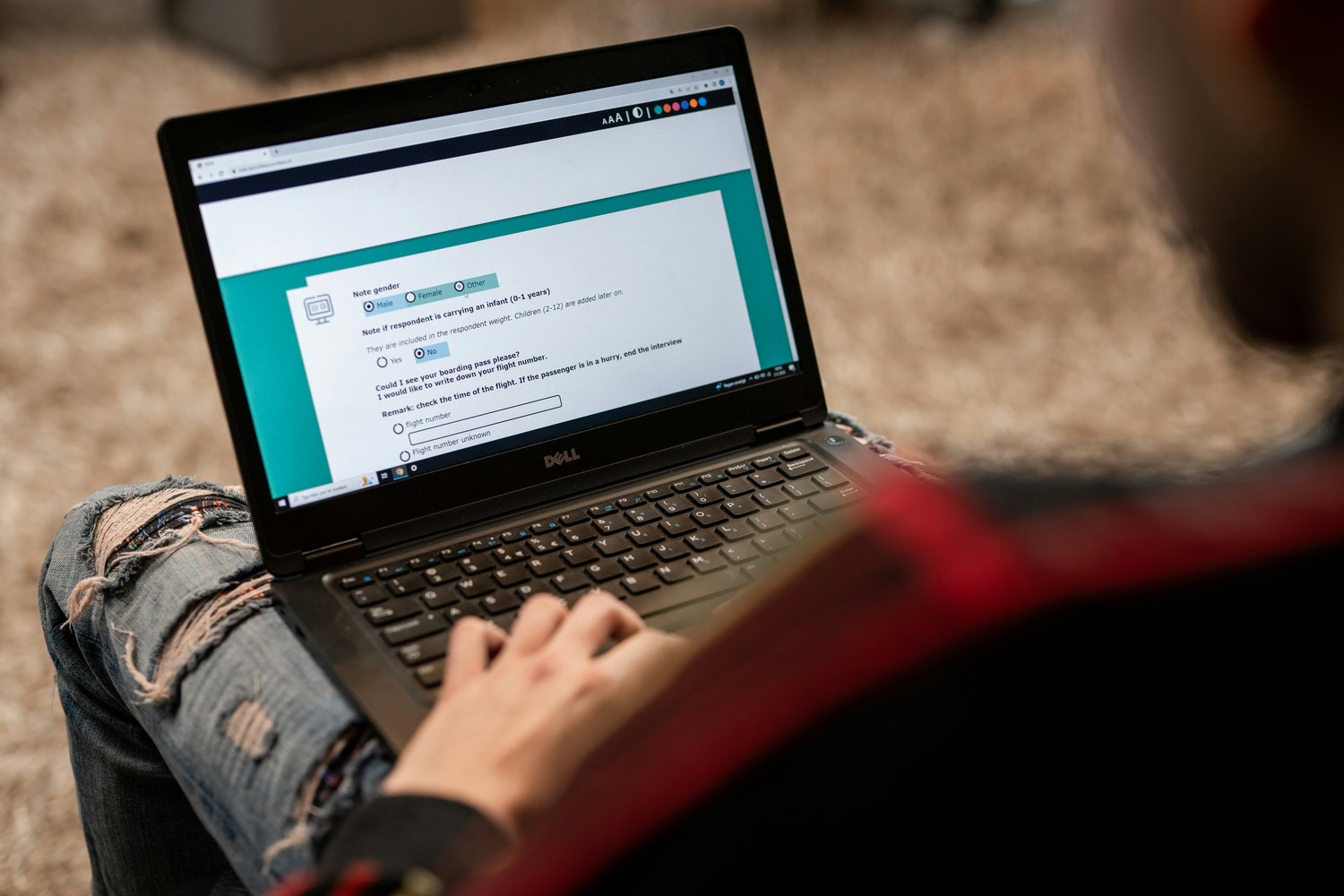

This isn't just a minor blip; it's a fundamental challenge that can derail your entire customer strategy. Without genuinely understanding customer insights, you're making decisions based on faulty information. But don't despair! This blog post is your enthusiastic guide to navigating the murky waters of customer survey bias, transforming ambiguous responses into crystal-clear directives, and ultimately, ensuring you get honest customer feedback that drives real, impactful change. Get ready to revolutionize the way you approach your customer feedback surveys and unlock truly actionable survey results!

The Unspoken Truth: Why Customers "Lie" (It's Not What You Think!)

The word "lie" feels harsh, doesn't it? But it's essential to shake us out of complacency. When we say customers "lie" in surveys, we’re referring to responses that deviate from their true feelings, intentions, or behaviors. This isn't usually a malicious act. Instead, it's often an unconscious process driven by deeply ingrained human psychology and the very nature of survey interaction. Understanding these underlying mechanisms is the first step to improving survey response accuracy.

Let's dive into the fascinating world of customer survey bias and explore the common culprits:

The Social Desirability Dragon

Ah, the desire to be seen as "good." This is perhaps the most pervasive and insidious form of bias. We're all wired to present ourselves in a positive light, to be agreeable, and to avoid conflict. When a survey asks if you enjoyed a service, it's far easier to tick "satisfied" than to articulate a nuanced complaint, especially if you think your answer might be seen by a real person or reflect poorly on you. Customers want to be polite, helpful, and not a bother. They might feel guilty giving a low score, fearing it could negatively impact an employee or a small business they generally like. This makes interpreting survey data a challenge because the "good" scores might not be good at all, but merely polite.

The Acquiescence Chameleon

This bias refers to the tendency to agree with statements regardless of their content. If given a series of statements and asked to agree or disagree, some people are more likely to simply agree with everything. This can stem from a desire to be cooperative, a lack of strong opinion on the topic, or simply mental fatigue. Imagine a long survey; it's easier to keep nodding along than to critically evaluate each statement. This can inflate positive responses and obscure true dissatisfaction, severely impacting survey response accuracy.

The Extreme Response Siren

On the flip side, some individuals consistently choose the extreme ends of a rating scale, whether it's "strongly agree" or "strongly disagree," "excellent" or "poor." This can be a personality trait, a cultural norm, or even a way to express strong feelings without going into detail. If you have a customer base that skews towards extreme responses, your average scores might look inflated or deflated, making it difficult to gauge the true sentiment and leading to misleading actionable survey results.

The Recall Ripple

Our memories are notoriously fallible. When you ask a customer about an experience they had last week, last month, or even last year, their recall will be imperfect. They might remember the most recent interaction (recency bias), the most emotionally charged one, or simply have a generalized feeling rather than specific details. This "recall bias" means that their survey answers might reflect a fuzzy recollection rather than an accurate account of their experience, making it harder to get honest customer feedback about specific touchpoints.

The Fatigue Factor & Satisfaction Slump

Let's be real: long, tedious surveys are a chore. If your customer feedback surveys are too long, too repetitive, or too complex, respondents will suffer from survey fatigue. This leads to rushed answers, random selections, and lower quality data. They might just want to get it over with, leading to "satisficing" – choosing the first reasonable answer rather than the most accurate one. Similarly, if a customer is genuinely satisfied but not delighted, they might just tick "satisfied" on every question, not because every aspect was perfect, but because nothing was notably bad. This leads to flat, uninspiring data that offers little insight for improvement, hindering your ability to understand customer insights.

The Leading Question Labyrinth

Sometimes, the "lie" isn't the customer's fault at all; it's ours! Poorly designed questions can subtly (or overtly) push respondents towards a particular answer. "How satisfied were you with our excellent customer service?" already primes the respondent for a positive answer. Questions that are double-barreled ("Were you satisfied with the product and the delivery?") make it impossible to give an accurate response if one was good and the other wasn't. These kinds of design flaws directly introduce customer survey bias, making it impossible to achieve survey response accuracy.

Beyond the Words: What Customers Are Really Telling You

If customers aren't always giving you the unvarnished truth, how on earth do you interpret survey data effectively? The key is to stop taking every answer at face value and start looking for the deeper signals, the unspoken truths, and the connections between different data points. Your customers are always telling you something; sometimes you just need to learn a new language to understand them. This is where the magic of truly understanding customer insights happens!

Look for Patterns, Not Just Pointers

A single "satisfied" answer means little. But 100 "satisfied" answers followed by a sharp drop-off in repeat purchases tells a powerful story. Instead of fixating on individual scores, look for trends, correlations, and anomalies. Do customers who rate your onboarding highly also have higher retention? Do those who complain about a specific feature also experience more support tickets? Connecting the dots between survey responses and behavioral data (purchases, website activity, support interactions, churn rates) is paramount. This holistic approach is critical for understanding customer insights and uncovering the real drivers of satisfaction or dissatisfaction.

The Power of the Unsaid

Sometimes, what customers don't say is more important than what they do. If your survey offers open-ended comment boxes and they remain largely empty, it could mean several things:

- They truly had no strong feelings (good or bad).

- They didn't feel their feedback would be heard or acted upon.

- They didn't have the time or energy to elaborate.

- They felt uncomfortable articulating negative feedback.

Similarly, if you're consistently getting high satisfaction scores but no one is mentioning specific features or aspects you're proud of, it might indicate that those elements aren't as impactful as you think. Learn to read between the lines and consider the gaps in the feedback.

Triangulate Your Data: Surveys Are Just One Piece

To get honest customer feedback and achieve high survey response accuracy, you absolutely cannot rely on surveys alone. Think of surveys as a single lens. To see the full picture, you need multiple lenses (or data sources) and to "triangulate" your findings.

- Behavioral Data: This is your gold standard. What are customers actually doing? Are they buying more, using your product less, abandoning their carts, or engaging with your content? This data often reveals the true story, overriding polite survey answers. High survey satisfaction but low feature adoption? That's a red flag!

- Qualitative Interviews & Focus Groups: These are invaluable for depth. While surveys give you breadth, one-on-one interviews or small group discussions allow you to probe, ask "why," and observe body language and nuances. This is where you can truly dig into the motivations behind their "lies" or vague responses. It's a fantastic way to get honest customer feedback in their own words.

- Customer Support Interactions: Your support team is on the front lines, hearing real problems, frustrations, and compliments in real-time. Analyze support tickets, chat logs, and call recordings. Look for recurring themes, specific pain points, and emerging trends that might not surface in a structured survey.

- Social Listening: What are people saying about your brand, products, or industry on social media, review sites, and forums? This unsolicited feedback is often raw, honest, and unfiltered. It can provide a temperature check that complements (or contradicts) your survey data.

By combining and comparing these different data sources, you can start to form a much clearer, more nuanced, and significantly more accurate understanding of your customers. This holistic approach is essential for truly interpreting survey data and uncovering those elusive customer insights.

Strategies to Get Honest Customer Feedback & Boost Survey Response Accuracy

Now that we understand why the "lies" happen and how to look deeper, let's get proactive! The good news is there are numerous strategies you can implement to design better customer feedback surveys and foster an environment where customers feel comfortable giving you the real scoop. Your goal is to minimize customer survey bias and maximize survey response accuracy.

1. Master the Art of Survey Design

- Keep it Short & Sweet: Respect your customers' time. Every extra question increases fatigue and decreases survey response accuracy. Focus on the most critical questions only. For complex topics, consider breaking them into multiple, smaller surveys.

- Anonymity is Your Ally (When Appropriate): If you want truly candid feedback, especially on sensitive topics, ensure anonymity. Clearly communicate that responses cannot be traced back to individuals. This drastically reduces social desirability bias. Of course, for some operational feedback, linking to an individual might be necessary, but be aware of the trade-off.

- Clear, Unambiguous Questions: Avoid jargon, technical terms, and loaded language. Each question should be singular in focus. Instead of "How happy were you with our new product features and user interface?" ask two separate questions.

- Vary Question Types: Don't just use multiple-choice. Incorporate open-ended questions to allow customers to elaborate. Use rating scales (e.g., Net Promoter Score, Customer Effort Score), but follow up with a "why did you give that score?" question. This helps bridge the gap between quantitative metrics and qualitative reasoning, significantly aiding in interpreting survey data.

- Avoid Leading Questions: We already touched on this, but it bears repeating. Frame questions neutrally. Instead of "Did you enjoy our fast, friendly service?", ask "How would you describe the speed and friendliness of our service?"

- Use Conditional Logic: Don't ask irrelevant questions. If a customer says they didn't use a certain feature, don't then ask them to rate their satisfaction with it. Use survey logic to route them to relevant questions, reducing fatigue and improving survey response accuracy.

- Test, Test, Test: Before launching to your entire customer base, test your survey with a small internal group or a few friendly customers. Look for confusing questions, technical glitches, and overall flow. This crucial step helps catch potential biases before they skew your entire dataset.

2. Optimize Survey Timing & Context

- Timeliness is Key: Ask for feedback immediately after a specific interaction (e.g., after a purchase, a support call, a product onboarding). This minimizes recall bias and ensures the experience is fresh in their minds, leading to more accurate responses and helping you get honest customer feedback.

- Explain the "Why": Tell customers why you're asking for their feedback and how you intend to use it. "Your feedback will help us improve our service" makes them feel their time is valued and encourages more thoughtful responses.

- Manage Expectations: Be transparent about the survey's length. "This survey will take approximately 3 minutes." This sets realistic expectations and reduces abandonment.

3. Beyond the Survey: Cultivate a Feedback Culture

- Open Channels: Provide multiple, easily accessible avenues for feedback beyond formal surveys. This includes website forms, dedicated email addresses, in-app feedback buttons, and even suggestion boxes in physical locations. The easier it is to give feedback, the more likely you are to get honest customer feedback.

- Act on Feedback (and Show It!): This is perhaps the most critical strategy. If customers see that their feedback leads to actual changes, they will be far more likely to provide honest, detailed responses in the future. Close the loop! When you implement a change based on feedback, announce it and credit your customers. "You asked, we listened!" This builds trust and validates their effort. This is the cornerstone of achieving truly actionable survey results.

- Empower Your Employees: Your frontline staff are critical feedback gatherers. Train them to listen actively, record common issues, and escalate critical insights. They are a rich, often untapped source for understanding customer insights.

- Focus on Relationships, Not Just Transactions: When customers feel a genuine connection with your brand, they are more likely to offer constructive criticism. Building a loyal community fosters an environment of trust and openness, making it easier to get honest customer feedback.

Transforming Insights into Action: Achieving Actionable Survey Results

So, you've improved your customer feedback surveys, mitigated customer survey bias, and now you're interpreting survey data with a keen eye for deeper customer insights. What's next? The ultimate goal of all this effort is to move from data to decision, from insight to impact. You want actionable survey results – insights that directly inform your strategies, product development, and customer experience improvements.

1. Prioritize Your Insights

Not all feedback is created equal. You'll likely uncover a multitude of insights, but you can't act on everything at once. Prioritize based on:

- Impact: Which issues, if resolved, would have the biggest positive impact on your customers and your business KPIs (e.g., retention, revenue, acquisition)?

- Feasibility: What can you realistically address with your current resources and timeframes?

- Frequency/Severity: How many customers are affected by this issue? How severe is the pain point?

- Alignment with Business Goals: Does acting on this insight support your broader business objectives?

Use frameworks like an "effort vs. impact" matrix to help you decide where to focus your resources for the most actionable survey results.

2. Create a Clear Action Plan

For each prioritized insight, develop a specific, measurable, achievable, relevant, and time-bound (SMART) action plan.

- What specific change will be made?

- Who is responsible for implementing it?

- What resources are needed?

- What is the timeline for completion?

- How will you measure the success of the change?

This structured approach ensures that your insights don't just sit in a report but actually translate into concrete improvements. This is how you generate actionable survey results that drive real business value.

3. Close the Loop: Show You're Listening

This cannot be stressed enough. If you ask for feedback, you must act on it and communicate those actions back to your customers.

- Inform: Tell customers what changes you've made based on their feedback. Use newsletters, social media, in-app notifications, or even direct emails.

- Thank: Express genuine gratitude for their input.

- Measure: After implementing changes, re-survey or monitor relevant metrics to see if the changes had the desired effect. This completes the feedback loop and demonstrates the value of their input, encouraging more honest customer feedback in the future.

4. Integrate Feedback into Your Business Rhythm

Customer feedback shouldn't be a once-a-year event. It should be a continuous process, woven into the fabric of your business operations.

- Regularly schedule time for feedback analysis.

- Incorporate customer insights into product roadmap planning, marketing campaigns, and service training.

- Appoint "customer champions" within your organization who advocate for the customer voice in all decisions.

By doing this, you're not just collecting data; you're building a truly customer-centric organization that instinctively seeks out understanding customer insights and translates them into actionable survey results.

The Enthusiasm for Truth: Your Path to Real Customer Love!

The journey to understanding why customers lie in surveys and what they're truly telling you is not about uncovering malicious intent. It's about peeling back layers of human psychology, refining your listening skills, and embracing a holistic approach to interpreting survey data. It's about moving beyond superficial satisfaction scores to unlock the profound, nuanced customer insights that drive genuine growth and connection.

Forget the simplistic notion of customers giving you perfect answers. Embrace the complexity! Recognize the pervasive nature of customer survey bias, and actively work to mitigate it through thoughtful design of your customer feedback surveys and a multi-channel approach to listening. Strive relentlessly for survey response accuracy, not just for the sake of data integrity, but because it's the foundation for truly actionable survey results.

The most successful businesses aren't those with the highest survey scores; they're the ones who deeply understand their customers – their behaviors, their unspoken needs, their true pain points, and their deepest desires. So, go forth with enthusiasm! Re-examine your surveys, diversify your listening channels, and commit to truly hearing your customers, even when their voices are masked by bias or polite half-truths. When you learn to decipher their real messages, you won't just improve your products and services; you'll build relationships rooted in authenticity, trust, and mutual understanding. And that, my friends, is the bedrock of enduring success and truly passionate customer loyalty. Now, go get honest customer feedback and transform your business!