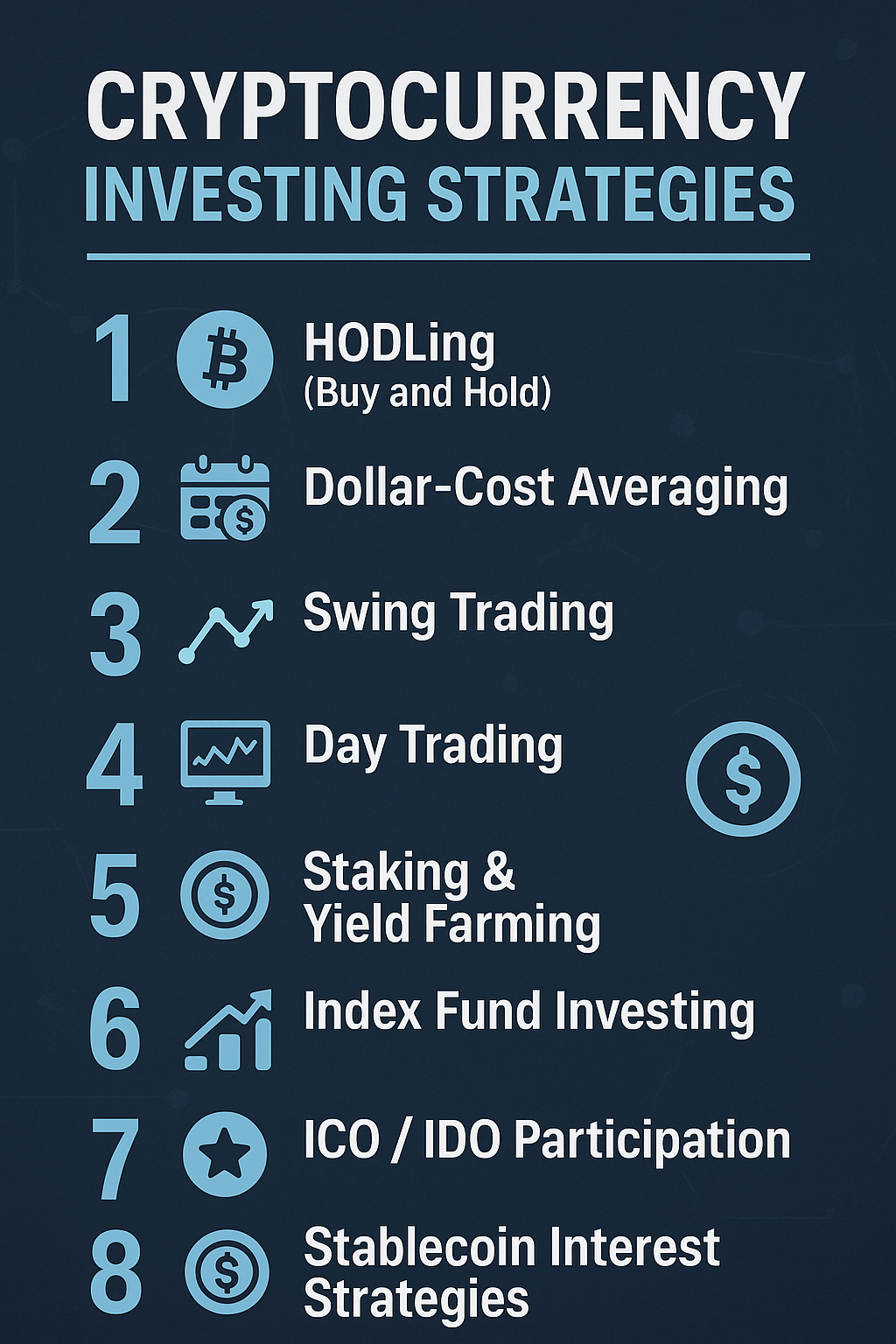

Cryptocurrency Investing Strategies

1.

HODLing (Buy and Hold)

- What it is: Buying crypto and holding it long-term regardless of market volatility.

- Best for: Long-term believers in Bitcoin, Ethereum, or solid altcoins.

- Tip: Use cold wallets (hardware wallets) for added security when holding large amounts.

2.

Dollar-Cost Averaging (DCA)

- What it is: Investing a fixed amount at regular intervals (e.g., weekly, monthly).

- Benefits: Reduces emotional decision-making and averages out entry prices.

- Tool Tip: Automate with exchanges like Coinbase, Binance, or Kraken.

3.

Swing Trading

- What it is: Taking advantage of short-to-medium-term price movements (days to weeks).

- Tools used: Technical indicators like RSI, MACD, and support/resistance.

- Risk level: Higher than HODLing; requires active chart monitoring and strategy.

4.

Day Trading

- What it is: Buying and selling on the same day to profit from intraday volatility.

- Requires: Fast decision-making, technical analysis, and usually leverage (careful!).

- Tip: Start with small trades and paper trade first to avoid big losses.

5.

Staking & Yield Farming

- What it is: Locking your crypto (like ETH, ADA, or SOL) to earn rewards or interest.

- Platforms: Lido, Binance Earn, Coinbase, or DeFi protocols (e.g., Aave, Compound).

- Watch out for: Lock-up periods, impermanent loss, and smart contract risk.

6.

Index Fund Investing

- What it is: Buying a diversified basket of cryptocurrencies (like a crypto ETF).

- Examples: Bitwise 10, Crypto20, or creating your own index of BTC/ETH/stablecoins.

- Why it works: Reduces exposure to a single asset and smooths performance.

7.

ICO / IDO Participation (High Risk)

- What it is: Investing early in new coins before public listing.

- Be cautious: Many projects fail or are scams. Research whitepapers, tokenomics, and teams.

- Pro Tip: Follow launchpads like Polkastarter, DAO Maker, or CoinList.

8.

Stablecoin Interest Strategies

- What it is: Earning yield on USDT, USDC, or DAI via CeFi (e.g., Nexo) or DeFi (e.g., Aave).

- Why it’s smart: Lower volatility; passive income.

- Note: Even stablecoins carry risk—especially algorithmic ones.

🔍 Bonus Tips:

- Do your own research (DYOR): Don’t blindly follow hype.

- Use stop-losses: Protect your capital.

- Avoid over-leveraging: Margin trading can wipe you out.

- Stay updated: Crypto changes fast—follow CoinDesk, Decrypt, Messari.