Zimbabwe’s Minister of Finance, Hon. Prof. Mthuli Ncube, is expected to announce a supplementary national budget in the coming days. By several measures (mathematical, empirical, projection and extrapolation), this impending reallocation will need to be 10 trillion Zimbabwe Dollars (ZWL) or more to satiate the competing needs facing the country at present.

A supplementary budget has become necessary because of the erosion of the ZWL’s value, where allocated ministry money, and other expenditure for financing government and national business, has become inadequate. Reflective of this, are the country’s macroeconomic fundamentals which currently show that the economy is likely to miss its GDP growth rate target of 3.8% in 2023, given the country is currently facing a multiplicity of challenges, chief among them being energy shortages, inflation and depreciation of the local currency.

Deserving to be singled out is inflation. It has been on an upward trend since the beginning of the year. Blended month-on-month inflation jumped from 0.7% in January 2023 to 74.5% in June, suggesting a steeply escalating cost of living. The parallel market rate at one point increased by 111% in June and over 700% year-to-date.

Zimbabwe Minister of Finance Hon. Prof. Mthuli Ncube before presenting the 2023 Budget Proposal

A raft of interventions by the Honourable Professor in the past month, to arrest the situation have, assuredly, begun to bear fruit. Some of these measures, in no particular order, include:

Increasing the retention on domestic foreign currency sales to 100%

This has resulted in domestic businesses accessing more foreign currency from the market and this potentially translating into additional US dollar deposits in the banking system.

Adoption of all external loans by Treasury

This process is well under way and will result in all external liabilities being funded transparently through the National Budget. A conversation for another day has to be had though, of how exactly will treasury carry this extra burden when current obligations are barely being met. Suffice to mention here that it is the correct move as fiscal matters have to be housed in the treasury department, not what was obtaining where the RBZ indulges in quasi-fiscal exertions.

Increasing Consumers’ Access to Basic Commodities

Lifting restrictions on imported basic groceries has promoted competition, thereby resulting in a less steep rise grocery prices in the country and even price reduction in other products. The jury is, however, still out on the impact this will have on industry capacity utilisation long terms. This sector had, up to the time of announcement to open borders, been carefully nurtured back to over 70% capacity utilisation across board. This is a classic demonstration of the difficult choice the Zimbabwe Ministry of Finance has to contend with.

Promotion of use of domestic currency by Government Agencies

Which is expected to further increase the demand for the local currency, if uniformly and equally implemented by all government entities. There are still reports of some still insisting on providing services only after United States Dollar payments.

To this end, I will hasten to add a recommendation.

Zimbabwe should endeavor to go back to universal use of the Consolidated Revenue Fund by all these entities where they all use one purse for deposits. This is important because it will enhance transparency and accountability in the collection and management of public revenue, as well as reduce leakages and wastages that may arise from multiple funds and accounts. The Consolidated Revenue Fund will also enable the Treasury to have a comprehensive and accurate picture of the government's financial position and performance, and to allocate resources more efficiently and effectively according to national priorities.

Imagine these scenario where Forestry Department, Parks and Wildlife, or indeed the Police Force, to site a few examples, collect revenues and deploy within their entities but also expect to be supported by the national budget through their line ministries. It is no coincidence that the Auditor General's office is replete with advisories noting misappropriation of funds, instances of leaders in these departments making undesirable/unnecessary trips to harvest allowances for themselves, and other abdicable examples. All these become minimal when the country reverts back to the Consolidated Revenue Fund.

Treasury funding the Zimbabwe Dollar component of the 25% foreign currency surrendered by exporters

In order to eliminate the creation of additional money supply into the market, which had seen an exponential increase in liquidity with money supply being reported at 1.9 trillion ZWL in September 2022 and now understood to be hovering above 5 trillion ZWL, the Central Bank has taken several measures, such as raising the interest rates, liberalising the forex market, issuing gold coins and e-tokens (Central Bank Digital Currency), and tightening monetary policy. These measures are aimed at reducing bank lending and money creation, which will help to contain inflation and exchange rate pressures, and to restore confidence and credibility in the economy.

Introducing a system to manage the traceability of gold

To curb smuggling and increase official gold deliveries, the government has introduced a system to manage the traceability of gold. Amid a backdrop of the scurrilous allegations made in Al Jazeera Media's "Gold Mafia" documentary, a system has been pronounced that will involve the use of electronic seals, tracking devices, and security escorts for gold shipments from mines to refineries. The system will also require all gold producers and buyers to register with the authorities and to comply with the legal requirements for gold trading. The system will help to improve the transparency and accountability of the gold sector, as well as to increase the government's revenue from royalties and taxes.

Creating a debt redemption fund

To service external debt arrears and improve creditworthiness, the government has created a debt redemption fund. This fund will be used to pay off the outstanding debt obligations to international financial institutions and bilateral creditors, as well as to negotiate for debt relief and restructuring. The fund will be financed by a portion of the foreign currency earnings from exports, remittances, grants, and donations. The fund will help to reduce the debt burden on the economy, as well as to restore Zimbabwe's access to concessional finance and investment.

Tightening monetary policy

As briefly touched on earlier, monetary policy is being rid of fiscal matters and concentration on core monetary policies. This, among other things, will ensure a reduction in bank lending as money creation is tightened. The anticipation is it will help to contain inflation and exchange rate pressures, as monetary side was seen to be pushing liquidity levels higher, through wanton increase in bank credit deposits (loan books), concessionary foreign currency (forex) Auction System, and slack monitoring of policies in place.

Cases leading to the temporal order to cease operations to Mobile Money Transfer Agencies as well as the Stock Exchange itself refers.

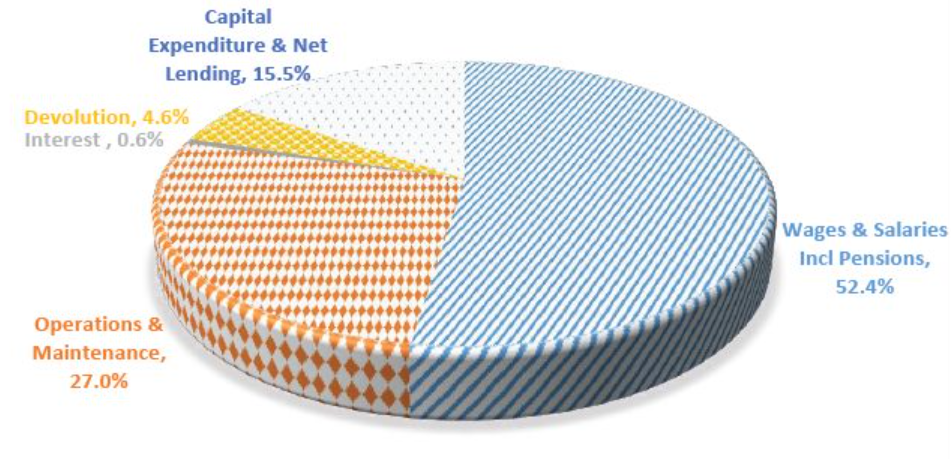

The 2023 Zimbabwe national budget expenditure distribution

These measures are expected to continue to stabilise the economy and the currency, as well as restore confidence and credibility in the country's economic management in both the medium and short term, thus allowing for an environment calm enough to propose a supplementary budget.

As it stands, the effectiveness of these interventions is evidenced by the stabilisation of the exchange rate and the decline of inflation in July. According to the Zimbabwe National Statistics Agency (Zimstat), blended month-on-month inflation slowed down to 55.4% in July, while annual inflation eased to 156.9% from 175.8% in June. According to the Reserve Bank of Zimbabwe, the exchange rate as of July 6, 2023 was ZWL 5,412.55 per US dollar, compared to a peak above ZWL 10,000 on the parallel market.

The supplementary budget is expected to reflect these positive developments and provide further measures to support economic recovery and growth. Some of the key areas that this impending budget may need to address are:

- Increasing social spending to cushion vulnerable groups from the effects of high inflation. Here can be included a continuing review of civil servant salaries and allowances in line with these developments and policy measures. An upward revision of their salaries will need to give a minimum USD $150 and the widening of tax bands (and perhaps, as I have advocated in other platforms, the provisional inclusion of a non taxable grocery allowance)

- Enhancing revenue mobilisation and expenditure rationalisation to reduce fiscal deficit and debt. Especially in focus is that treasury has assumed RBZ debts to the tune of US$4.9 billion. This debt run up this high by the Central Bank represents about 35% of total external public and publicly guaranteed (PPG) debt which stands at US$14.04 billion at at time of writing. The budget will need to show frugal collection and allocation to amortise this debt as its servicing fees are estimated at about US$60 million annually.

There is unconfirmed speculation that the bank would run the printing mill and then source forex on the open market to keep abreast with instalments, which tap kept the market very liquid, and by extension, highly inflationary. Treasury will need to find other non-inflationary means to keep servicing these debts, without printing. And as economic analysts we await to see this in the budgets now, including supplementary ones. As we know, “a nation can not tax itself into prosperity.”

Revenue mobilisation and expenditure rationalisation will entail improving efficiency and effectiveness in tax collection and administration, meanwhile, as well as broadening the tax base to increase government revenue, not by adding transactional taxes, but bringing a bigger section of the informal sector into the tax base. It will also mean prioritising and aligning public spending with national development goals, as well as eliminating wasteful and unproductive expenditure to reduce government borrowing and debt servicing costs.

- Aligning monetary and fiscal policies to maintain price stability and exchange rate stability, and iron out any differences between these two departments critical to economic measure implementation, as became apparent in the press statements of the recent months showing veiled apportionment of blame.

- Continue promoting productive sectors such as agriculture, mining, manufacturing and tourism to further boost exports and foreign currency earnings, on the back of record forex receipts in 2022. The success stories in record wheat and maize deliveries of the past season, making Zimbabwe grain sufficient, are no doubt a result of this support. This will relieve the strain on forex to import cover grain.

Hyperinflation description

I will be quick to aver, as I have in a previous article, that there are still in-built inefficiencies in the Zimbabwean economy, like in the staple grain subsidy system application via only the grain Marketing Board and the Grain millers association as the legal players. This necessarily created arbitrage opportunities which will not bode well for overall agriculture value chain efficiencies.

I pray the coming into the sector of the Zimbabwe Mercantile Exchange offering market driven transactions in grains including maize, will improve the efficiency and transparency of the commodities market, enhance price discovery and competitiveness, and provide access to finance and risk management tools for farmers and traders to market their agro-commodities in a safe, secure and convenient manner.

The supplementary budget will, thus, be a crucial test for the Minister of Finance and his treasury team, as they seek to restore confidence and credibility in the country's economic management. Importantly, The budget will need to set the tone for the 2024 national budget, which will also be presented in under 6 months.

To estimate the nominal value of the supplementary budget I simply used the formula:

Supplementary Budget = (Real GDP Growth Rate + Inflation Rate) x Original Budget

The real GDP growth rate for Zimbabwe is projected to be around 3.6% in 2023, while the inflation rate is estimated to average 213% in 2022 and remain in triple digits in 2023. Therefore, using this formula, we can calculate the supplementary budget as follows:

Supplementary Budget = (3.6% + 213%) x ZWL 4.9 trillion Supplementary Budget = 216.6% x ZWL 4.9 trillion Supplementary Budget = ZWL 10.613 trillion

This means that the government will need to raise an additional ZWL 10.613 trillion to finance its expenditure needs for 2023, based on the real GDP growth rate and inflation rate.

Two other simpler ways of determining the value of the supplementary budget are; First, assuming budgeting needs and allocation have remained constant, are to use the real value of the total budget at time of pronouncement on the 24th of November 2022 and determining that value as at today and deducting what has already been spent:

Total expenditure was projected at ZWL 4.9 trillion (which was US$6.5 billion on the day). At the RBZ Forex Auction exchange rate of 6th of July 2023 of 5251.064 that same value is ZWL 34,131 trillion today. If we divide by 2 to remove about 50% which as already been allocated in the first half of the year and the residue needed is ZWL 17,065 trillion.

Further adjusting for allocations already made for the full year even though we had gone half a year, (for instance the the cost of holding elections in Zimbabwe is estimated to be around US$50 per voter, which translates to about ZWL$264.6 billion for 6.6 million registered voters and this was already allocated in USD). We realise that ZWL 10 trillion is a realistic estimate for the supplementary budget.

Secondly, another way is to consider the previous budget as a percentage of GDP and apply that same percentage to current GDP to determine current value. Total expenditure, as alluded to earlier was projected at ZWL$4.9 trillion (US$7.5 billion), with a deficit of ZWL$400 billion (US$615 million). This collection figure excluding the deficit was 12.9% of GDP so we take today’s GDP and determine 12.9%:

Supplementary Budget = (GDP x 12.9%) x exchange rate - percentage already spent

Supplementary Budget = (USD 35 billion x 12.9%) x 5251.064 - 66%

Supplementary Budget = ZWL 23,708 trillion / 2

ZWL 11,854 trillion

As we can see from these three estimates, there is a wide range of possible supplementary budgets for 2023, all ranging between 10 and 17 trillion ZWL depending on the assumptions and variables used. Therefore, we can conclude that a minimum supplementary budget of ZWL 10 trillion is expected for 2023, which is equivalent to 18.37% of GDP. This is consistent with the total expenditure target set by the government in the 2023 National Budget Statement.

In reality though, not all ministries will be allocated as according to November 2022 percentages. Some ministries will received a much higher percentage increase than others, such as the Ministry of Defence and War Veterans Affairs, the Ministry of Home Affairs and Cultural Heritage. These ministries may have more urgent or strategic needs or priorities that require more resources from the supplementary budget, like in this case increased need for security during the impending 23rd of August harmonised plebiscite, and after.

Regardless, this new allocation will need to be transparent and accountable, with clear and realistic targets, indicators, and outcomes. It is of utmost importance that it be subjected to parliamentary scrutiny and approval, as well as public consultation and participation, but we are aware this parliament is soon to be dissolved and the new one will be voted in by end of August, by which time, I surmise, would be way late for this budget.

Political scholars and those of legal persuasions will have to advise us on what should be the likely scenario, because us as economic analysts will tell you that beyond August may be too late as the nation needs this budget now.

Growth policy targets for capitalist economy

In conclusion, Zimbabwe is facing a challenging economic situation that requires urgent and decisive policy actions. We expect the Minister of Finance to announce a supplementary budget of at least ZWL$10 trillion to finance the government’s expenditure needs for the rest of 2023. This budget will need to be aligned with the national development goals and the macroeconomic stability objectives and it will be a critical test of the government’s commitment and capacity to deliver on its promises and to restore confidence and credibility in the economy.

Will the Minister rise to the occasion and deliver a budget that will transform Zimbabwe’s fortunes? Will he wave the same magic wand to that seems to be halting economic ills of particularly the last four months or will he brandish a stick that may poke civil servants, punish business and point more in the direction of political expediency over economic frugality?

The answers are nigh upon us and, as usual, we will be on hand to dissect, analyse, and summarise for you whatever economic pronouncement is made. Till next time…