Book: Zimbabwe's Financial Revolt

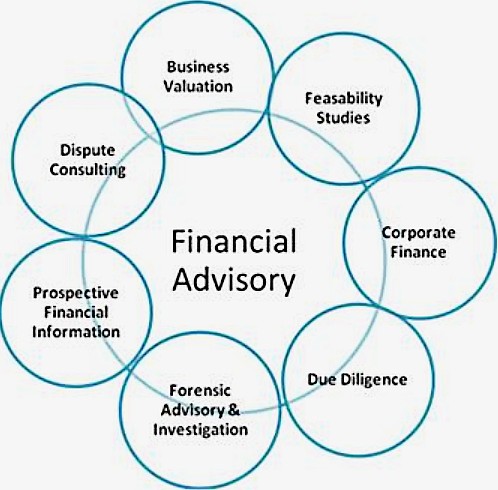

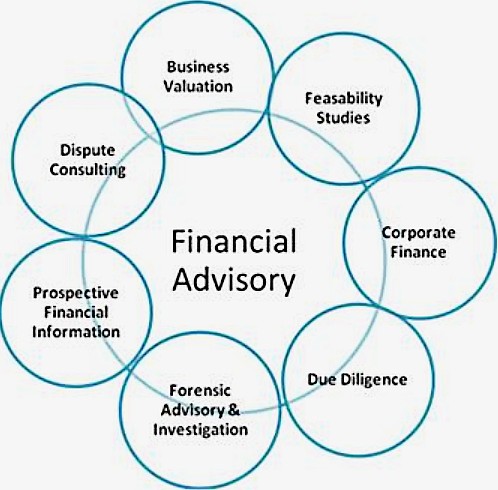

Financial Advisory

Monthly Retainer Program

Dr Admire Maparadza Dube is the founder and CEO of BidVerse Finance, the ultimate partner for investments, capital raising (debt/equity/hybrid), trade finance, transfers and savings. BidVerse is also the holding company for BidPay, a Paygate and Payment Processing platform working with several banks in 3 countries in the SADC region.

He is responsible for providing strategic leadership for the group including finance functions for the Operating Units. He has a wealth of experience in executive positions spanning banking, project management, wealth management, financial planning, the statutory environment, tax and customs procedures in Financial Services companies, Banks, Energy sector, Wealth Management and a Tax Authority, in 4 countries across 3 continents, over a 22 year career.

Currently, Dr Dube seats on several boards, including CMF Ghana, Maghreb Intercontinental, and Red Ribbon Wealth Managers. Academically, Dr. Dube holds an Honours Degree in Banking & Finance, Masters in Development Finance, a CFA Charter Holder, as well as Internal Controls Investments among various other executive Certificates. He also recently graduated with a Ph.D. in Finance. His thesis being : The Relevance of Central Banks In A More Global Economy Where More Exogenous Factors Than Local Policies Determine Direction of National Macroeconomics.

His career objectives are to grow professionally in the fields of Finance & Admin, Strategy, Capital Markets and Economic planning & Research to realise his full potential leading to a simultaneous growth of his organisations and make a positive impact in the community.

http://www.admiremaparadzadube.com

X: @admire_dube

For Zimbabwe, how will replacing the later with the former improve or infringe on these functions? Is a Currency Board effective dollarisation and surrender of economic independence and national sovereignty?

Is the Reserve Bank of Zimbabwe’s (RBZ) propensity to practice economics of politics the harbinger of economic afflictions, like high inflation, or is the practice a necessary evil in the face of drying investment, economic sanctions, ebbing local productivity and singular exports of primary un-beneficiated raw products? How is either of the Currency Board or the Central Bank critical in ameliorating the specific adverse macro-economic situation Zimbabwe finds itself in at present?

THE African Continental Free Trade Area (AfCFTA) was established in 2018 with the aim to create a single market for goods and services, to deepen the economic integration of the African continent.

Consolidating Africa into one trade area provides great opportunities for entrepreneurs, businesses and consumers across the continent and ultimately countries, which boosts chances to support sustainable development in the world's least developed region.

With the backdrop of the Covid-19 pandemic exposing challenges of a continent already ravaged by socio-economic ills, AfCFTA offers great potential to not only offer economic mitigations against such a pandemic again, but also speedily extricate African nations from regression and to a path of self betterment.

Authorities in Zimbabwe are regularly in the news lately with one pronouncement or another altering current fiscal and monetary policy.

Sometimes they will introduce a completely new one, only to reappear days later to rescind prior announcements.

To the casual observer, and indeed to us keen analysts, the impression being emitted by leadership is of knee jerk reactive interventions. A fire fighting modus operandi.

This gives affected people sizeable consternation, reminiscent of the abysmal 2008 economic catastrophe. It is not unimaginable that some among us may be questioning if we are regressing back to that epoch. But are we..?

Below is an except of a presentation I made teaching non-finacial managers of an engineering entity about the basics of Financial Markets...

Financial Markets are the system through which companies, governments, and other entities are able to raise and exchange capital.

Financial markets are important because they provide an efficient and cost-effective way to raise capital, which is essential for investments in production, innovation, and economic growth.

Financial markets also provide the means for individuals and institutions to diversify their portfolios, manage their risk exposure, and create investment opportunities.

The Mosi-oa-Tunya gold coins were made available for purchase by entities and the general public on the 25th of July 2022.

The opening day price for each coin was US$1,823 or Z$805,000, reflective of the Willing Buyer Willing Seller (WBWS) exchange rate being applied in conversion.

Speculation has been rife on what effect these coins will have on overall performance of the economy; so, is the fact that 2000 coins were put for sale on open day.

It’s natural to cogitate on how many more coins are to be introduced to market as to have a desired effect but the authorities are yet to announce those numbers.

To borrow from colloquial lingo, is the mathematics balancing?

Zimbabwe's economy has been declining for two to three decades. Reasons vary, but some point to the Economic Structural Adjustment Program (ESAP) implemented under IMF orders in 1990 as the genesis, or subsequent droughts hampering its effectiveness.

Others cite haphazard land acquisitions in the late 90s, and inefficient or corrupt reallocation of land to new farmers.

This article assesses the efficacy of economic interventions to improve growth prospects: is it oversight, incompetence, or deliberate opportunity cracks?

Get Market Trends, Business News, Economics Podcasts and Services directly to your inbox.

...every week on Capital Markets Watch Africa Podcast and stay abreast of the latest Economics & Business news and insights on African Investment Markets.

Be sure to tune in as we explore continent wide stories and provide you with the insider information you need!

The Mosi-oa-Tunya gold coins were made available for purchase by entities and the general public on Monday 25 July 2022. It’s natural to cogitate on how many more coins are to be introduced to market as to have a desired effect but the authorities are yet to announce those numbers. To borrow from colloquial lingo, is the mathematics balancing?

“Diaspora Home Loans” is a mortgage finance plan by the financial services institution whose goal is to ensure expatriates can procure properties from their home country. Dr. Admire Maparadza Dube here was making a presentations to Zimbabweans based abroad on this investment opportunity.

In this edited audio clip (with an info video as background), Dr Admire M. Dube discusses in Open Parly one of the RBZ interventions to help fix Zimbabwe's economy: The introduction of Mosi-Oa-Tunya gold coins. Dr Dube explains that these coins are meant to increase liquidity, reduce inflation, and help build investor confidence in the country. He also outlines the various benefits the coins could bring to Zimbabwe, including greater access to foreign currency, increased savings, and the potential to create more jobs.

I'd love to hear from you!

Please use the form below for any questions or comments.