The world is witnessing a historic transformation of the global monetary system.

Traditional fiat money has dominated the global economy since 1971 when American president Nixon shocked the world with a unilateral decision to end the convertibility of the US dollar into gold, effectively ending the Bretton Woods monetary system.

This arrangement, colloquially known as the “gold standard”, had hitherto, established an international monetary system based on fixed exchange rates between the US dollar and other currencies, and between the US dollar and gold, hence the moniker.

Five decades on, fiat money is showing signs of catastrophic failure - or is being deliberately culled by the powers that be as they now favour a new money system. As will be explored further in this article.

What is Fiat Money?

Fiat money is a medium of exchange that is issued and backed by a government, such as the U.S. dollar, the Euro, the Yen, and most internationally traded currencies. The term fiat derives from the Latin word, meaning “let it be done.”

Fiat vs. Commodity vs. Representative Money: What's the Difference?

An over simplified reason for what gives (or diminishes) the value of fiat money is that it depends on each respective government’s economic policies, endowments, strength of a country’s economy, geopolitical actions, as well as the trust and confidence of the public in the government’s ability to maintain its value. Critically, fiat money is NOT backed by any physical commodity, such as gold or silver, but by the legal authority of the government to declare it as legal tender.

This monetary system has some advantages over commodity-backed money, such as flexibility, convenience, and lower transaction costs but it is its drawbacks that are sounding the death knell for its demise, such as inflation risk, exchange rate risk, and political risk.(if we are for now to ignore the active push by powerful nations to once again transform the monetary system like the 1971 Nixon bombshell).

Why is Fiat Money Failing?

According to some analysts, fiat money is failing because it is no longer able to sustain the growth and stability of the global economy. They argue that fiat money has reached its limits in terms of its ability to stimulate demand, manage debt, and cope with shocks. They point out that since the global financial crisis of 2007, central banks have resorted to unconventional monetary policies, such as quantitative easing, zero or negative interest rates, and forward guidance, to support economic recovery and prevent deflation.

As it turns out, even these policies have had diminishing returns and unintended consequences. They have created asset bubbles , distorted market signals , increased inequality , and encouraged excessive leverage . They have also eroded the profitability and solvency of banks , reduced the effectiveness of fiscal policy , and undermined the credibility and independence of central banks . Moreover, they have failed to address the underlying structural problems of the global economy, such as low productivity growth and high debt levels.

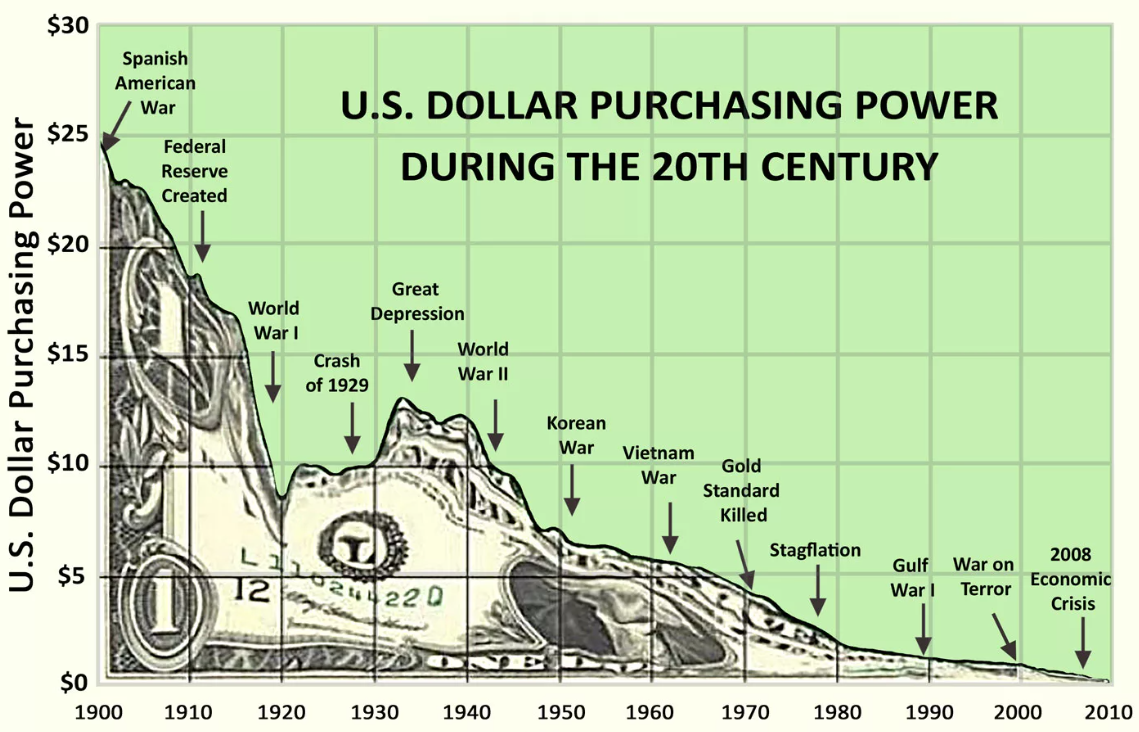

US$ purchasing power during the 20th century

As a result, fiat money is losing its value and its role as a store of value, medium of exchange, and unit of account. The purchasing power of every fiat money in the world is declining due to inflation which has has been rising steadily but surely. This means that fiat money is losing its purchasing power over time, making it less attractive as a store of value, with each passing day, and anywhere and everywhere in the world. The exchange rate of fiat money is also fluctuating due to various factors, such as trade balances, interest rate differentials, capital flows, expectations, and speculation.

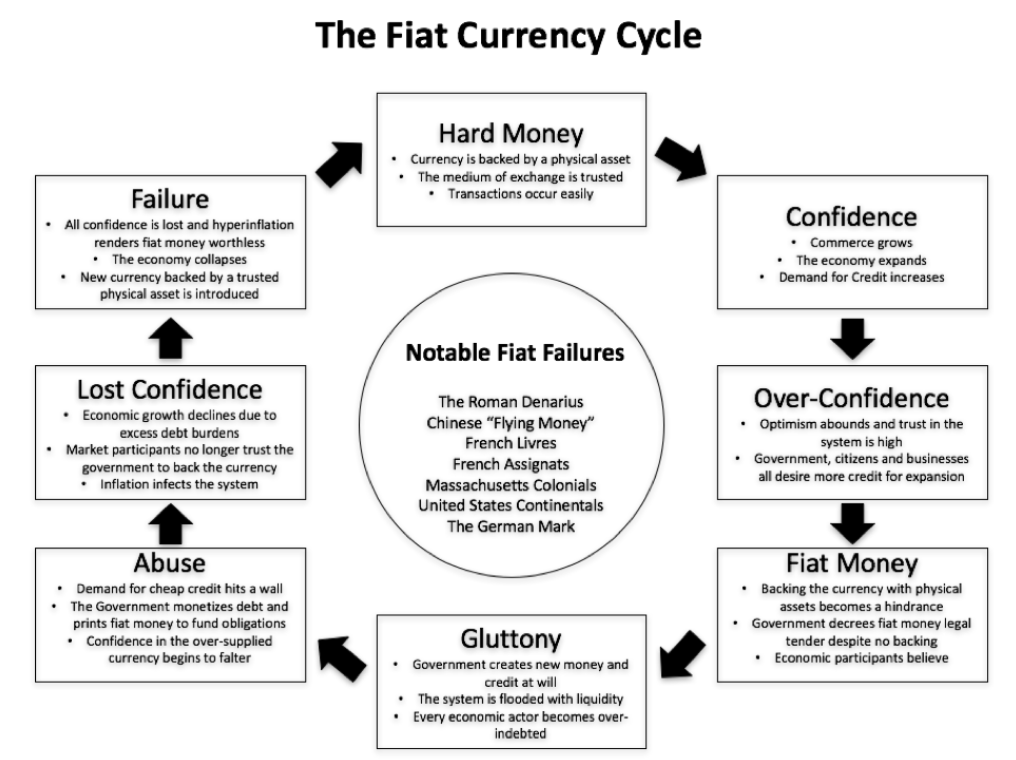

Vicious cycle

Analysis is, generally, a detailed examination of something complex in order to understand its nature or to determine its essential features. This means it includes extrapolating from the present and/or the measurable, and using a tried, or values system, (and a little bit of history) to project a likely reason or outcome.

And my analysis of the act of desperation by eminent global superpowers to push fiat money to the precipice, along with other its very defects I alluded to above, underline that we are only but just a few years away from another Nixonesque monetary system overhaul.

Fiat currency vicious cycle

If we look at the world financial crisis of 2007-8, had governments back then not mobilised huge amounts of taxpayers money and the central banks instructed that stacks of money to be created (read printed) out of nothing, the fiat system would have collapsed there and then.

Data acquired by Finbold finance media group indicates that the world’s leading central banks, including the Federal Reserve of USA, Bank of Japan, European Central Bank, and the Bank of England, have injected more than $25 trillion into the global economy since 2008! This injection of money was done through a policy called quantitative easing (QE), which involves buying bonds and other financial assets to lower interest rates and stimulate spending.

To put that figure into context, $25 trillion is equivalent to about 28% of the global gross domestic product (GDP) in 2020, which was estimated at $88.6 trillion by the World Bank. It is also more than the combined GDPs of the United States ($20.9 trillion), China ($14.7 trillion), and Japan ($4.9 trillion) in 20203. In other words, the amount of money printed by central banks since 2008 is larger than the output of the world’s three biggest economies.

Regardless, despite all this monolithic intervention, salvation still seemed only temporary. The amounts of money had to be continuously increased over a period of 12 years. The interest rates, equally, had to be reduced several times. So, the system was made ever more unstable. In the long term that could not go well. With the advent of the COVID-19 pandemic $9 trillion had to be “created” to stimulate the then moribund global economy on the back of forced locked downs.

But for how long will this vicious cycle of inflation sustain? Where there are shocks, cash injection, interest rates reduction, then inflation and shocks again, with intervention needed yet again?

Just last year, 2022, it was to the point where the next collapse was threatening. And this collapse has been postponed through a final feat of strength, namely the reduction of interest rates to zero and the injection of yet more billions and billions for one final time. With that however, a qualitatively new situation has come about. A further deferral would require interest rates to be dropped into the minus range, and this would destroy the foundation of the current banking system.

Banks are the centerpiece of fiat monetary system (the credit system) and these cannot operate long-term with negative interest rates, as this is where the system has pushed us to. This means that a further deferral with the previously used approach will no longer be possible going forward.

In the present situation one can inject billions and billions into the system at maximum one or two more time. However, with the result that the already strongly growing rate of inflation will further surge head and we will be driven into global hyperinflation, not just in a few countries.

Were that to happen any further “injection” will only accelerate the collapse of the monetary system and the value of fiat currencies. This would have devastating consequences for the global economy and society, leading to widespread poverty, social unrest, political instability and even national conflagration. Therefore, it is not misplaced at all to see leading central banks and governments pushing for a new monetary system to prudently (and more responsibly) avoid such a scenario.

What is this new system? The testing phase is happening before our very eyes and yet very few hardly see it happening!

The “new monetary system” and the death of fiat money

Quite clearly, proponents of, and the main protagonists in, this fiat money system, have chosen to install a new system and a double strategy.

On one side, in the background and away from public view, but ambiguously, also right before our very eyes, they are preparing a new system. And on the other side, they are using the end phase of the present dying fiat money system, to pillage it using all tricks at their disposal.

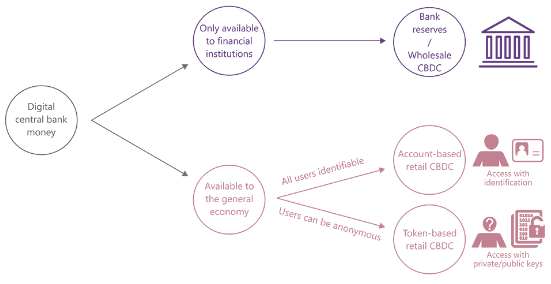

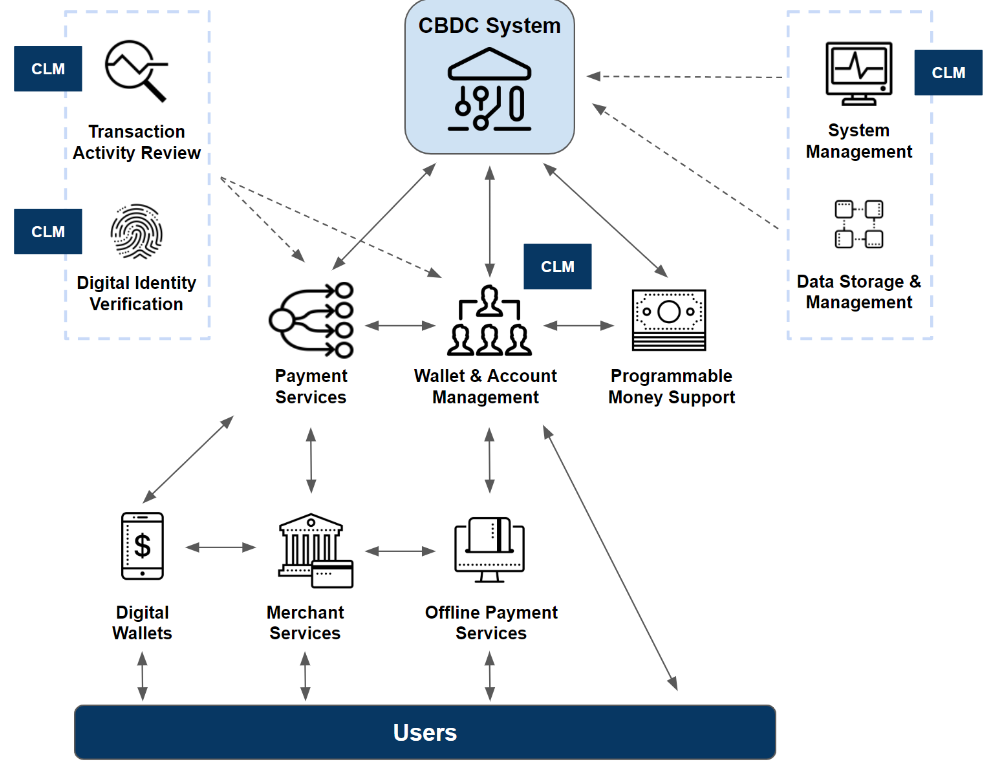

This “new monetary system” is the Central Bank Digital Coins (CBDCs).

This “new monetary system” is the Central Bank Digital Coins (CBDCs) all controlled by the government.

This has seen a deliberate and premeditated destruction of the world economy, for the exclusive expansion of this new digital-financial complex, with simultaneous preparation via the central banks, of a new system and in collaboration with the IT corporations. And we already know how this system will look. It is about the complete removal of cash and banks in their previous form, and the introduction of digital money from central banks.

The end goal as it appears, is that we will all have just a single account through which all transactions run. And this account will not reside in a business or high-street bank but with the central bank. Let me explain further…

Why is Digital Central Bank Money Rising?

What is Digital Central Bank Money?

Digital central bank money is a new form of money that is issued and controlled by central banks, such as the Federal Reserve, the European Central Bank, or the Bank of Japan. It is a digital representation of fiat money that can be stored and transferred electronically through a centralized ledger or database. Unlike fiat money, which exists in both physical (cash) and digital (bank deposits) forms, digital central bank money exists only in digital form.

Granted, digital central bank money has some potential benefits over fiat money, such as efficiency, transparency, and innovation. It can:

-reduce the costs and risks of intermediation, settlement, and clearing in the financial system.

-enhance the visibility and accountability of central banks’ monetary policy and operations.

-enable new forms of financial inclusion, innovation, and competition in the digital economy.

However, it is the unsaid advantages (for the governments and central banks) of digital central bank money that are significant and worth every lasy dying penny to mention it. And we are not just talking the disruption of the existing monetary system and financial intermediation by changing the demand and supply of money and credit. Or the likely scenario where banks as we know them become obsolete as central banks become the be-all-and-end-all of finance matters. But the serious concerns about privacy, security, and governance by giving central banks unprecedented power and control over people’s financial transactions and data.

The “new monetary system” is the Central Bank Digital Coins (CBDCs).

Do we really want, in this day and age, a monetary system that undermines financial intermediation and competition by crowding out or displacing existing forms of money and payment systems, such as cash, bank deposits, or cryptocurrencies?

Are we ready to accept these new CBDCs that threaten monetary sovereignty and independence as we all know central banks are organs of, or exposed to, political organs or interference from governments or other actors? What will become of a “bank-less” environment where “digital wallets” become our new “banks” on our devices all under central banks control?

We have seen enough already in global governance in the recent years to correctly interpolate that this system will infringe on privacy and civil liberties by enabling excessive surveillance or control over people’s financial transactions and data by central banks or other authorities.

It is all about power and control

Digital central bank money is programmable. That means central banks have finally created a perpetual money printing monster of frankenstine proportions as with CBDCs they now can create unlimited money out of nothing. One can indeed operate in this way, and with negative interest rates, without having to destroy the system.

Furthermore and perhaps even more importantly, to governments, this is not the only interesting feature of digital central bank money. Digital coins and virtual wallets will allow governments to watch over ALL transactions made. To assign us various tax rates instantly and right in our wallets and impose upon us individual fines if so chosen. With this new monetary system governments (through central banks) will be able to place an expiry limit on a part of our money and require that we spend certain amounts within certain time periods, if they so choose!

I understand if this is numbing your brain. It is that cloak of un-believability that is being used to test the new monetary system before our very eyes and we are passing it off as “digital age transformation.” Let me twist the dagger here… governments will have the ability to require “your” money to be used for specific purposes, and/or require that specific amounts be paid only for certain products, and/or that they be sourced only from certain regions, the gory list is endless. That they will apply this is neither here nor there, but it is the capability alone that is a control in its own right. So will your money remain “your” money in this new monetary system?

CBDCs are all about power and control

The total control factor in the system is that a government will be in the position to cancel our ability to make all transactions with a single mouse click, and so, shut us down financially. Digital central bank money would be the most efficient tax collection method for society that has ever occurred in the whole history of man, and with that, nothing more and nothing less than the realisation of an all-encompassing dictatorship brought about through “money.”

However, this policy proposal faces a major obstacle. That is, the anticipated opposition from the populace. It is highly likely that a significant fraction of individuals will not comply with this form of monetary reform. Therefore, the implementation of digital central bank currency would entail substantial social costs. And it is precisely this challenge that the digital-financial sector has evidently considered, and devised a counter-intuitive strategy for introducing this (digital) medium of exchange.

Instead of pursuing a gradual transition to digital currency, which would elicit considerable resistance, they will opt for the opposite approach. They will induce societal disorder, in order to present the adoption of digital central bank currency as the remedy for all problems. Namely, in the guise of a global reset that will supposedly restore stability, prosperity, and sustainability.

This reset will involve not only a radical overhaul of the monetary system, but also a transformation of the social, political, and environmental spheres. The digital-financial sector will claim that this reset is necessary to address the multiple crises that afflict the world, such as the pandemic, climate change, inequality, and geopolitical tensions.

As it turns out, the real motive behind this reset is to consolidate the power and influence of the digital-financial sector over the economy and society, and to impose a new form of digital totalitarianism that will undermine democracy, freedom, and human dignity.

Conclusion

The global monetary system is undergoing a profound transformation as fiat money is failing and digital central bank money is rising. This transformation has significant implications for the macroeconomic and financial stability of the world. It will affect how people save, invest, trade, and spend their money. It will also affect how central banks conduct their monetary policy and operations.

It will require new forms of cooperation and coordination among different stakeholders, such as governments, regulators, financial institutions, technology providers, consumers, etc.

The future of money is uncertain and unpredictable. However, one thing is clear: money matters.

Money is not just a medium of exchange, but a social institution that reflects the values and preferences of society. Money is not just a technical issue, but a political issue that involves power and interests. Money is not just an economic issue, but a human issue that affects well-being and happiness. It is for this reason that we should not let the digital-financial sector dictate the future of money, but rather engage in a democratic and participatory process to decide what kind of money we want and need.

But they again, when last was our collective voice heeded in the corridors of power?

What we should bear in mind at all times around this topic is that we should not take money for granted or leave it to experts or elites. We should be aware of the changes and challenges in the global monetary system. We should be informed about the benefits and risks of different forms of money. We should be engaged in the debate and decision-making about the future of money. We should be responsible for our own money choices. And we should reserve the ability to say no to changes that concentrate power in a few in a few entities.

Money is the new rights front.