Africa needs to mobilise its domestic resources to address its development challenges.

Some of Africa’s wealthy individuals and businesses have a tendency to accumulate capital in Africa and then transfer it abroad for “safekeeping”, where it is then used by foreign institutions to generate wealth for themselves.

This is a suboptimal allocation of resources, from Africa's perspective, as the same capital could yield higher returns and have greater developmental impact if reinvested in Africa. Moreover, it would benefit the African countries where the capital originated from after all, by creating jobs, income, and tax revenues.

Of course, there are political and economic risks that may discourage such investments, such as political interference, corruption, legal uncertainty from unjust prosecution, macroeconomic instability, and market failures. These are valid concerns that need to be addressed by improving the governance and business environment in Africa.

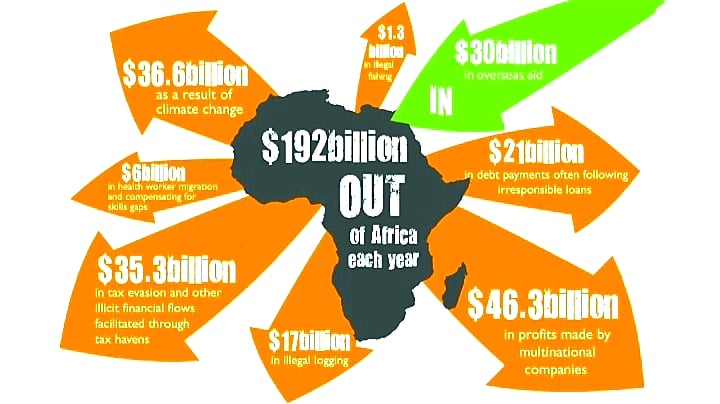

However, they should not overshadow the enormous opportunities and potential that exist in the continent. It is absurd that Africa exports almost US$200 billion worth of goods and services annually and receives back only US$30 billion in foreign direct investment! As it stands, Africa’s wealthiest 100 individuals have a combined net worth of US$110 billion, which is more than the GDP of the bottom 40 of 55 African countries!

The US$21 Billion Dangote oil refinery in Nigeria, commissioned last year in 2022, is a commendable example of how African capital can be deployed to create value-added industries. It is the world’s largest single-train refinery. The refinery’s pipeline infrastructure is the world’s largest at 1,100 kilometres, capable of handling three billion Standard Cubic Feet per day of gas.

This project not only generates employment, income, and foreign exchange for Nigeria, but also enhances regional trade and integration, especially under the African Continental Free Trade Area (AfCFTA) agreement.

The AfCFTA is a historic opportunity for Africa to boost its industrialisation and diversification by creating a single market of 1.4 billion people, rivaling India and China, but with a very young demography. The AfCFTA will also stimulate intra-African trade, which currently accounts at only 17% of Africa’s total trade, compared to 69% for Europe and 59% for Asia.

The African market is ready and hungry for infrastructure development. According to the African Development Bank, the continent faces an annual infrastructure financing gap of US$68-US$108 billion, which affects the living conditions of Africans and the continent’s global competitiveness. Infrastructure development is a key driver for progress across the African continent and a critical enabler for productivity and sustainable economic growth.

It contributes significantly to human development, poverty reduction, and the attainment of the Sustainable Development Goals (SDGs).

However, public resources alone are not sufficient to meet this demand. Public-private partnerships (PPPs) offer an additional approach to increase private sector investments and higher levels of efficiency in the development and operation of infrastructure assets in Africa. PPPs are contractual arrangements between public authorities and private entities that involve the sharing of risks and rewards in the delivery of public goods or services. And these can be marketed aggressively to African entities as a way from diverting profits from being taken out of the continent.

PPPs can leverage the comparative advantages of both sectors, such as innovation, technology, management skills, access to finance, and accountability from the private sector; and regulation, policy direction, social responsibility, and public interest from the public sector.

The African Development Bank Group has recently approved its first strategic framework for the development of PPPs in Africa, which aims to provide an end-to-end solution to member countries, from upstream support to ensure an enabling environment and capacity building; to midstream support for project preparation and transaction advisory services; to downstream support for project financing and implementation.

The Bank will also establish a dedicated special instrument, to be known as the Africa PPP Development Fund, to support pillars one and two. This is precisely one of a raft of policies that should be spearheaded not only by this continental Bank, but also every state in Africa. Unfortunately, nothing yet is evident, by way of concerted continent wide exertion towards making this common place policy.

This framework would have enabled not only the Bank, but also individual countries, to provide much needed assistance for the development and implementation of PPPs in its regional member countries, and to accelerate its infrastructure drive in the continent.

And then there's the African Diaspora remmiting +US$55 billio annually! Double the yearly US$ 5 billionn "AID" + $20bn "investment" combined! Shouldn't there be a "Diaspora Ministry" in all African countries specifically tapping into this vast pool of resources?

Where are the incentives for them?

Besides encouraging local reinvestment, African states cld also tap into these remittances through deploying Diaspora Bonds, Equity Funds, Incentivised Special Economic Zones, etc for them. The Dangote Oil Refinery is testament to what African resources can achieve with right vision.

Africa needs to harness its own resources to address its development challenges. This requires a shift in mentality from relying on external sources of finance to mobilising domestic capital for productive investments. There is local money to do that. Numbers don't lie. So much so that the agenda of AID will not even be necessary.

It only requires a conducive environment to be fostered by countries for profitable and judicially ringfenced private sector participation and partnership with the public sector in delivering infrastructure services. The AfCFTA offers a unique opportunity for Africa to leverage its market size and potential to encourage more internal (re)investment to be fostered through regional integration.

As the late former UN Secretary-General Kofi Annan once said, “Nobody is going to develop Africa except us”

Story Picture Gallery:

https://twitter.com/admire_dube/status/1656485362825326592?t=CkPmFTOREa3jKrrQFyrCRw&s=19