12 JULY 2023

Welcome to our VERY FIRST weekly analysis of news and trades on the three Zimbabwe securities and commodities exchanges, the Zimbabwe Stock Exchange (ZSE), the Victoria Falls Stock Exchange (VFex), and the Zimbabwe Mercantile Exchange (ZMX).

We are BidVerse, an official broker on the ZMX, and we are here to provide you with insightful and objective reports on the market performance, conditions and outlook for Zimbabwe's securities and commodities. Going forward these reports will be coming out every Friday analysing the past week, and projecting for the following, on any movements or noteworthy news from these three markets.

Our analysis is intended for public consumption, for those who are interested in trading, or just learning more about it. However, please note that our analysis is not legal or financial advice and is provided for informational purposes only. You should not rely on our analysis as a basis for making any investment or trading decisions. If you need legal or financial advice, or you want to participate in the ZMX auctions and others we will be happy to be of assistance.

Please contact us directly at trades@bidverse.org or info@admiremaparadzadube.com

In this inaugural edition, we will focus on the ZMX maize commodities auction held on the 12th of July 2023.

ZMX maize auction

We will examine the factors that influenced the market structure, conditions and behavior of the participants, and how they affected the auction results. We will also look at the possible outlook for the next ZMX maize commodities auction, based on the global and regional market trends and the government policies and regulations. Finally, we will offer projections.

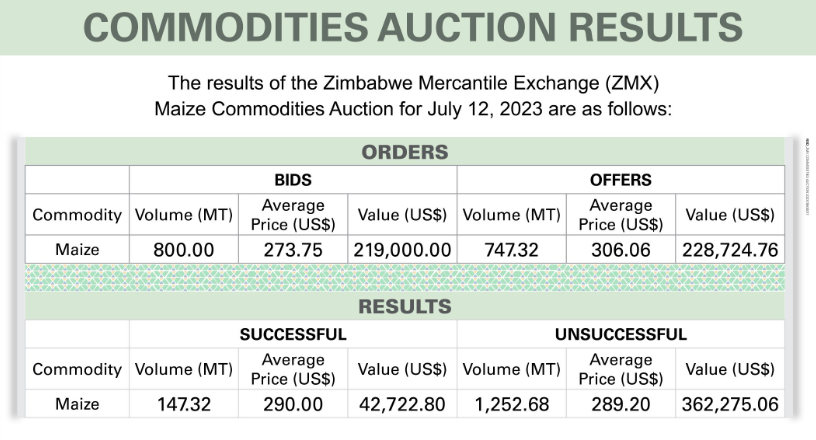

12 July 2023 ZMX Maize auction results

From these tables, we can see that the demand for maize was higher than the supply, as the total volume of bids exceeded the total volume of offers by 52.68 MT. However, the average price of offers was also higher than the average price of bids by 32.31 USD, indicating that there was a gap between the sellers' and buyers' expectations. This resulted in only 19.6% of the total volume being traded successfully, at an average price of 290 USD per MT, which was close to the midpoint between the average bid and offer prices.

To understand why the market was not cleared and why there was such a discrepancy between the bid and offer prices, we need to look at some factors that may have influenced the market structure, conditions and behavior of the participants.

Assessment

Only a small fraction of the total volume was traded successfully, at an average price that was closer to the offer price than the bid price, and the lower clearing ratio confirms that.

Clearing ratio is the ratio of the volume traded successfully to the total volume offered or demanded. It measures how well the market clears or matches supply and demand. A higher clearing ratio means that more transactions are completed and less surplus or shortage remains. At close of business this was only 19.7%, indicating that only a small proportion of supply and demand was matched.

Clearing price is the price at which supply and demand are equalized or cleared. It is also known as the equilibrium or market price. It reflects the marginal value of the commodity to both buyers and sellers. This was US$290.00. Clearing price was relatively high, indicating that sellers had more bargaining power than buyers.

Market efficiency is the ratio of the value traded successfully to the total value offered or demanded. It measures how well the market allocates resources or maximizes social welfare. A higher market efficiency means that more value is created and less value is lost due to unmet demand or unsold supply. Again, as auction is only a few trades old, this was depressed at 19.5%

Price discovery is the process by which buyers and sellers converge to a common price through their bids and offers. It reflects how well the market reveals information about the true value of the commodity. A better price discovery means that there is less volatility, uncertainty and arbitrage in the market.

The price discovery quotient for this week was 0.038 and a possible understanding of this could be that there was a lot of variation and uncertainty in prices.

Internal and external factors

There might be a GMB factor at play here, the lower price discovery quotient could have been from that the market participants had similar expectations and preferences about the value of maize. However, this could also indicate that the market was not very competitive, and that the prices were influenced by the GMB’s support price.

The role of the Grain Marketing Board (GMB), which is a parastatal entity, is to regulates and intervene in the maize market in Zimbabwe, because this is the country's staple diet and thus shocks, glut or unavailability therein could impact the people and/or farmers very negatively. Thus GMB plays the balancing act by setting a "minimum support price" for maize, which was 0.2889 USD per kg or 288.90 USD per MT as at the date of the auction.

This means that any seller who deposits maize with GMB is guaranteed to receive at least this price, regardless of the market conditions. And they may only participate in the ZMX auction in so far as the price is higher than the "minimum support price" otherwise they will sell their produce at GMB. No surprise then the average price was $290.00

This may have created a situation where sellers, naturally seeking to maximise their returns, have an incentive to deposit their maize at GMB Warehouses and then offer it at a higher price on the ZMX platform, hoping to capture a premium over the support price. On the other hand, buyers may have been reluctant to pay more than the support price, knowing that they could always buy from GMB at that price or lower if there was excess supply. This may be, at present, contributed to the divergence between the bid and offer prices and the low volume of successful trades.

Another factor likely at play is that generally maize prices have been surging in the regional and global market.

The global maize market is reported as experiencing a tight supply-demand balance due to matters linked to droughts in major producing regions, increased demand from China and other emerging markets, the Russo-Ukraine conflagration and rising biofuel production. This is pushing up the global maize prices to record levels, reaching an average of 350 USD per MT in July 2023.

It goes without saying that the regional maize market in Southern Africa was also affected by these factors, as well as by Zimbabwe specific issues, such as currency instability and policy uncertainty in as well as outright profiteering/speculation tendencies.

The regional maize prices varied widely, ranging from 250 USD per MT in South Africa to 450 USD per MT in Malawi in July 2023. Zimbabwe's maize price was thus relatively low compared to its neighbors, partly due to the GMB's support price and partly due to the depreciation of its currency against the US dollar.

On the backdrop of a nation adequate maize harvest in the last season in Zimbabwe, authorities need be aware that these market conditions may create an opportunity for arbitrage, where traders from the region could buy maize from Zimbabwe at a lower price and sell it in other markets at a higher price, earning high profits profit. So export permits for same need be scrutinised more closely.

On the other hand, higher regional maize prices might have also increased the expectations of sellers, who may have been aware of the higher prices elsewhere and demanded a higher price for their own maize on ZMX's auction. This, in part, explains the widened gap between the bid and offer prices and reduced the volume of successful trades.

Outlook

The projection for the coming ZMX maize commodities auction may depend on several factors, such as:

- The global and regional market conditions for maize, which may affect the supply and demand dynamics and the price levels of maize in Zimbabwe and other countries.

- The government policies and regulations regarding the maize market (including import/export quotas), which may affect the role and influence of the Grain Marketing Board (GMB) and the ZMX in setting prices and facilitating trade.

- The behavior and preferences of smallholder farmers and other market participants, which may affect their decisions on how much maize to produce, consume, store and sell in different markets and at different times.

- The challenges and constraints that need to be addressed, such as improving the infrastructure, technology and accessibility of ZMX's platform and designated warehouses, providing more information, education and incentives to smallholder farmers, and enhancing the coordination and integration of ZMX's auction with other regional and global markets.

Based on these, we would say that the outlook for the next ZMX maize commodities auction is likely to mirror the past week but with a marginal firming of prices as there is only one direction for prices as long as prices hover on the GMB support price - UP.

There may also be an opportunity for higher prices and more trade due to the tight global market conditions and the continued liberalisation of the maize domestic market coupled with the trading momentum generated by ZMX.

The market is always changing, but we are always ready. Keep up with the latest trends and developments with our timely analysis and outlook projections.

Happy trading.