This will go against the grain of my very training and run counter to acceptable finance industry practice… Yet, here we stand, in the shadow of a valuation paradox so incredulous that simply stating it feels radical.

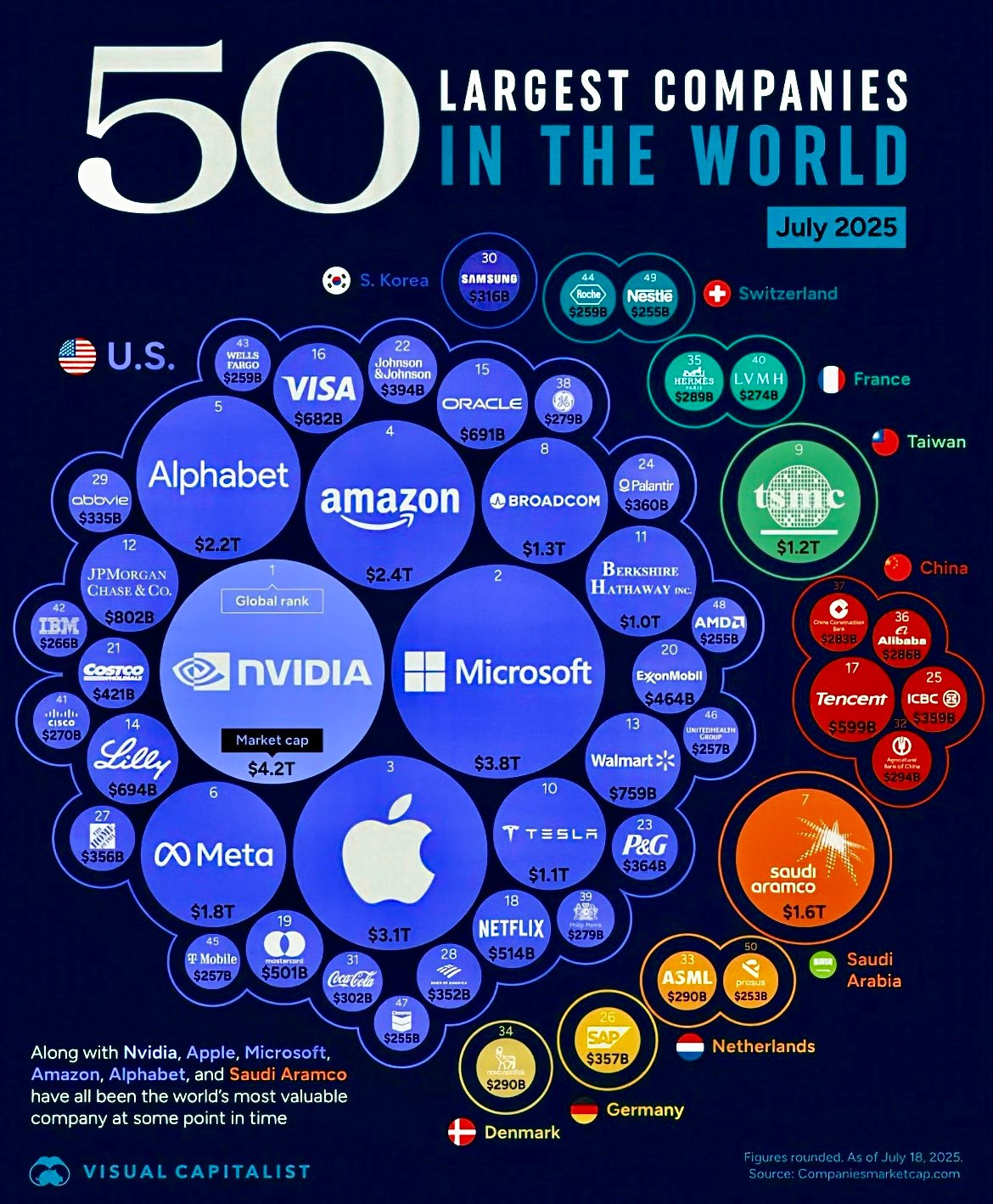

So Nvidia is valued at $4.2 trillion, and Saudi Aramco $1.6 trillion?

On the surface, the world bows to the $4.2 trillion market capitalisation of Nvidia, the mighty chipmaker vying for digital dominion. But if we dare scratch beneath the veneer of sentiment-driven share value, and instead gaze upon the colossal, calculable assets of Saudi Aramco, the numbers begin to defy basic math, if not basic logic.

Consider what is universally accepted by the finance crowd, me included, that by the end of 2024, Nvidia is reportedly worth $4.2 trillion by market capitalisation. Saudi Aramco, the world’s single largest oil producer, limps in at $1.605 trillion. The difference? Investor sentiment, AI fervour, and perhaps, mass Wall Street hypnosis, dare i add.

Is this the way our collective financial machinery is meant to operate though? Can one industry’s intangible promise truly outweigh the basic sum of earth’s calculable (and almost indispensable) “physical” wealth?

Here’s the absolutely wild part: by any metric that factors actual, tangible assets into the mix, Aramco’s worth explodes into stratospheric multiples. Its hydrocarbon reserves alone (250 billion barrels of oil equivalent at the close of 2024) valued conservatively at $60 per barrel, balloon to a potential $15 trillion!

This is before even counting its downstream operations which include oil refining 4.1 million barrels per day and manufacturing 57.6 million metric tonnes of chemicals annually. How is this not top billing in any grown-up, albeit archaic, valuation conversation?

Against this backdrop, Nvidia’s financials look every inch the “runaway” story investors love. In 2024, revenue soared to $60.9 billion, with net income surging 581% from 2023 to hit $29.76 billion. Its profit margin, a staggering 48.9%, powered by AI exuberance, is what every tech CEO dreams of. Resultantly, their P/E ratio in early 2024 soared over 110, reflecting appalling optimism.

Now, contrast this with Aramco’s whopping $480.57 billion revenue, $106.2 billion net income in the same period, which is more than triple Nvidia’s, plus a solid, pragmatic 22.1% margin. May I ask: Is valuation meant to be a popularity contest, or a ledger of economic reality?

Additionally, Saudi Aramco handed shareholders a jaw-dropping $124.2 billion in dividends last year, yielding 6.9%. Nvidia? Zero.

The chipmaker’s profits are ploughed right back, fuelling yet more breakneck expansion. Both strategies have their charm — but which is more “real”? Which company is truly creating value, not just in boardrooms but in the world? Perhaps I’m opening up a whole new different debate, similar to the valuation one we currently have, but just as much different, so I’ll end it there.

Back to ours, let’s play devil’s advocate further. Apply a P/E multiple of 20 (the old standby for blue-chip stability) to Aramco’s haul, you arrive at $2.124 trillion — still lagging Nvidia’s market cap. One won’t be too wrong, if wrong has a scale, to think this all agrees with finance, yet defying basic math.

Basing on sentiment-driven share value against basic calculable and quite tangible assets, the finance industry, and all its acolytes, seem to stand at a crossroads. With oil prices averaging above $80 per barrel in 2024, why does Wall Street cling to its calibrated formulas and dismiss the elephant in the room? Which is the unbeatable allure of growth stories, those electrifying tech narratives) overwhelms hard-earned, seasoned cash flows?

What does all this mean for investors? Can we afford to ignore dividends so colossal they could fund national budgets, or reserves so vast they anchor entire economies? Or is the gamble on future technology truly “worth” more in rapturous anticipation than the calculable, near-arcane solidity of sub terrain wealth? Literally!

If this discussion seems incredulous to all finance funds, it’s simply because it is to all other professions. The great valuation divide isn’t just an academic spat; it is the very blind spot through which market bubbles are born and historic fortunes lost, me-reckons. If Saudi Aramco’s asset-based value is $15 trillion, nearly quadruple Nvidia’s share-price glory, how long will financial orthodoxy keep dancing around the facts?

But of course, we are professionals. We play by the rules of “the street”: market cap is king, sentiment runs the show. Yet sometimes, just sometimes, it feels that the price of a barrel of that black stuff, or that yellow metal, or that crystal stone, or that rare earth mineral, you name it, ought to weigh more in the scales for whomever owns and controls these, than the next chip design (or all those other sentiment driven “assets”). Please don’t blame me, i trained in the 90s and may need retraining, if need be. I’m open to that.

But first hear me out.

Be that as it may, as the sun sets on 2024’s financial theatre, investors would do well to wonder: are they betting on reflections in the water, or the foundations beneath it? As Warren Buffett once said, “Price is what you pay. Value is what you get.”