Zimbabwe's president, HE. E. Mnangagwa, announced the introduction of a structured currency to stabilise its local currency, the Zimbabwean dollar (ZWL), which has been suffering from high inflation and exchange rate volatility.

The President said this while addressing the first Zimbabwe Ministers' Cabinet meeting for the year 2024 at the State House on the 6th of February.

As a nation now used to the frenetic pace of monetary policy adjustments, granted in endeavours to arrest currency and indeed fiscal challenges in the economy, we have almost become numb to these new announcements.

Regardless, this is a new, fancy even, prospect about Zimbabwe money, and questions have been flying back and forth among the populace seeking to know what exactly is a "structured currency"?

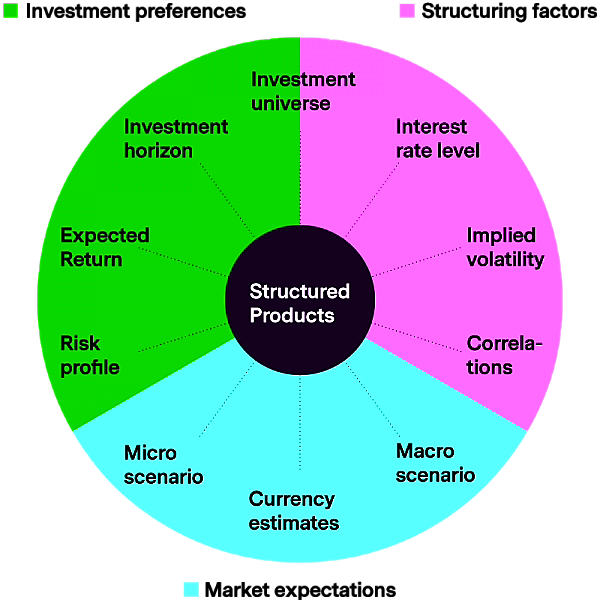

Structured currency is a type of financial instrument that combines a traditional currency with a derivative component, such as a share, an option, a swap, a commodity, or a combination of these, to modify its risk-return profile. Simply put, this is indexed money deriving its value not from the demand and supply mechanism from macroeconomic fundamentals in an economy, but from value of the underlying instrument(s).

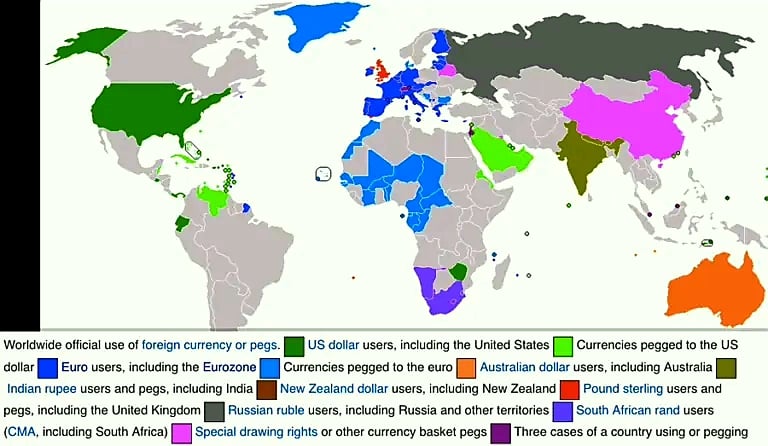

Dollarisation is some form of "structured currency," but strictly indexed to the United States dollar (USD), and with support mechanisms to monitor this strict indexing, like a Currency Board, and little flexibility. It is in this rigidity where it's easy to understand why Zimbabwean authorities opted for the former, although it likely will include the USD as well as the underlying value. We expect to see other currencies in there too to for a "combination basket." Using light interpretation, we can hazard and say the Zimbabwe dollar (ZWL) will now be a derivative - a financial instrument whose value is obtained from another.

We can already surmise that the ZWL structured currency would be backed by a basket of foreign currencies, (such as the US dollar, the euro, the British pound, and the South African rand), because the country doesn't have gold reserves to back it, otherwise this gold would have backed the ZWL directly.

And the local stock market instruments are very volatile to act as a stable backing, if even there are enough blue chip instruments to back the M3 monetary needs of the Zimbabwe economy. Hence the conclusion that this structured finance will be backed by other currencies. The derivative component using multi currencies would thus allow the structured currency to adjust its value according to the market conditions and the performance of the underlying currencies through a fixed exchange rate between them and the ZWL.

We can see that this indexed money is designed to reduce inflation risk and increase monetary stability by borrowing from the more stable backing value currencies. However, indexed money will have some drawbacks which we hope the authorities have "priced in," such as the loss of monetary sovereignty, the exposure to external shocks, and the dependence on the credibility of the issuer.

We could go so far as to stick our necks out here and aver that, perhaps the reason we are having a structured currency and not dollarisation is that the former will afford a little wiggle room, like to print more ZWL when needed, and cover it over time back to equilibrium (which every country does and is a great release valve in times of monetary squeeze) as and when needed. Something dollarisation does not afford.

Along with this potential ability, which we hope the authorities with use prudently, the introduction of a structured currency could potentially solve some of the economic challenges that Zimbabwe faces in 2024, such as:

- Reducing inflation and exchange rate fluctuations, which erode the purchasing power and confidence of the ZWL holders, at least in the immediate term, and hopefully the economy stabilises enough to improve other fundamentals, to enable longer term balance.

- Increasing the availability, and affordability, of foreign currency, which is needed for imports, debt repayments, and investment, through reduction in forex demand pressure, stimulation of productivity, and increase of exports.

- Enhancing the credibility and transparency of the monetary policy, which could attract more domestic and foreign investors and boost economic growth, (potentially).

However, all this aspirational talk will bear little fruit, if at all, if the introduction of a structured currency is not accompanied by adequate foreign currency reserves.

Is the country getting external help in terms of setting up this reserve? How much will it be?

Because in an indexing system, such as this one, the reserve should cover all notes in circulation 1 is to 1, at least at inception, to foster public acceptance and adoption.

In money, confidence is everything.

There is also the impact on the fiscal policy, which could face constraints and pressures from the fixed exchange rate regime and the potential fiscal dominance of the monetary authority. Equally as significant will be the implications for the financial sector, which could face challenges and opportunities from the increased competition and innovation in the payment system and the financial intermediation.

The structured currency is not a novel idea, as other countries have adopted or considered similar schemes in the past. For example, Ecuador and El Salvador implimented it in their economies, but using only the US dollar as the anchor value. Panama and Hong Kong have currency board arrangements, where their currencies are fixed to the US dollar and fully backed by foreign currency reserves, which is the stricter form of currency indexing - dollarisation.

Argentina and Brazil have used similar currency baskets, which is possibly what Zimbabwe will do with their structured currency, where their currencies are linked to a weighted average of several foreign currencies.

Venezuela and Iran have even created parallel exchange rates, where their currencies have different values depending on the type and purpose of the transaction, which Zimbabwe should not do, considering the already vexing arbitrage scourge in other sectors of the economy, so it can ill afford yet another "gap."

We then see that a structured currency is not a magic bullet, as it does not address the root causes of Zimbabwe's economic woes, such as the lack of productive capacity, the incongruity sometimes seen between monetary and fiscal policies and the general mistrust of the public about policies.

The structured currency then is not a panacea, as it does not guarantee the success of Zimbabwe's economic reforms, such as the fiscal consolidation, the debt restructuring, and the structural transformation. But importantly, it can be a starting point to heal the economy, if accompanied by requisite frugality.

Invariably, a structured currency is not a silver bullet, as it does not solve the challenges of Zimbabwe's economic integration, such as the regional cooperation, the trade diversification, and the global competitiveness.

But... we can conclude that it is a bold and innovative move, as it shows Zimbabwe's willingness and readiness to try new and different solutions to its old and persistent problems. The structured currency is a challenging and complex endeavour no doubt, as it requires Zimbabwe's coordination and cooperation with its domestic and foreign partners to ensure its smooth and effective implementation and operation.

It is, finally, a promising and hopeful opportunity, as it offers Zimbabwe some potential and possibility to achieve a more stable and prosperous economic and financial future.

If only there is a concerted and true follow through.