Zimbabwe is on the verge of launching digital currency tokens backed by gold. This is according to the governor of the country's central bank, the Reserve Bank of Zimbabwe (RBZ). The move is seen as an attempt to stabilise the new iteration of the Zimbabwe dollar (ZWL), which was introduced in June 2019 as a replacement for the bond notes and coins, a surrogate currency since 2016.

But will this bold move pay off or backfire? And what does it mean for the future of money in Zimbabwe, in Africa, and beyond?

In this article I explore the rationale, the risks, and the implications of Zimbabwe's latest monetary pronouncement.

Let us begin by elucidating details of Zimbabwe's gold-backed crypto token, how it works, and why it could be a game-changer, or a disaster, for the country. I also compare this token to another alternative currency that is currently in circulation in Zimbabwe: the Mosi-oa-tunya gold coins. Finally I interrogate the economic and political implications of these two competing currencies for Zimbabwe, and beyond.

What are tokens, crypto-currencies, and CBDCs?

Before we delve into the details of Zimbabwe's plan, let us first clarify what tokens, crypto-currencies, and CBDCs are.

Tokens are digital representation of an asset, or a unit of value, that can be transferred and exchanged on a blockchain network (a distributed electronic ledger that records transactions and ensures their security and transparency). This asset can be anything of value from commodities to services and even rights. Tokens, like the asset they stand for, can be traded on platforms that connect buyers and sellers, such as exchanges or peer-to-peer networks, or themselves used as a form of currency with an inherent value equivalent to the asset they represent.

Crypto-currencies, on the other hand, are a type of token that are designed to function as a medium of exchange, a store of value, and a unit of account. They are not backed by any physical asset or authority, but rather derive their value from supply and demand, network effects, and cryptography (encryption techniques for secure communication). For reference, some of the most popular cryptocurrencies include Bitcoin, Ethereum, and Tether.

Crypto-currencies use cryptography to ensure the validity and integrity of transactions and to prevent counterfeiting and/or double-spending. So there are crypto-currencies that are decentralised, like Bitcoin or Ethereum, meaning that they are not controlled by any central authority or intermediary. Others, such as Tether or USD Coin, are centralised, meaning that they are backed by fiat currencies or other assets and issued by a trusted entity.

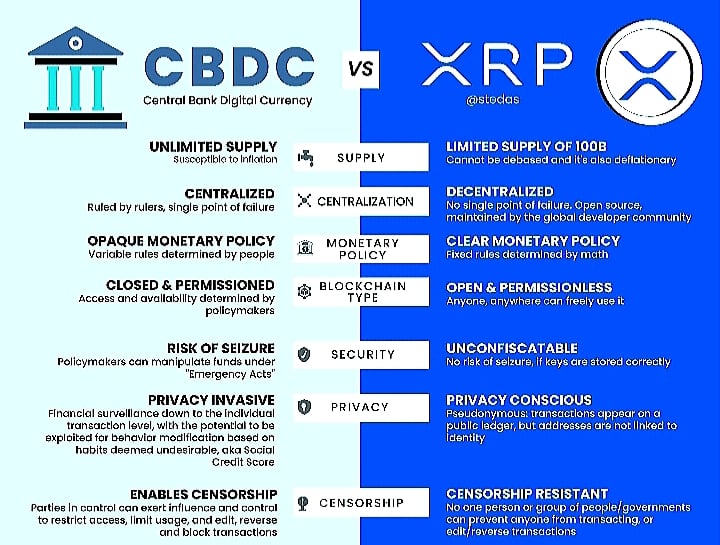

Central Bank Digital Currencies (CBDCs), are another type of token, but these are, as the name implies, issued by central banks as a digital form of their national fiat currency. They are intended to complement or replace cash and other forms of money in circulation. CBDCs thus have all the attendant attributes of fiat (regular) money but only in an electric token form.

Central Bank Digital Currencies can then have various inherent features, such as, whether they are account-based or token-based, whether they are retail or wholesale, and whether they are centralised or decentralised. Countries exploring or piloting CBDCs include, but are not limited to, China, Sweden, and the Bahamas.

We see here that CBDCs, from inception, are an authorities-driven digital alternative to fiat money and are meant to enhance the efficiency and inclusivity of the payment system. This means they can be designed in different ways, depending on the policy objectives and technical features of each issuing authority. Hence the need to study each one carefully and independent of others, since they individually bear the fingerprints, and therefore intentions, of the issuer.

What is Zimbabwe's gold-backed digital currency?

With this background, we naturally come to the logical question of what the nature of Zimbabwe's gold-backed digital currency is. According to Dr. John P. Mangudya, the RBZ governor, the central bank will soon introduce "…digital gold tokens as a way to reduce demand for foreign currency and provide a more stable store of value for Zimbabweans.”

So these tokens will be backed by, and thus representative of, physical gold. They are being introduced to act as hedges against currency volatility and inflation, which has seen the new ZWL lose almost 100% of its value against the US dollar, both on the official rate and on the parallel market rate, since its re-introduction at par with the US dollar about 4 years ago to the month.

According to the 19th of April 2023 RBZ Foreign Exchange Results, the derived weighted exchange rate for the ZWL was trading at 1000.02 to 1 USD. However, according to ZimRates.com, on the parallel market, on the same day the same ZWL was changing hands at 1 USD = 1,700 ZWD!

Surely the central bank had to do something, especially considering that almost 50% of that value evaporated in only just the last month!

And this is it; gold backed digital tokens.

But, don’t we have in circulation the "Mosi-oa-tunya" gold coins, introduced on the 25th of July only last year in 2023 for that exact same purpose? Are the gold coins not working as intended? And if not, then what chance of an ice cube in hell will these digital tokens stand, as representative of the actual asset which the central bank failed to use? Are there other underlying factors?

All these are penitent questions. They solicit widely (and indeed wildly) varied and subjective responses depending on who you ask, how much they understand macro-economics, and especially, of what political persuasion they are, between the main belligerent parties in Zimbabwe.

Have the Mosi-oa-tunya gold coins failed?

At the risk of regurgitating an article I have already written before on the subject matter, the gold coins have worked as designed, but as I alluded to in that article, they were bound to face an uphill task without smaller denominations of gold coins and without industrial buy in as they were never going to be enough to cover the need on a one to one basis.

Just to recap, Zimbabwe invested heavily in infrastructure to stimulate economy growth. The rate of this intervention however was so high such that in the 2021 national budget, capital expenditures for “national projects” accounted for a ZWL 334 billion which was a whooping 34.5% of the national budget. And by end of that year, 46.5% of that budget, or about Z$450 billion, of expenditure allocation went to only the infrastructure sectors in a single financial year!

This added to an already growing liquidity position where the new Zimbabwe dollar was introduced three years earlier with Z$10 billion in circulation, and by end of 2021 there was a reported Z$1 trillion in circulation. A 100 fold increase in roughly 30 months!

So the gold coins were definitely needed to mop up this liquidity and allow the overheating economy to vent, and especially divert these ZWLs away from the parallel market, to starve that market and control rates.

Which it did. For a while.

However, as I calculated in that article, the RBZ needed to produce 496 435 gold coins to absorb the targeted ZWL in the market! Calculating further and using that 6 month period as a target (as that was how long the moratorium to re-sell the purchased coins was), I surmised that to meet that coin number target, the central bank had to introduce 19 094 coins into the market each week!

Any economist worth their salt could see that the country could not produce that amount of gold for the coins and thus they were only introduced to calm the market through intent. Read more about the mathematics of the Mosi-Oa-Tunya coins on here:

https://nehandaradio.com/2022/07/30/the-mathematics-of-mosi-oa-tunya-gold-coins-is-it-adding-up/

Even if the country could produce the requisite gold coin numbers, they were intended as a store of value for high net worth entities and individuals, shown by their 1 troy ounce weight (USD 2003.76 at the time of writing). So, for transactional purposes people still needed to be covered, by smaller gold coin denominations or otherwise, if the ZWL pressures were to be extinguished.

Enter the gold backed digital tokens

The digital gold tokens should be viewed as a secondary attempt by the RBZ to use gold as a monetary anchor. The digital gold tokens are similar to the physical gold coins in terms of their backing and value. However, they differ in terms of their form and accessibility.

The digital tokens are issued on a blockchain platform and can be bought and sold on-line or through mobile devices. They are also more affordable and divisible than the physical coins, which require a minimum investment of around +$2,000.

The digital tokens are meant to complement the physical coins and expand their reach to more people, especially those of low net worth. The RBZ hopes that both currencies will reduce the demand for foreign currency and provide a more stable store of value for Zimbabweans.

How does Zimbabwe's gold-backed digital currency compare to Mosi-oa-tunya gold coins?

Zimbabwe's gold-backed digital currency and Mosi-oa-tunya gold coins are both intended to serve as alternative currency that is linked to the value of gold. However, they have some important differences in terms of their design and functionality.

The gold-backed digital currency will be based on blockchain technology, which means that it will be able to leverage the benefits of decentralisation, transparency, security, and efficiency. It will also be more accessible and convenient than physical coins, as it will not require any intermediaries or infrastructure to facilitate transactions, like the gold coins do.

Over and above that, the digital currency will be more scalable and flexible than physical coins, as it will not be limited by physical constraints such as supply, transportation and/or vaulting needs.

And therein lies my concern. From my calculations in my other article I referred to earlier, it is clear that Zimbabwe is not producing enough gold as a nation for export, to cover national needs, as well as for reserves. That we could not produce enough gold coins already is testament that we may yet not have enough gold as well to back every digital token for national transactional use.

Other benefits of the digital e-ZWL tokens

On the flip side to these concerns is the understanding that this is not a Zimbabwe specific challenge. Neither is any other country’s fiat money fully backed by gold nowadays. In fact, seigniorage, which is the profit that a government or central bank makes by issuing money, which usually costs less to produce than its face value, or by printing money to fund a project then reap economic rewards from it higher than the value of printed money, is common practice in capitalist economies.

It all boils down to if the issuing authority can be trusted to make good on a promise, than it is about the actual backing of a currency by physical gold.

Also, not to be forgotten is that crypto-currencies, as alluded to earlier, are a type of token that are designed to function as a medium of exchange, a store of value, and a unit of account without any physical asset backing it, as the value is derived from supply and demand, network effects, and cryptography (encryption techniques for secure communication).

So what could be more important for the success of e-ZWL will precipitate down to RBZ discipline, than it will do with each digital token having physical gold backing.

One key word - "confidence."

How much of that can the RBZ master, to enable the token to hold value, even in cases where the gold backing is fluctuating? And how much is the central bank able to keep the market satiated by continuously pushing more gold coins into the market, while it is also managing these tokens, to have the two complementary than competing? We wait to see.

The Harare Institute of Technology (HIT), which is developing this CBDC is on record stating that they envisaged the digital currency will curb vices such as currency manipulation, the hoarding of cash, as well as illegal foreign exchange deals.

The tokens, especially if they are to be introduced with an e-wallet facility and divisible to a minute denomination, may yet diminish the the appetite for non importing entities/people to want to always swap their local currency for USD on the parallel market, since the tokens will equally hold value, if they work as designed.

Considering the proliferation of smart devices in the country, the blockchain-anchored CBDC can potentially bring the un-banked population into the formal banking system as well. This segment includes those with access to banks but do not transact through them because of lack of trust, eroded by the 2009 Zimbabwe dollar crush.

Not to be underestimated is the capacity for this digital currency to significantly reduce the regulatory costs for RBZ, effectively reducing the transactional costs, which may ultimately reduce the costs of service fees. So access, value, stability and convenience of the e-ZWL has a potential to set off a chain reaction that will result in increased business for small-to-medium enterprises.

The list of other benefits of a properly implemented digital currency will include to;

- Provide a more stable and credible alternative to the Zimbabwe dollar

- Reduce dependence on foreign currency and improve external balances

- Increase financial inclusion and innovation by leveraging digital technology

- Enhance transparency and accountability by using blockchain

- Boost confidence and trust in the monetary system

For these benefits to be realised the RBZ has to be wary of, and prepared to handle;

- Technical challenges and cyber risks

- Apathy due to infrastructure failures, like internet downtime or offline/approval delays etc

- Legal and regulatory uncertainties (we are yet to update all our laws to align with the 2013 constitution a decade later, what of the proper legislative framework to account, run and administer this fresh new innovative financial novelty?)

- The possible complete erosion of the fiat paper money ZWL and monetary plus sovereignty, policy effectiveness etc that comes with introduction of digital money.

- Trigger capital flight and currency substitution by introduction of transacting efficiency that e-ZWL will bring, if it is not accompanied by commensurate economic activity

- Expose the economy to external shocks and gold price fluctuations as this token directly tracks, and is indexed to, the global gold prices. (all which can be managed better with a raft of macro-economic adjustments, like those I recommend in yet another article; “Advice to Zimbabwe Finance Minister: Open a Minerals Market Exchange in the country and replace USD with ZWL for all export transactions…”

My consolidated analysis of Zimbabwe introducing the e-ZWL

Zimbabwe's plan to launch a gold-backed digital currency is an ambitious and innovative experiment that could, and indeed should, have some positive effects on its economy. However, it also faces many risks and uncertainties that could undermine its success, mostly implementation, behavioural and the whole state machinery backing this to the hilt.

Therefore, my opinion on the RBZ's new digital tokens is cautious approval and yet conditional.

On one hand, I surmise that the plan could provide a more stable and credible complimentary option to the Zimbabwe dollar, which has been eroded by hyperinflation and volatility for years.

It could also reduce dependence on foreign currency, especially for local transactions, and improve external balances by increasing demand for local products and services, ultimately. It could also increase financial inclusion and innovation by leveraging digital technology and blockchain, which in itself increases economic activity - the nation’s GDP.

On the other hand, I think that the plan could face technical challenges, knowing Zimbabwe current infrastructure as I do. Not to speak of that the country still has more people in the rural areas, which are less developed and with minimum access to the tech. and power needed for digital currencies, than there are in urban areas, which too recently have been blighted by power outages. And we add to this cyber risks that could compromise its security and reliability.

As I have already alluded to above, legal and regulatory uncertainties could hamper its adoption and acceptance. And there is the possibility of this new e-currency cannibalising existing paper ZWL through people shunning it in favour of the new kid on the block in the absence of their usual foreign currency.

Therefore, my conditional approval of the plan depends on how well it is designed, implemented, monitored, and evaluated, but it being a good idea. It also depends on how well it is complemented by other policies that address the underlying causes which have led us to even be looking at digital money as the saviour.

What are some recommendations for the plan?

Zimbabwe's plan to launch a gold-backed digital currency is a bold move that requires careful planning and execution. Here are some recommendations that could help improve its chances of success. The RBZ and the Zimbabwe government may strive to;

- Ensure adequate and transparent governance and oversight of the digital token issuance and distribution. Authorities must establish clear rules and procedures for verifying, auditing, and especially regularly inform about the gold reserves that back the tokens, involve relevant stakeholders and experts in the design and implementation of the plan.

- Enhance cybersecurity and resilience of the digital token platform and infrastructure. RBZ must adopt best practices and standards for protecting the data and transactions of the token users. They should implement contingency plans and backup systems for dealing with potential cyberattacks or technical failures.

- Harmonise legal and regulatory frameworks for the digital token with existing laws and regulations for money and finance. It is imperative for there to be clarity on legal status, rights, and obligations of the token users, issuers, intermediaries, and regulators. Potential issues such as taxation, consumer protection, anti-money laundering, and dispute resolution have to be addressed beforehand.

- Coordinate monetary policy and fiscal policy to support the digital token and maintain macroeconomic stability. The Treasury department must back the tokens with gold, especially at inception, as promised. Where seigniorage is necessary, they must avoid excessive money creation and public spending that could undermine the credibility and value of the token. Equally as important is the need to align monetary policy objectives and instruments with a gold-backed regime and ensure fiscal sustainability and debt management to avoid default and arrears.

- Promote public awareness and education on the digital token and its benefits and risks. Even less public dissemination of information is happening about the digital tokens than was given for gold coins. Yet public awareness campaigns for the gold coins were in themselves inadequate, leaving people to mostly misinforming each other about those coins.

Which paints a picture of inadequacy of current public announcement about an even more complex digital currency. Authorities must conduct more campaigns and programs to inform and educate the public about the features, functions, and advantages of the token as well as provide guidance and assistance on how to access, use, and store the token safely and securely.

- Monitor and evaluate the performance and impact of the digital token on the economy and society. Just to mention, but naturally expected to happen, is that RBZ will need to collect and analyse data and indicators on the supply, demand, price, circulation, adoption, and usage of the token and be making adjustments in real time. All this will be done with an aim to assess the effects of the token on inflation, growth, trade, poverty, inequality, financial inclusion, innovation, etc.

Conclusion

Zimbabwe's plan to launch a gold-backed digital currency is a daring pronouncement, probably spurred by down turn of economic fundamentals in the past month, but necessary nonetheless given the mentioned inherent inadequacies of the paper ZWL along with the MOsi-Oa-Tunya gold coins. So this pronouncement could have significant implications for its economy and society.

It could offer a more stable and credible alternative to those averse to the paper Zimbabwe dollar and allow confidence in it to grow alongside its digital cousin. This could also reduce dependence on foreign currency and improve external balances by increasing demand for local products and services. There is a huge potential also to increase financial inclusion and innovation by leveraging digital technology and blockchain.

However, the plan also faces many risks and uncertainties that could undermine its success. It could face technical challenges and cyber risks that could compromise its security and reliability. It could also create legal and regulatory uncertainties that could hamper its adoption and acceptance. It could also erode monetary sovereignty and policy effectiveness by limiting the central bank's ability to respond to shocks and manage liquidity.

It could as well trigger capital flight and currency substitution by encouraging people to hoard or convert their tokens into foreign currency or other assets. There is also a possibility that these tokens could expose the economy to external shocks and gold price fluctuations that could affect its value as they are directly indexed to the yellow metal. All matters the RBZ has to be, and are assume are already, cognisant of.

It also depends on how well it is complemented by other policies that address the underlying causes of inflation, instability, and underdevelopment in Zimbabwe. Especially the politics, both internal and external.

The central bank governor, Dr John P. Mangudya, has taken chances, and these could pay off or backfire, all depending on implementation, follow through and Zimbabwe specific issues, than about the flaws of digital currencies in general.

Only time will tell.