Tax Academy Course

Tax Academy courses are designed to equip individuals with practical and professional knowledge of taxation laws, compliance requirements, and financial strategies. Whether you're a beginner exploring the basics or a professional seeking advanced tax planning techniques, these courses cater to a broad spectrum of learners, including accountants, business owners, students, and tax consultants.

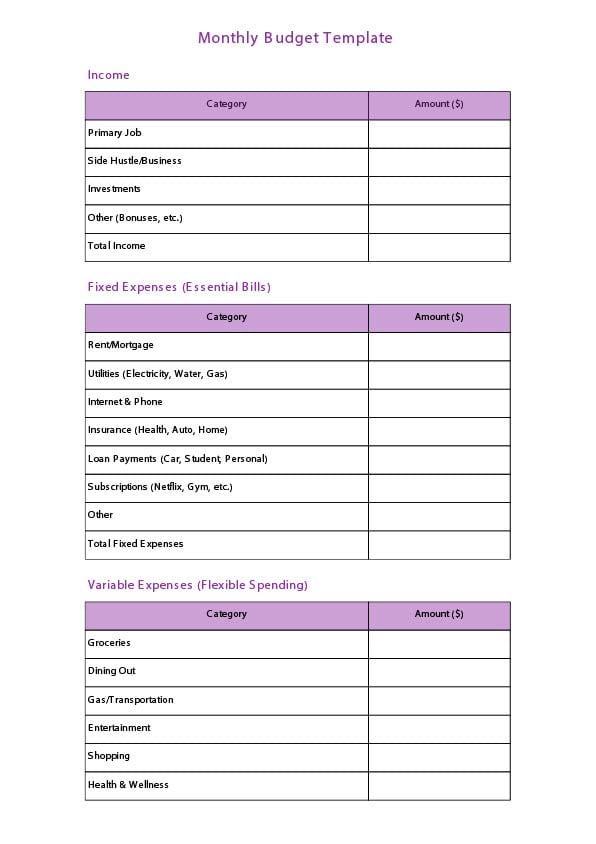

TAX ACADEMY COURSE incudes:

Schedule A, B, D, and E

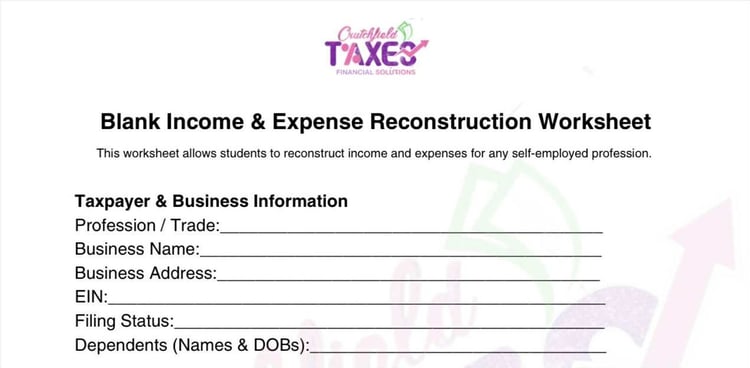

Shed C and record reconstruction

Business deductions

Filing status/dependents

Due diligence

Ethics

Federal tax laws

Refundable and non-refundable tax credits

1040 income and adjustments

Depreciation

Social media marketing

Customer service

End of module quizzes

Practice scenarios

Certificate of completion for your class