Real Estate – Simple Acquisition Model for Office, Retail Properties - Excel File

This is a fully functional, institutional quality, and dynamic real estate financial model for calculating the return on the acquisition and sale of an Office (or other types of commercial real estate). It is a robust model (with only three tabs), very user-friendly that will provide the user with a detailed Excel spreadsheet. It’s purposely simple, clean, and made to be filled out in no more than half an hour.

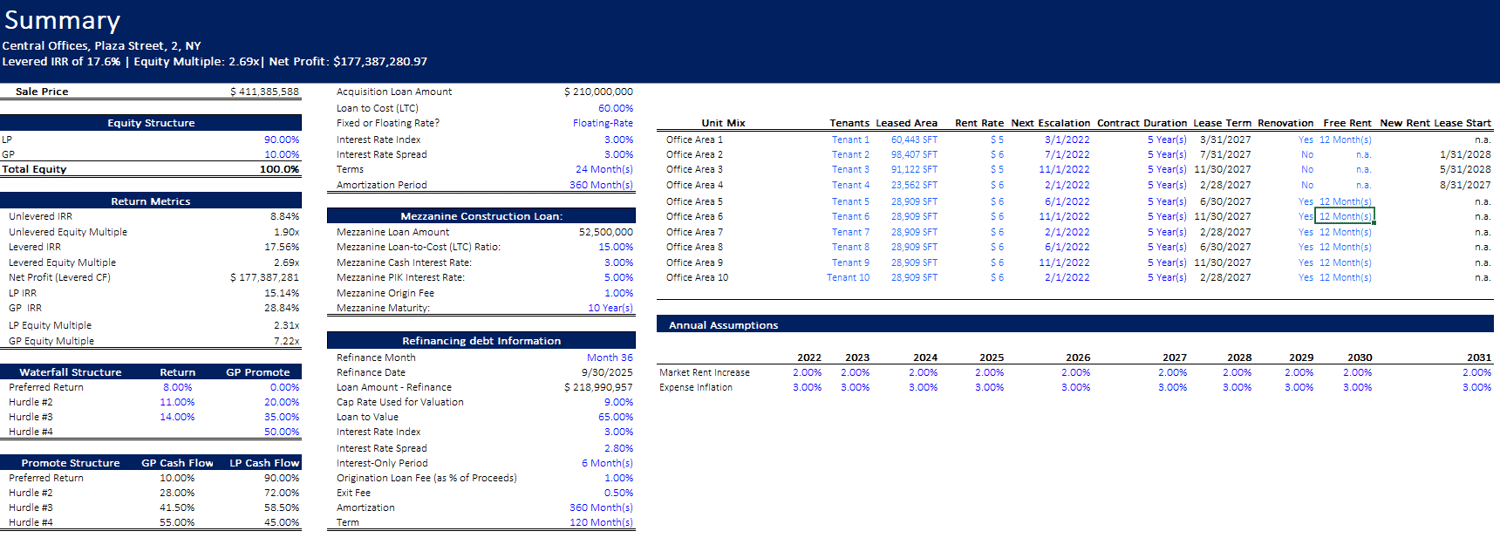

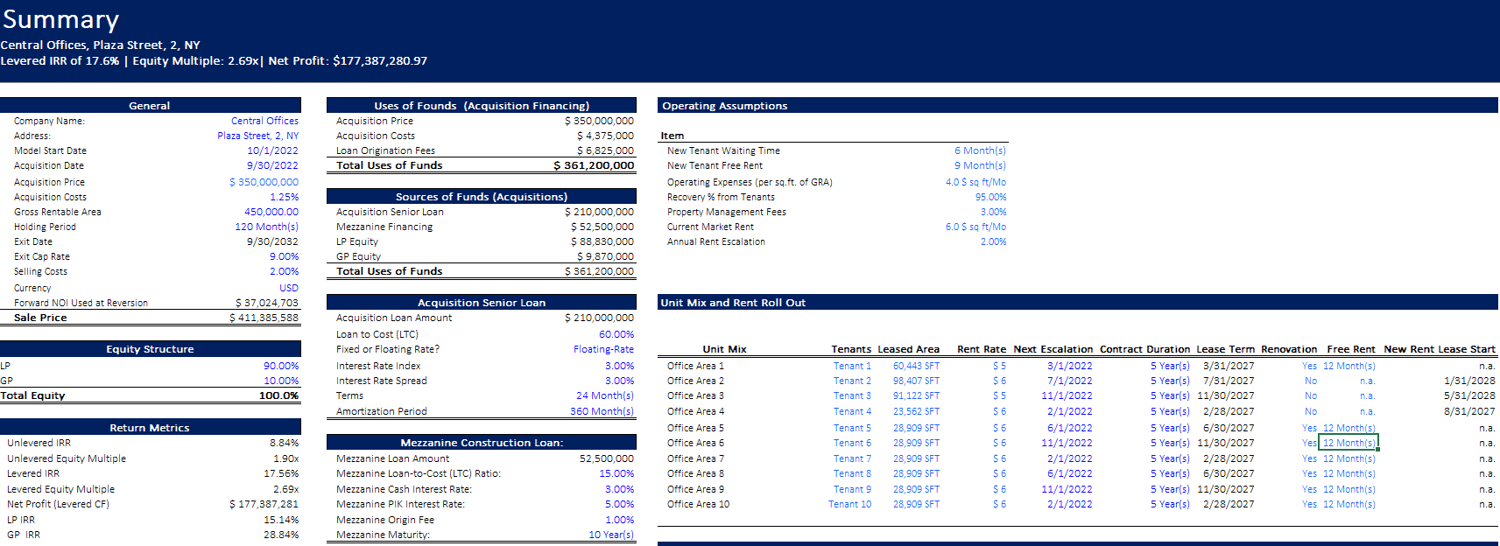

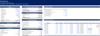

Summary – all investment-related inputs are entered into this sheet. These include property description, investment timing, acquisition, Capex, sale assumptions, operating expense assumptions, financing assumptions, etc.

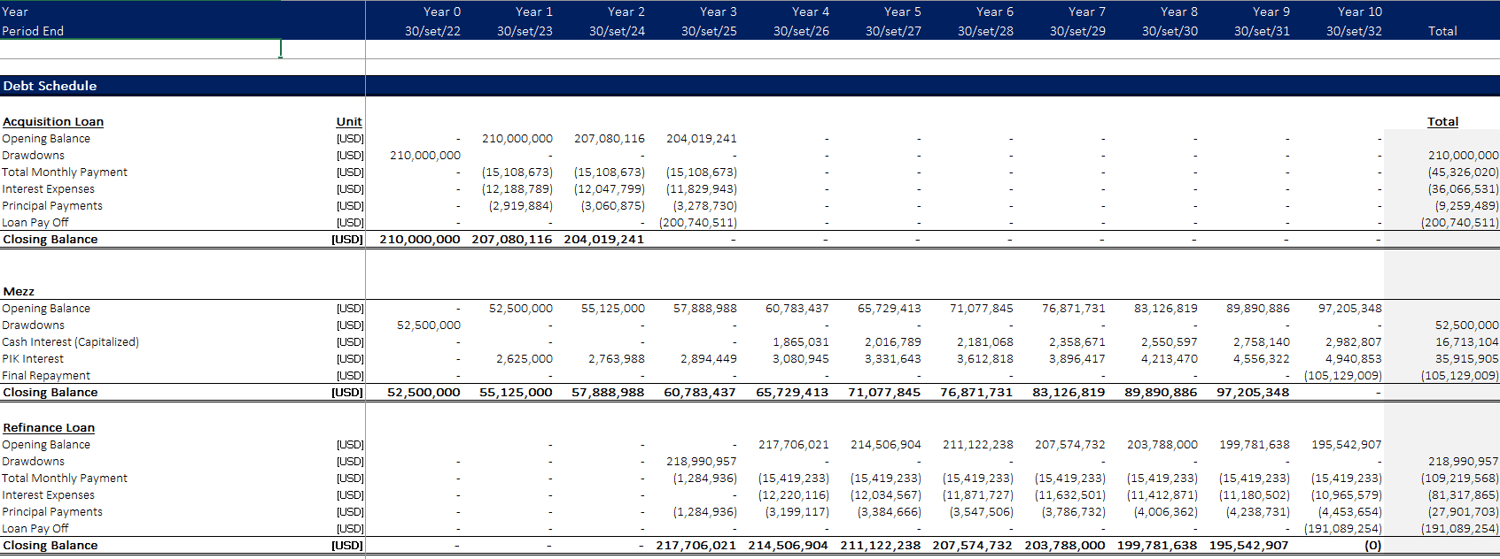

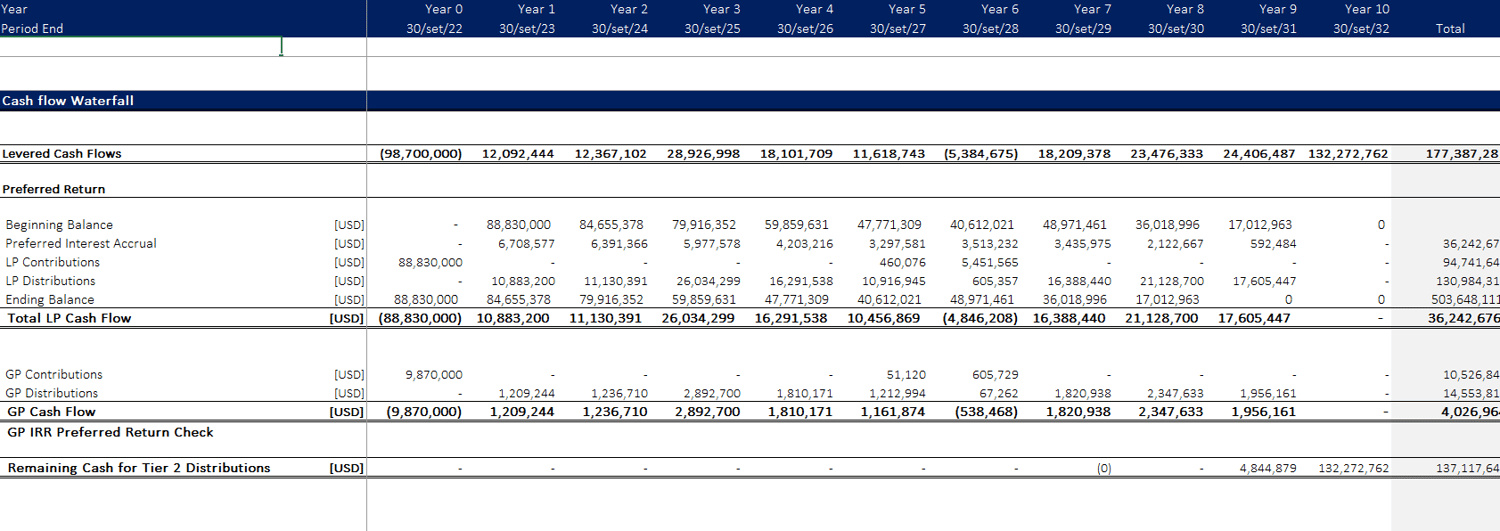

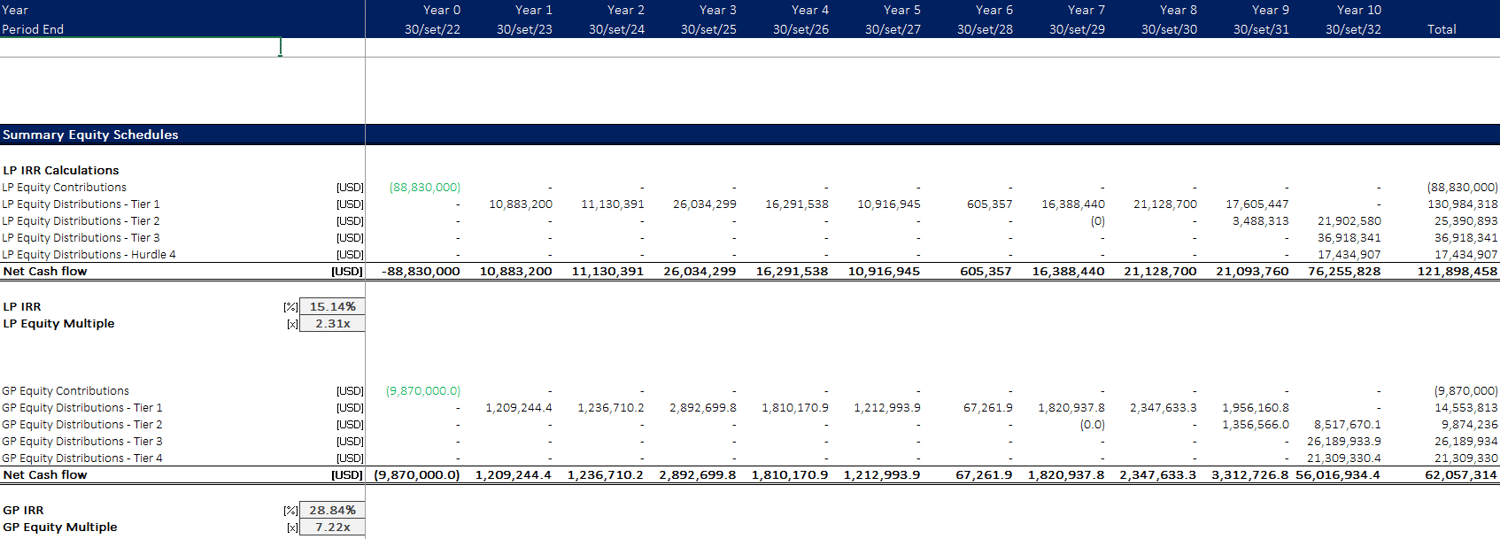

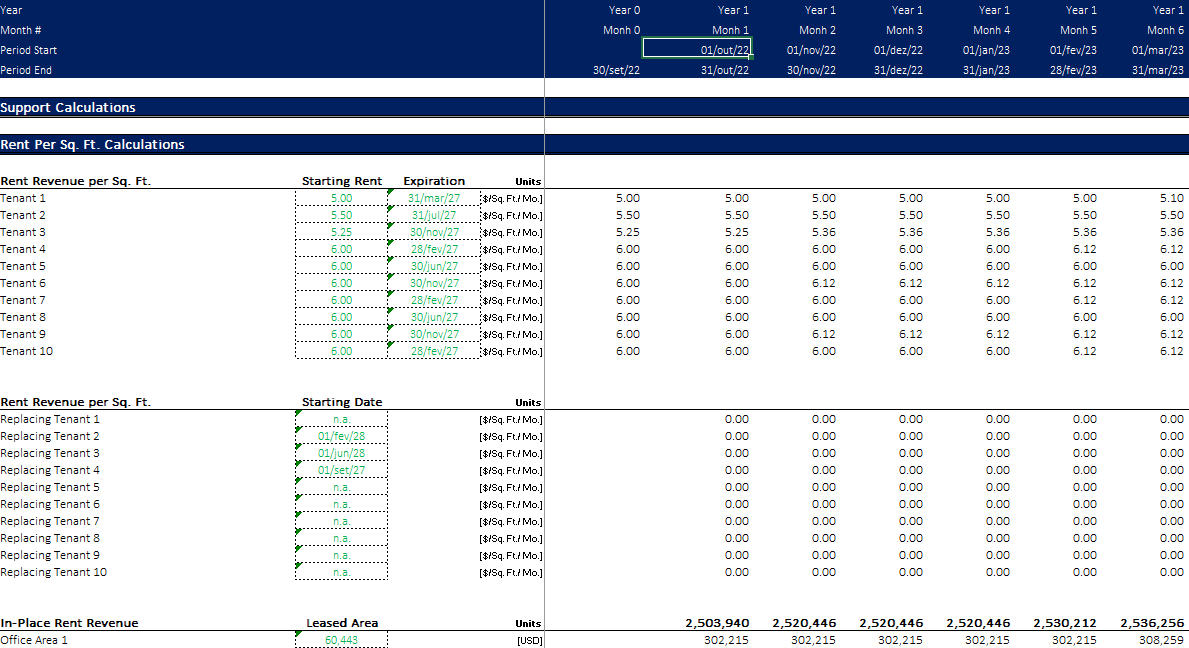

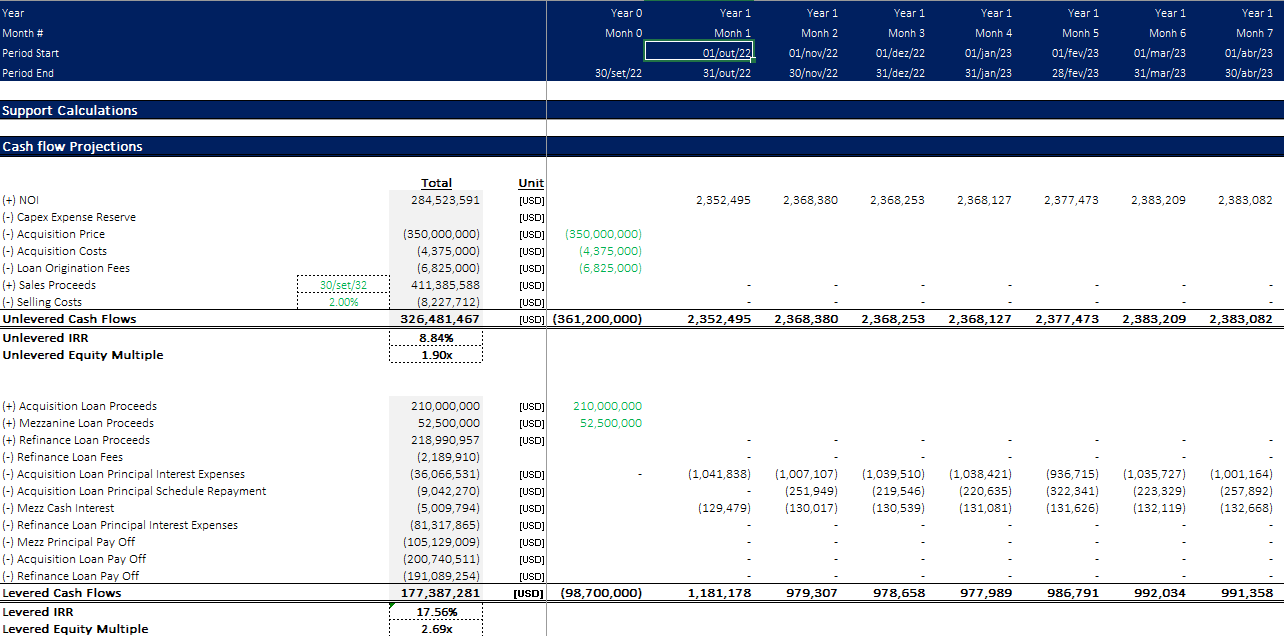

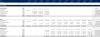

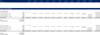

Monthly Cash Flow Tab: All Cash Flow calculations are performed on this sheet. The Assumptions entered on the Input sheet flow to the Monthly Cash Flow sheet, where a monthly forecast of all cash flows is calculated. This includes the calculation of Levered and Unlevered CF and the calculation of Cashflows by Equity partner following a 4-tier Waterfall model.

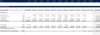

The Annual Cash Flows tab rolls up the monthly cash flows to annual periods so that you can view high-level cash flows on one page. The report is printable.

Instructions

• The user only needs to input information into the cells formatted in the dark blue font in the Investment Summary and Budgets sheets. If the contents of a cell are colored black, it means that it is a formula;

• The template is provided with information from a hypothetical property, for demonstration purposes, that must be erased;