US Equity Option Trading - Primer

Trading Primer

Contents

American Option Trading - PPT Overview

American Option Trading & Analysis

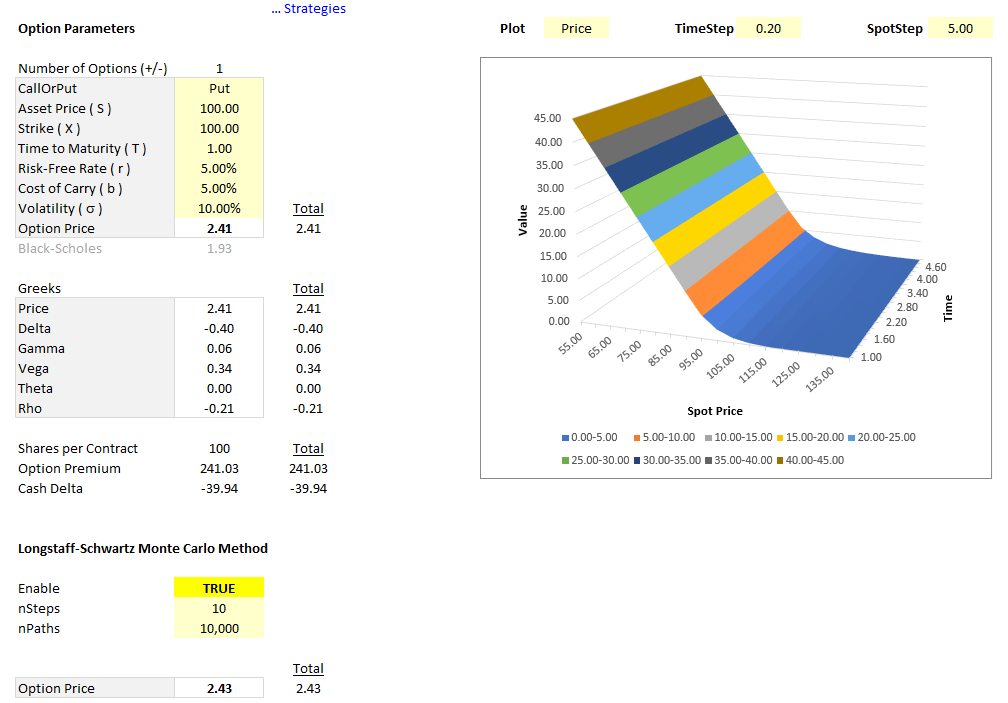

These materials provide a practical overview of American options, covering pricing, trading, and strategy design across US equity derivative markets. The slides combine foundational theory with real-world applications, giving an overview of live trading, option chains and the use of the Greeks for dynamic risk management. They also explore how to structure trading strategies to minimize cost and maximize profit — reviewing directional and income trades to spreads and structured positions—and demonstrating how to implement pricing models in Excel, from basic Cox–Ross–Rubinstein trees to advanced Longstaff–Schwartz Monte Carlo methods.

This resource is especially valuable for anyone looking to understand how quantitative techniques translate into actionable trading insights and how professional traders and quants approach the fast-paced derivatives market.

Keywords: American options, derivatives, US equity markets, live trading, pricing, risk management, Greeks, structured strategies, Monte Carlo, Excel, Cox–Ross–Rubinstein, Longstaff–Schwartz, option chains, Interactive Brokers, quantitative finance