Making Tax Digital (MTD) VAT Return Template in Excel (UK 2025/26)

Simplify your VAT Returns with this ready-to-use Excel template – built for Making Tax Digital (MTD) compliance in the UK.

Perfect for small business owners, bookkeepers, and finance professionals, this spreadsheet automatically calculates your VAT return boxes, tracks submissions, and gives you a clean dashboard view of your VAT position each quarter.

✅ What’s Included

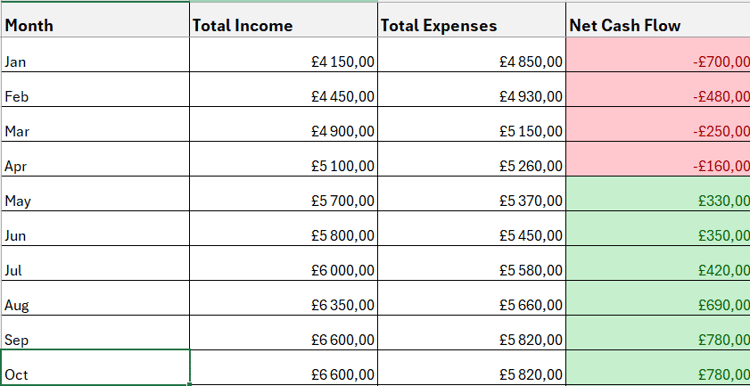

- Transactions Sheet – Enter your sales and purchases; VAT is calculated automatically

- VAT Summary – All 9 VAT boxes auto-filled using SUMIFS formulas

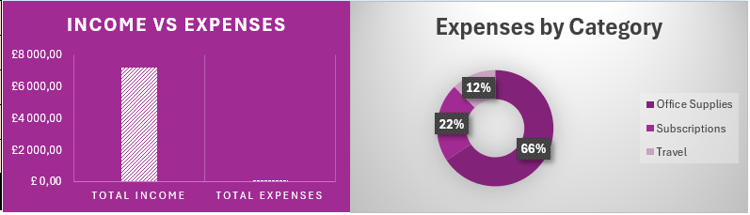

- Dashboard – Clear overview of VAT payable or reclaimable with conditional formatting

- MTD Submission Log – Record each quarterly submission for compliance tracking

💡 Excel Features

- Dropdowns for VAT Type (Sale/Purchase) and VAT Rate (20%, 5%, 0%)

- Automated Net, VAT, and Gross calculations

- Built-in conditional formatting and charts

- Fully editable and reusable for future VAT quarters

- Compatible with Excel 2019, 2021, and Microsoft 365

🎯 Ideal For

- UK small businesses & sole traders

- Bookkeepers & accountants

- Finance professionals handling VAT compliance

📦 File Format: Excel (.xlsx)

📌 Designed by Excel for UK Finance — practical Excel tools for UK business owners.

🔗 Watch the full tutorial on YouTube: Making Tax Digital (MTD) VAT Return Template in Excel