Market Structure Analyzer EA

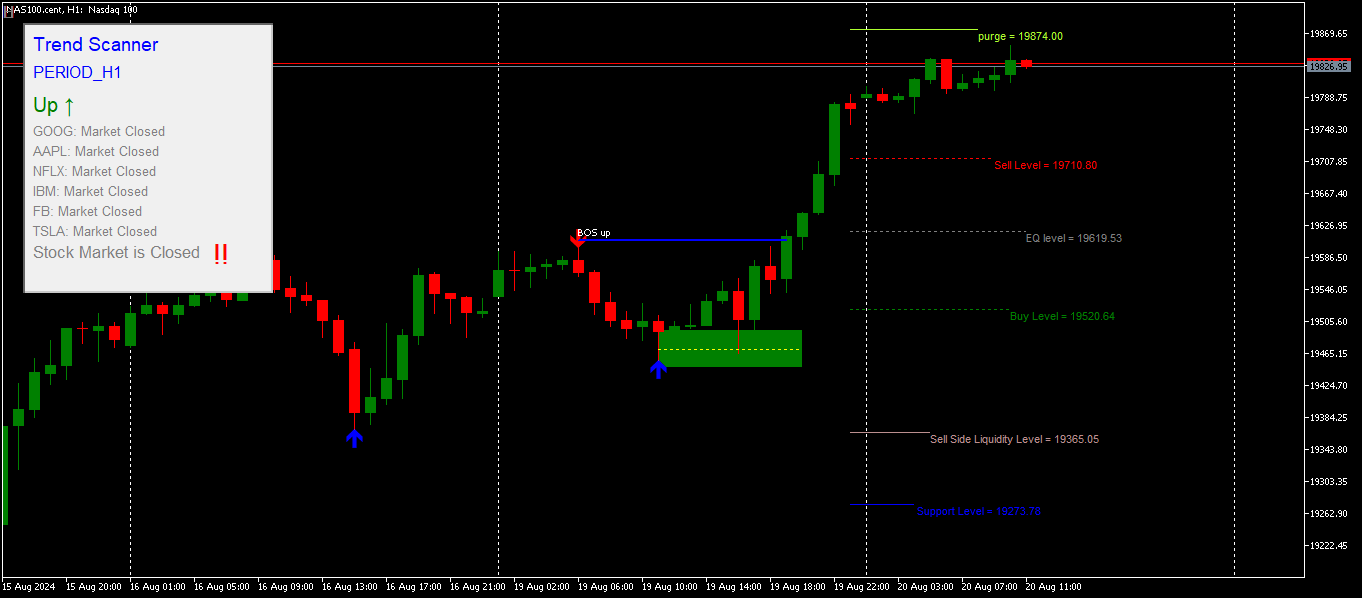

The Market Structure EA is a powerful trading tool which can analyse the market based on Smart Money Concepts. It identifies swing highs and swing lows, draws BOS ( Break Of Structure), FVG( Fair Value Gaps), OB ( Order Blocks) , and it also uses Fibonacci standard deviation to draw potential sell level , buy level, liquidity levels, support and resistance levels.

The Market Structure Analyzer can be used as a tool to help traders analyse the market, traders can also choose to turn on auto trading and allow the EA to also trade based on different strategies.

The EA can trade synthetic Indices on Deriv, Currencies, Metals ( Gold), Stock Indices ( US100 Nasdaq and US30 Dow Jones). The strategy for trading Stock Indices utilizes a powerful algorithm that tracks the performance of stock prices that move Nasdaq and US30 and trade based on the sentiment and volume of those stocks. Traders can choose their stock watchlist which will be analyzed by the algorithm.

Synthetic Indices use a market structure strategy which identifies break of structure and retests to demand or supply zones and liquidity zones.