Bitcoin & Ethereum Trader

On Sale

€3.49

€3.49

EBOOK: Trading Bitcoin and Ethereum Based on Technical Analysis, Market Sentiment, and On-Chain Data

Author: George M. Protonotarios (2021)

Website: TradingCenter.org

This book contains all the essential information about how to successfully trade the two dominant blockchain protocols, Bitcoin and Ethereum. It combines technical analysis with fundamentals, on-chain data, and market sentiment.

Author: George M. Protonotarios (2021)

Website: TradingCenter.org

This book contains all the essential information about how to successfully trade the two dominant blockchain protocols, Bitcoin and Ethereum. It combines technical analysis with fundamentals, on-chain data, and market sentiment.

- Chapter 1 begins with the crypto market cycle. The crypto market cycle is very short and lasts only four years. Chapter 1 also includes seasonal patterns. Bitcoin performs very well during the fourth quarter of the year, while Ethereum performs exceptionally well in the first semester of the year.

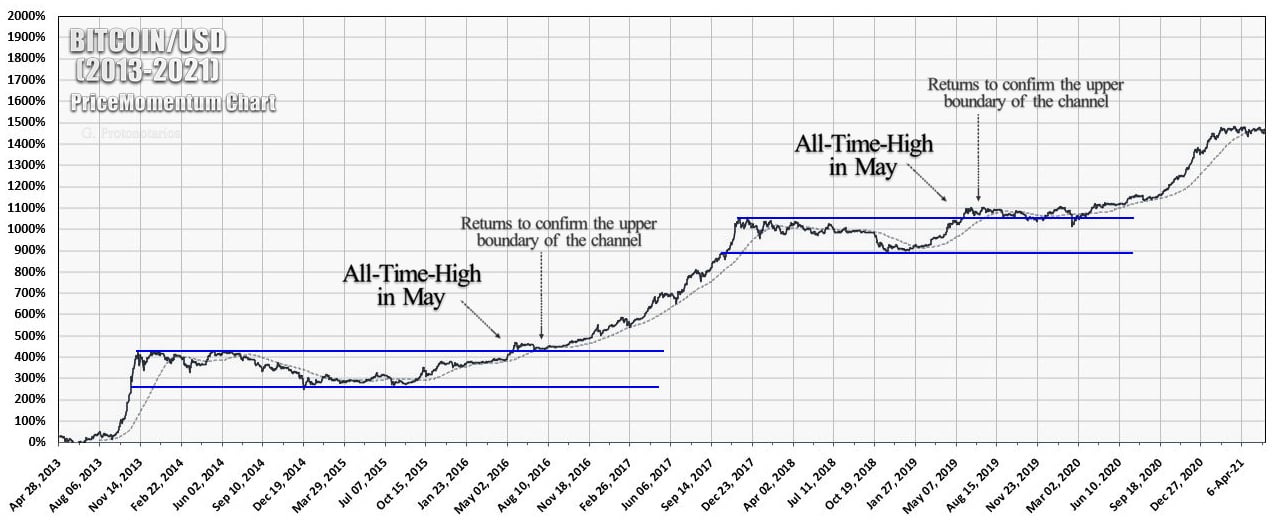

- Chapter 2 includes methods for identifying the trend. Chapter 2 also introduces a new chart type that is ideal for analyzing volatile asset classes. It is called ‘PriceMomentum’ and incorporates price momentum and periodic volatility.

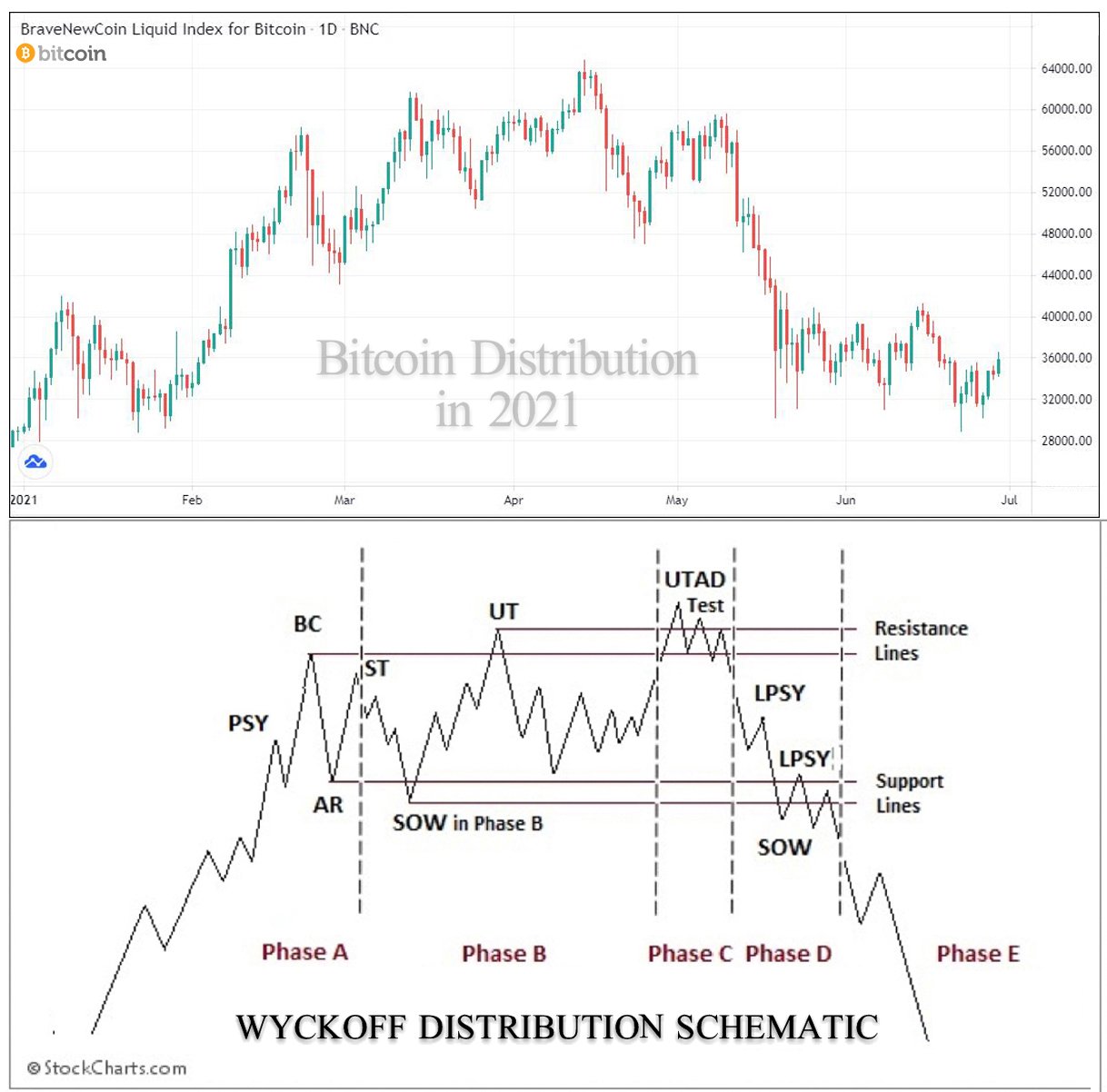

- Chapter 3 presents a variety of methods for recognizing market tops and bottoms at an early stage, starting with the crucial role of the trading volume. In addition, you will learn about the brand-new RSI Precision, and MACD. Also, you will learn about the Wyckoff Schematics, which are quite applicable in the cryptocurrency market.

- Chapter 4 examines the powerful signals of on-chain analysis. You will be able to find several on-chain indicators that can predict market tops and bottoms, such as the Puell Multiple, NVT, Unrealized Profit/Loss, and others.

- In Chapter 5, you will learn about the role of derivative products in the cryptocurrency market. You will learn about Open Interest and the Commitments of Traders report, and how to explain a significant premium/discount in Bitcoin Futures.

- Chapter 6 investigates the role of Bitcoin dominance in the general market cycle. Typically, each cryptocurrency bull market starts with a Bitcoin rally and a Bitcoin dominance surge. History isn't bound to repeat itself, but knowing these patterns may prove extremely useful when trying to time your investment decisions.

- In Chapter 7, you will learn about market sentiment. You will learn how to distinguish between the experts’ sentiment that you should generally trade in line with and the public sentiment that you should generally trade against. Moreover, the ‘Fear and Greed Index’ and the crypto funding rates reflect the expectations of retail traders and can often indicate overbought/oversold market conditions.

- Chapter 8 examines the relationship between cryptocurrencies and traditional markets. Liquidity in the global financial markets functions like water in communicating vessels. However, each asset class has a different risk/reward profile, and thus the impact of the flowing liquidity into the system is not the same for every financial market. Chapter 8 also investigates the correlation between Bitcoin price, the US dollar, gold, and equities.