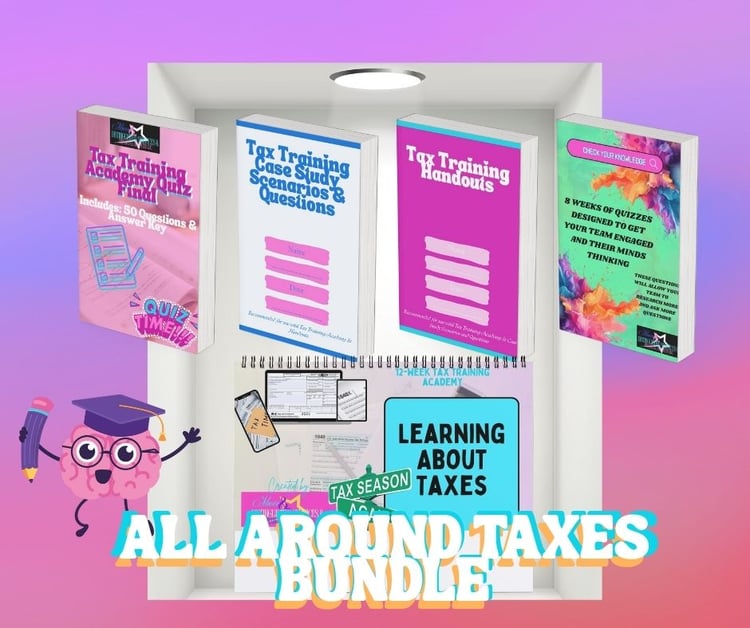

Tax Training Academy Quiz Final

Test your tax knowledge with this comprehensive 65-question Final Quiz, designed specifically for students who have completed a 12-week U.S. Tax Training course. This multiple-choice assessment covers all major tax topics discussed throughout the course, including income types, deductions, credits, filing statuses, self-employment, and more.

Perfect for reinforcing learning, preparing for certification, or evaluating overall mastery, this quiz is a valuable capstone tool for any tax education program.

What’s Included:

✅ 65 Multiple-Choice Questions

✅ Complete Answer Key for Self-Grading

✅ Printable PDF Format

✅ Covers Weeks 1–12 Content

✅ Suitable for In-Class, Virtual, or Self-Study Settings

Topics Covered:

- Filing Requirements & Status

- Income Sources (W-2, 1099, etc.)

- Adjustments & Deductions

- Tax Credits (CTC, EITC, Education)

- Self-Employment & Schedule C

- Retirement Income & Social Security

- Capital Gains & Losses

- Tax Forms & Due Dates

- Due Diligence Scenarios

- Real-Life Case-Based Questions

Ideal For:

- Tax preparer trainees

- Continuing education students

- Classroom instructors and tutors

- Individuals seeking tax knowledge verification

Format: PDF

Skill Level: Beginner to Intermediate