Learn Portfolio Maestro - Visually!

On Sale

$39.95

$39.95

Using Portfolio Maestro Is Not Easy!

TradeStation is really, really great at what it does. But its algorithm development paradigm is backwards. Instead of developing a trading system for a single market and then creating a small portfolio in a workspace to see if its viable, why not develop the portfolio first and then test your algorithm across many markets. Use the same EasyLanguage as TradeStation and develop portfolio quality algorithms. ** PLEASE NOTE **

In an attempt to thoroughly illustrate the power of Portfolio Maestro, George used Commodities/Futures based portfolios. Using smaller portfolio sets simplifies the discussion of optimization, Monte Carlo Simulation, sector analysis and correlation. The techniques could be used on stocks or ETFs as well.

Once you create an algorithm that works across different markets take your testing up several notches:

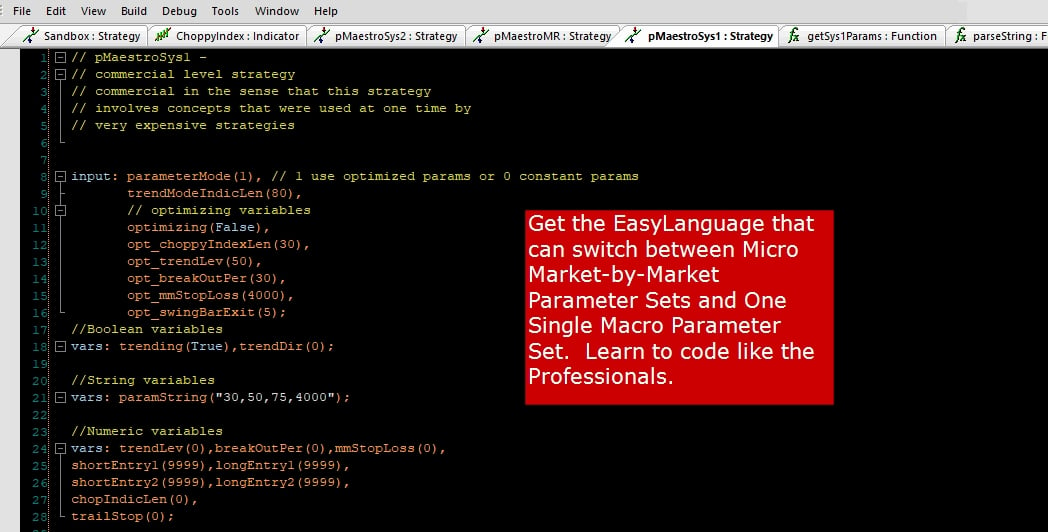

- Create one parameter set for all markets in the portfolio - use Artificial Intelligence and Genetic Algorithms to cover vast optimization search spaces. That's right - optimize multiple markets simultaneously.

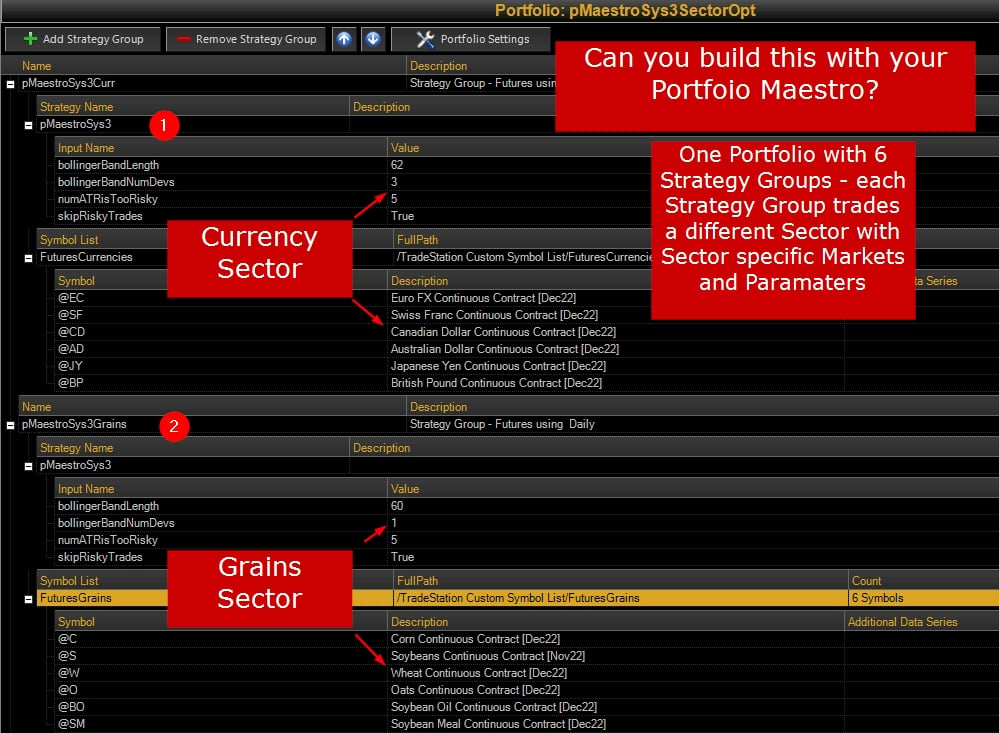

- Maybe you think you need to drill down to the sector level and develop parameters based on different sectors such as

- Grains

- Meats

- Metals

- Stock Indices

- Rates

- Currencies

- Energies

- Or maybe you want to go one step further and develop portfolios that combine markets with different algorithms and/or parameter sets.

- Pick and choose different markets based on their performance Correlation Coefficients

- Did your strategy just get plain lucky.

- Use Monte Carlo Analysis to jumble all the trades together and create alternate realities.

- Use George’s own Excel/VBA based workbook to create the Straw Broom Charts of the all the alternate profit paths. MonteCarlo4Maestro.xlsm

- pMaestro1Sys - a dual approach to trading trending and non-trending markets. Optimized on a market by market basis. Includes the GetSys1Params and ParseString functions. This system garners the lion's share of discussion throughout the manual and videos.

- pMaestro2Sys - can a trend following system use one simple indicator and be successful?

- pMaestro3Sys - Bollinger Band based trading system that skips risky trades. You determine what is considered risky

- pMaestroMR - a Mean Reversion approach to trading the stock indices. Pair it with one of the other trend following approaches and see if you found a happy "marriage."

WATCH ME FOR INSTALLATION INSTRUCTIONS AFTER DOWNLOAD.

IF YOU PURCHASE THE KIT, please watch this installation video. You will receive a large ZIPPED file and my Excel based MonteCarlo4Maestro.xlsm for creating the Straw Broom Chart and the Start Trade Drawdown analysis. The pMaestroKit.zip contains everything you will need to start working with the tutorial.