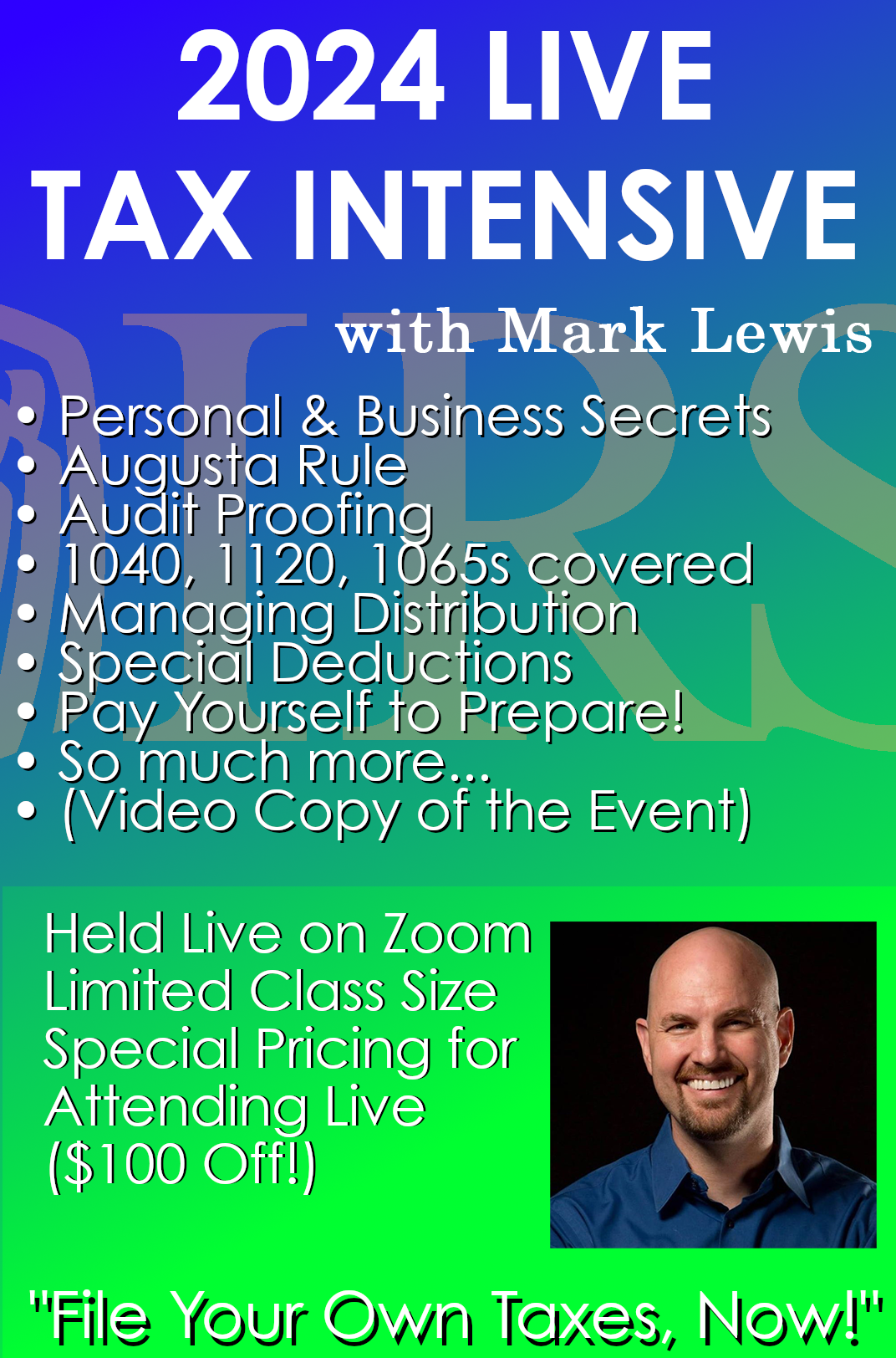

2024 Tax Intensive

On Sale

$197.00

$197.00

In this 5+ hour course, Mark Lewis reveals the secrets behind how to take someone with a $335,000 income and have them pay less than 10% tax. Using corporate structure as a path to success, this course goes through every form you'd need in order to do your own taxes, watch-dog your CPA and even get paid $1,500/company/year in order to do your own corporate taxes!

This includes:

- How to order your 1099/1096 information forms and fill them out

- 1040 and schedules: C, D, E, SE, 1, 2, 3, 4562 (section 179 depreciation), 8829 (business Use of Your Home), 8949 (sales and disposal of capital assets)

- 1120 and 1120S including schedules: D, 4562, 851 (affiliated group), election to forego NOL carryback

- 1065 and schedules K-1

- How to collate your expenses and keep good accounting

- How to file to lessen your chance of being audited unnecessarily

- Paying your kids (an easy $13,850 deduction)

- How to deal with your Trading Gains (Capital Gains)

- How to do the Musk Protocol (Never Get Paid - and Never Pay Tax)

- How to Use the Health Savings Account to strip another $3,850+ off your taxes

- How to take (or bank) massive new deductions including Qualified Business Income (20% off your income), Health Insurance, Mileage (I know, I said mileage), and Business Use of Your Home deductions

- How to Hide Income biz to biz with the 1099-rule

- A final exposé on the Augusta rule

- How to negotiate an audit

- How to create an insurance policy for an audit

- How to respond to the IRS

- So much more!