BOTT Price Action Guide 2

On Sale

$199.00

$199.00

BOTT Price Action Guide 2: Binary Options Turbo Trading, Forex, Crypto, Stock Exchange, Commodities, Digital & FX Options

IMPORTANT:

Payment can be done also via Skrill, Neteller, Paypal, Debitcard, Creditcard, Webmoney, AdvCash, PerfectMoney, Fasapay, Bitcoin and many other payment options, please contact me at boturbotrader@gmail.com also if you are facing problems providing the payment, contact me so i can provide a lot of different payment methods and a solution!

The ultimative BOTT Price Action Guide 2 for any kind of financial instrument (Binary Options, FOREX, Stock Exchange, Crypto, Commodities) any kind of time frame from 1 min over 5 min up to 15 min, 30 min and above and any kind of broker. This ebook is all you need, especially as a Binary Option Turbo Trader or FOREX day trader to get profit out of the market, to get out of debt, make yourself a living or help your friends and family and to archieve financial freedom.

Don't miss the opportunity to get this ultimative Price Action Guide 2

File Size: 9MB

Print Length: 856 pages

Publisher: BO Turbo Trader; 1 Edition (October 25, 2025)

Publication Date: October 25, 2025

Content:

1. Trading Psychology

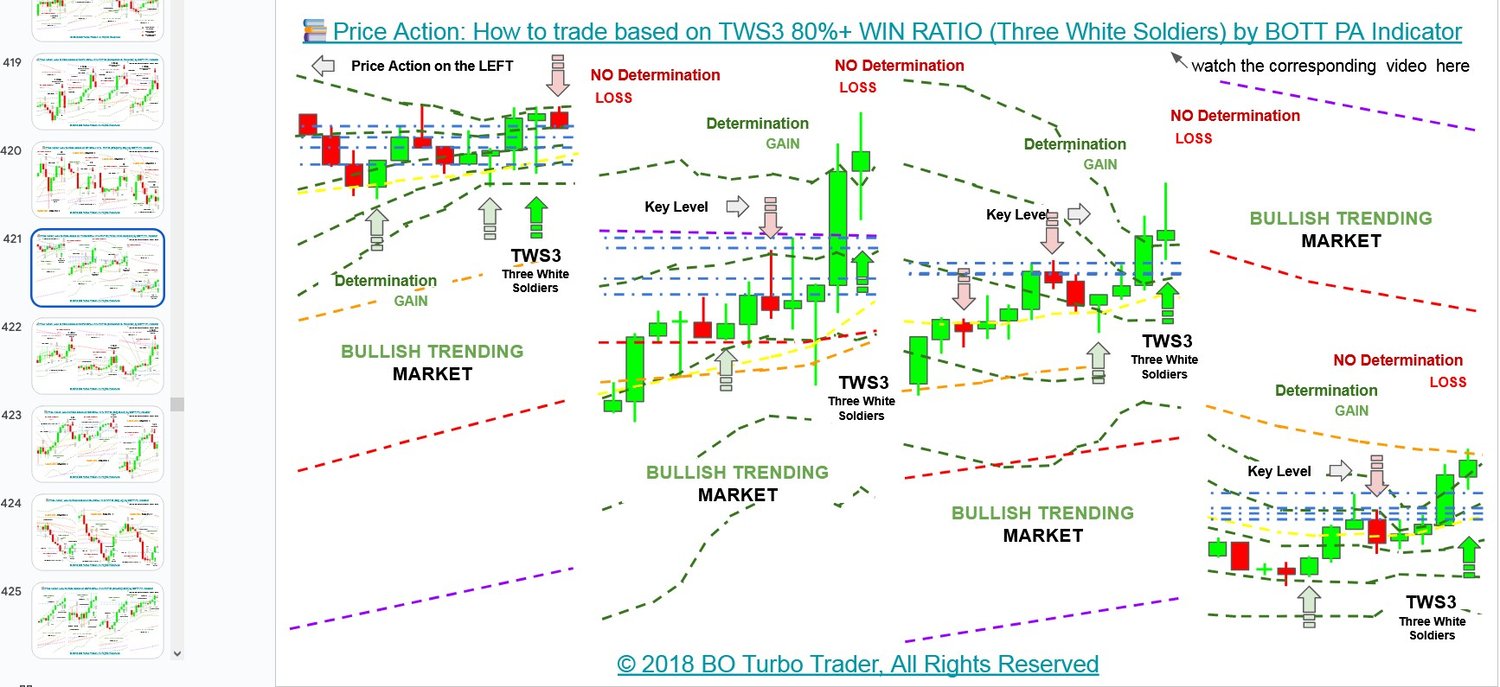

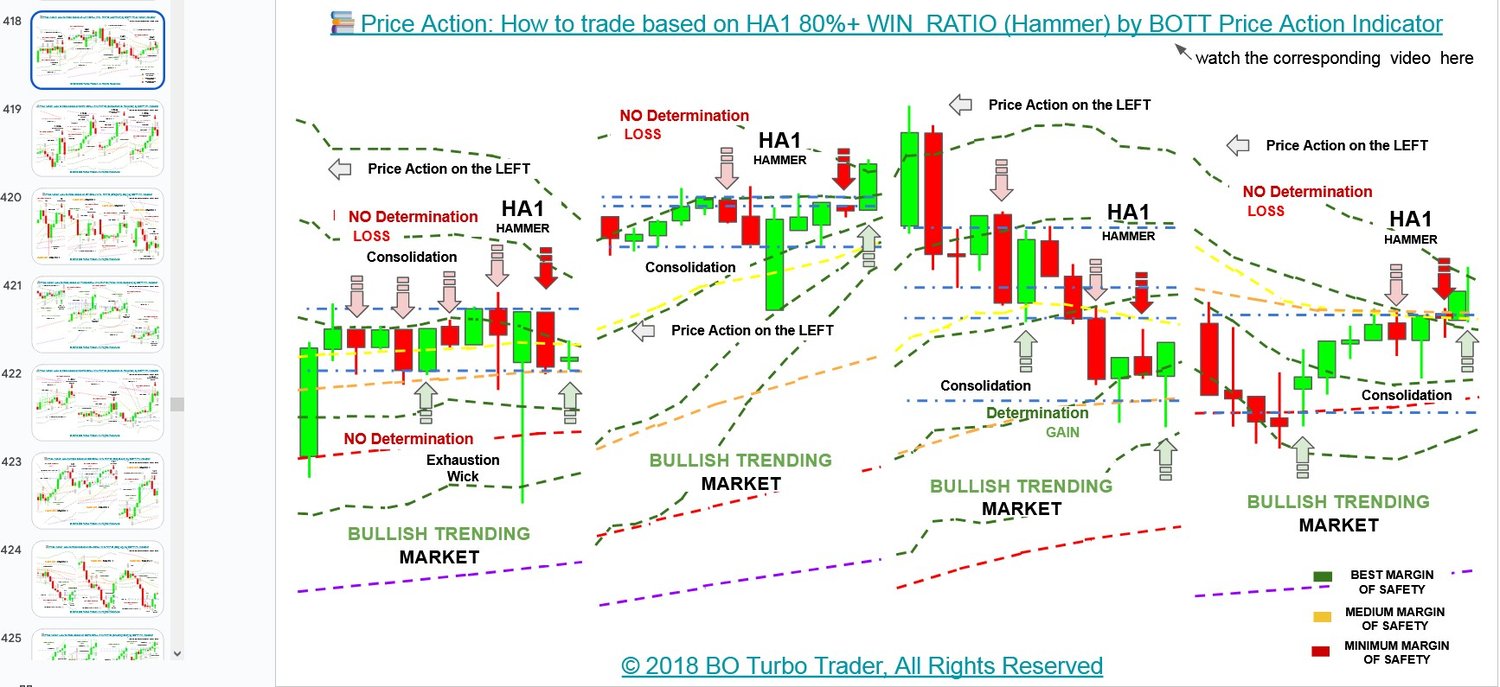

2. BOTT Price Action Candlestick Patterns

3. BOTT Price Action Chart Patterns

4. BOTT Price Action Concepts

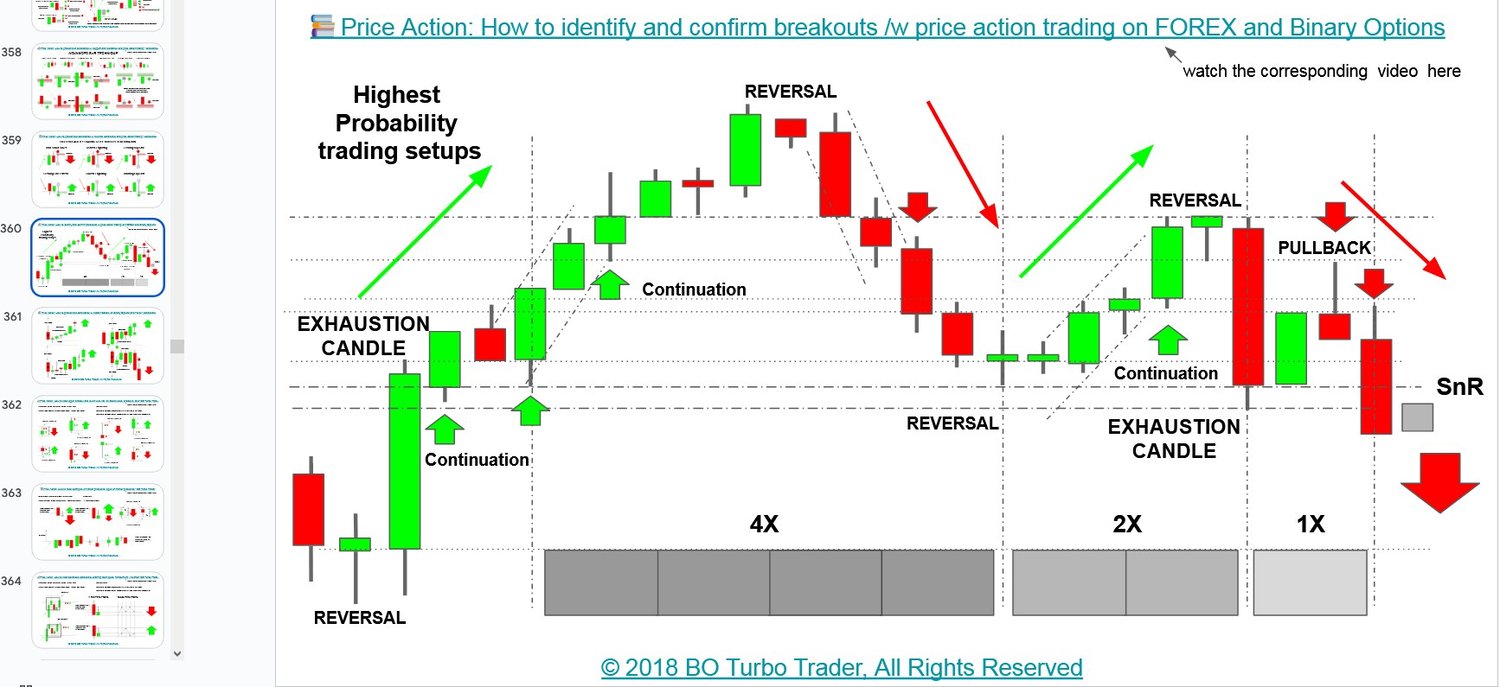

5. BOTT High probability trading setups

IMPORTANT:

Payment can be done also via Skrill, Neteller, Paypal, Debitcard, Creditcard, Webmoney, AdvCash, PerfectMoney, Fasapay, Bitcoin and many other payment options, please contact me at boturbotrader@gmail.com also if you are facing problems providing the payment, contact me so i can provide a lot of different payment methods and a solution!

The ultimative BOTT Price Action Guide 2 for any kind of financial instrument (Binary Options, FOREX, Stock Exchange, Crypto, Commodities) any kind of time frame from 1 min over 5 min up to 15 min, 30 min and above and any kind of broker. This ebook is all you need, especially as a Binary Option Turbo Trader or FOREX day trader to get profit out of the market, to get out of debt, make yourself a living or help your friends and family and to archieve financial freedom.

Don't miss the opportunity to get this ultimative Price Action Guide 2

File Size: 9MB

Print Length: 856 pages

Publisher: BO Turbo Trader; 1 Edition (October 25, 2025)

Publication Date: October 25, 2025

Content:

1. Trading Psychology

2. BOTT Price Action Candlestick Patterns

3. BOTT Price Action Chart Patterns

4. BOTT Price Action Concepts

5. BOTT High probability trading setups