ZoneTrader Analysis Framework for Day Trading 2.02

On Sale

$39.00

$39.00

Announcing Version 2.02.

Apply the ZoneTrader Framework to 24 hour markets now!

Markets Rarely Demonstrate Extended Break Outs on Intraday Basis

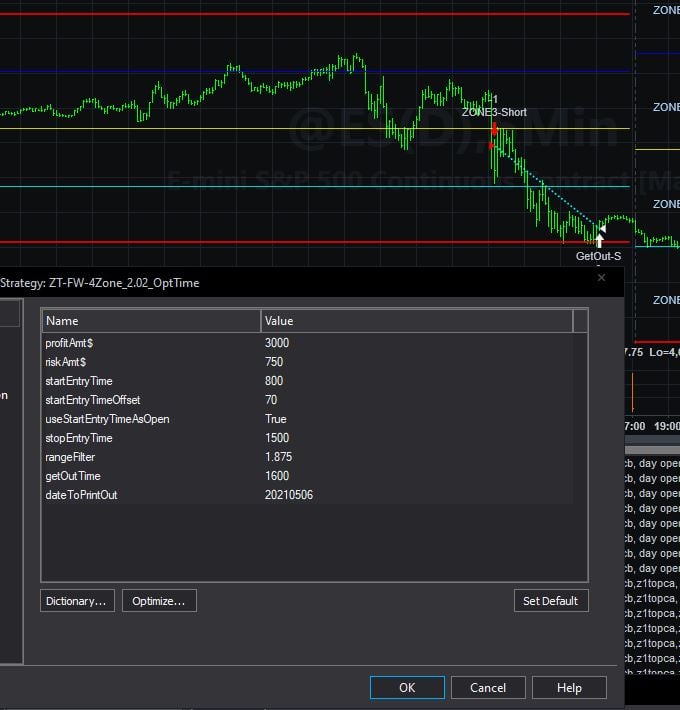

Breaking News! Version 2.02 allows users to plot and trade the zones on the regular session of your favorite day trading markets. You can plot the @ES.D or @ES and modify the start time to begin analyzing the zone level crossings. In addition, you can optimize the start time to see when is the best time to start your analysis and trading. The other mechanics of the framework work exactly the same as the original.

Break out and counter trend trading has been the most popular and successful day trading mechanisms for many, many years. Basically, it attempts to capture the big trend days via break outs and the counter trend moves via intraday reversals. If the market consistently broke out to either the upside or downside and kept going, then day trading would be like an ATM machine. Unfortunately, the market peppers chaos in the mix and you have break outs and false break outs and market congestion. While the pits were alive and doing well, the locals could use simple math to figure out price levels where the markets could potentially turn and reverse course or if these levels were penetrated with a certain level of gusto, then a momentum trade was setting up. These levels were labeled individual support and resistance levels (like the ones in the chart above). A resistance level is a price where price should struggle to cross above, and a support level is one where price should struggle to cross below. Combining the momentum and counter trend mechanisms into one strategy has been around since the 1980s. Richard Saidenberg along with John Ehlers/Mike Barna created very successful day trading systems with names like R-Breaker, R-Levels and R-Mesa. Many other traders utilized the same concepts and also created very successful algorithms – some leaned more on the either the breakout or counter trend entries. Initially, the success of these algorithms lay with the crowd mentality as many day traders in the pits and in front of the screens were looking at the same thing simultaneously – it was a self-fulfilling prophecy. However, as more traders started using these levels, the magic wore off. These levels became traps and the robustness of these day trading approach waned. Still the synergy of the breakout and counter trend approach was still a great approach and the only game in town. Traders started deriving their own levels and programmed entries and exits based on the interaction of the markets with these levels. Many traders incorporated risk measures by monitoring daily volatility and derived potentially higher probable trades by overlaying daily bar patterns.

The Framework

The code that is used to develop these types of algorithms can be quite complicated, especially for a not-so experienced EasyLanguage programmer. For this reason, I have created this framework. The code is fully explained at the end of the manual and a video is included on using the framework to reflect your own observations on the chart and in code. The framework is not only a tool for developing day trade systems, but the logic and coding can take you a long way to becoming a much better EasyLanguage programmer.

Easy to Lean and Use Nomenclature

"z1topca," = cross above zone 1 top

"z1topcb," = cross below zone 1 top

"z2topca," = cross above zone 2 top

dayOpenZone = "z0"

dayOpenZone = "z1"

dayOpenZone = "z2"

dayOpenZone = "z3"

dayOpenZone = "z4"

dayOpenZone = "z5"

Can you write this?

if dayOpenZone = "z2" and

last4Lev = "z2topca,z2topcb,z3topcb,z3topca," and

zoneArray[z2Buy] = 0 then

begin

buy("Z2VidBuy") next bar at open;

zoneArray[z2Buy] = 1;

end;

Can you write this?

if dayOpenZone = "z7" and // between s3 and s4

last1Lev = "z7botcb," and

zoneArray[z8Short] = 0 then

begin

sellShort("Z8-SBO") next bar at open;

zoneArray[z8Short] = zoneArray[z8Short] +1;

end;

If you answer yes, then you can probably use this frame work to develop your own day trading systems.