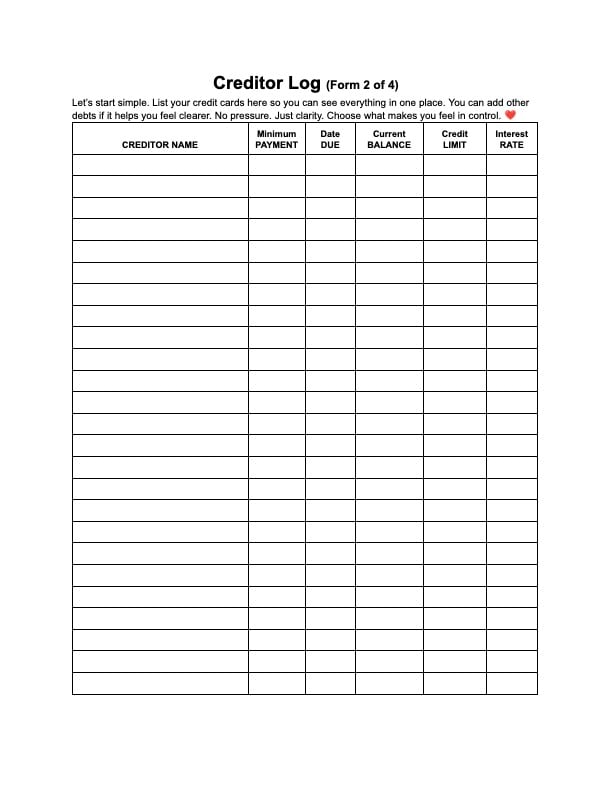

2026 Creditor Log Worksheet 2 of 4

Creditor Log Worksheet

Form 2 of 4 — Everything in One Place

This worksheet is about clarity without pressure.

The Creditor Log gives you one simple place to list your credit cards and revolving debts so you can see the full picture—without digging through apps, statements, or your memory.

Nothing changes yet.

You’re just getting oriented.

What This Worksheet Does

✔ Lists all credit cards in one clear view

✔ Tracks minimum payments and due dates

✔ Shows balances, limits, and interest rates side-by-side

✔ Helps you choose the best card to use as your “debt tool”

✔ Reduces anxiety by replacing guessing with facts

This is not about judgment.

It’s about knowing what you’re working with.

How to Use It

- Write down each credit card or revolving account

- Include minimum payment, due date, balance, limit, and interest rate

- You may also include other debts if it helps you feel clearer

No pressure to fix.

No pressure to optimize.

Just clarity.

Why This Matters

When your debts live in separate apps and statements, they feel heavier than they are.

Seeing everything in one place:

- Lowers emotional overwhelm

- Makes patterns visible

- Builds confidence

- Creates a foundation for smart decisions

This worksheet turns fear into information.

Who This Is For

This worksheet is perfect if you:

- Avoid looking at balances because it feels stressful

- Aren’t sure which card should come first

- Want to use Velocity Banking with intention

- Need a neutral starting point

- Want facts without shame

You don’t need motivation.

You need visibility.

What You’ll Receive

📄 1 printable PDF worksheet

✍️ Space to list multiple accounts

🔁 Reusable whenever balances change

This is Form 2 of 4 in the Debt Clarity system and works best when used before the Month-At-A-Glance and Money Tracker worksheets.

Gentle Reminder

You are not your balances.

This page is just information—and information is power.