Post-Filing Cheat Sheet

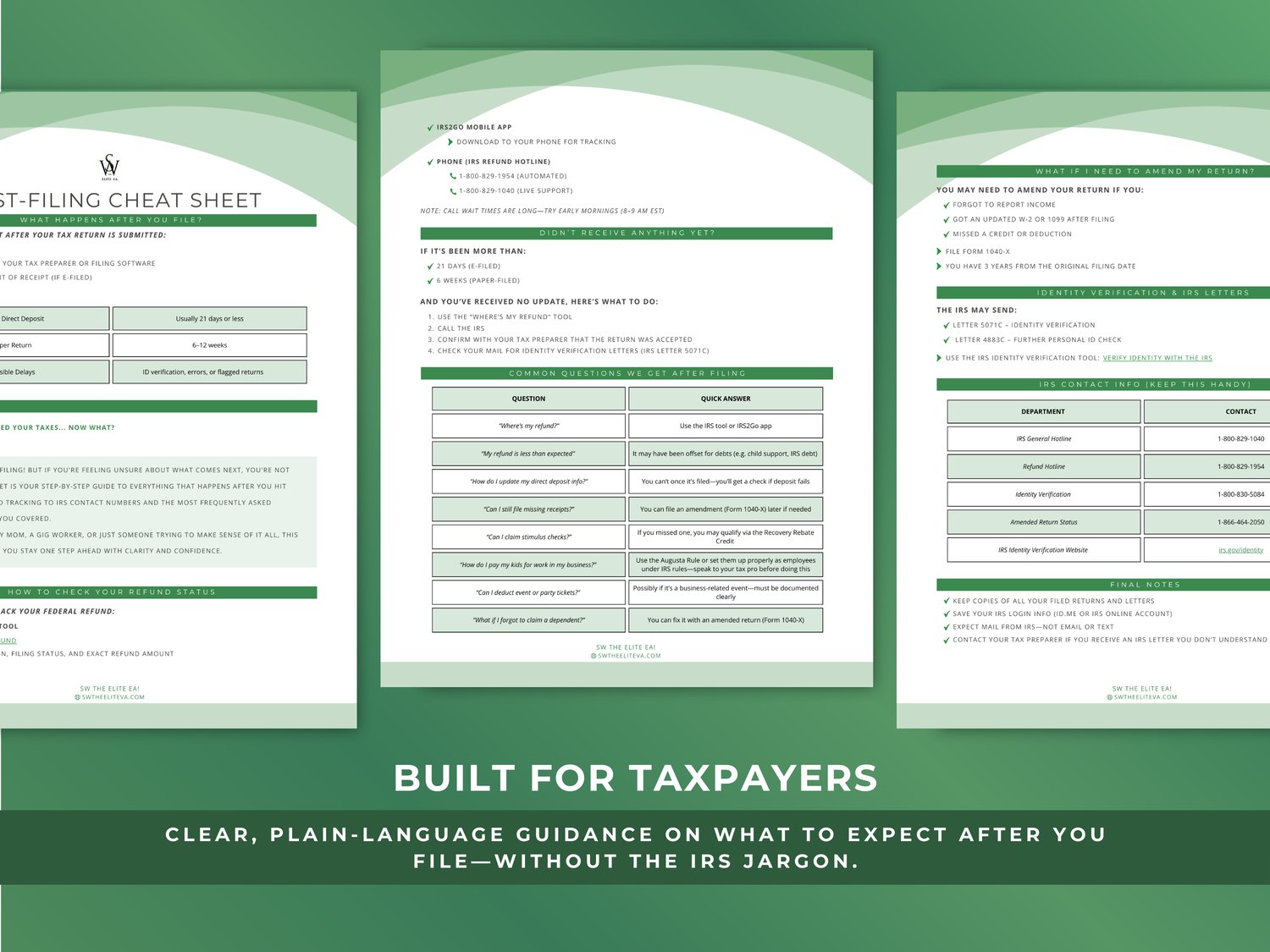

Take the guesswork out of what happens after you hit “submit” with the Post-Filing Cheat Sheet — a practical guide for everyday taxpayers and tax pros alike. From refund tracking to IRS contact numbers, this resource makes it easy to stay informed, avoid delays, and know your next steps with clarity.

Features:

✅ Step-by-Step Guide: What happens after filing (acknowledgments, timelines, delays)

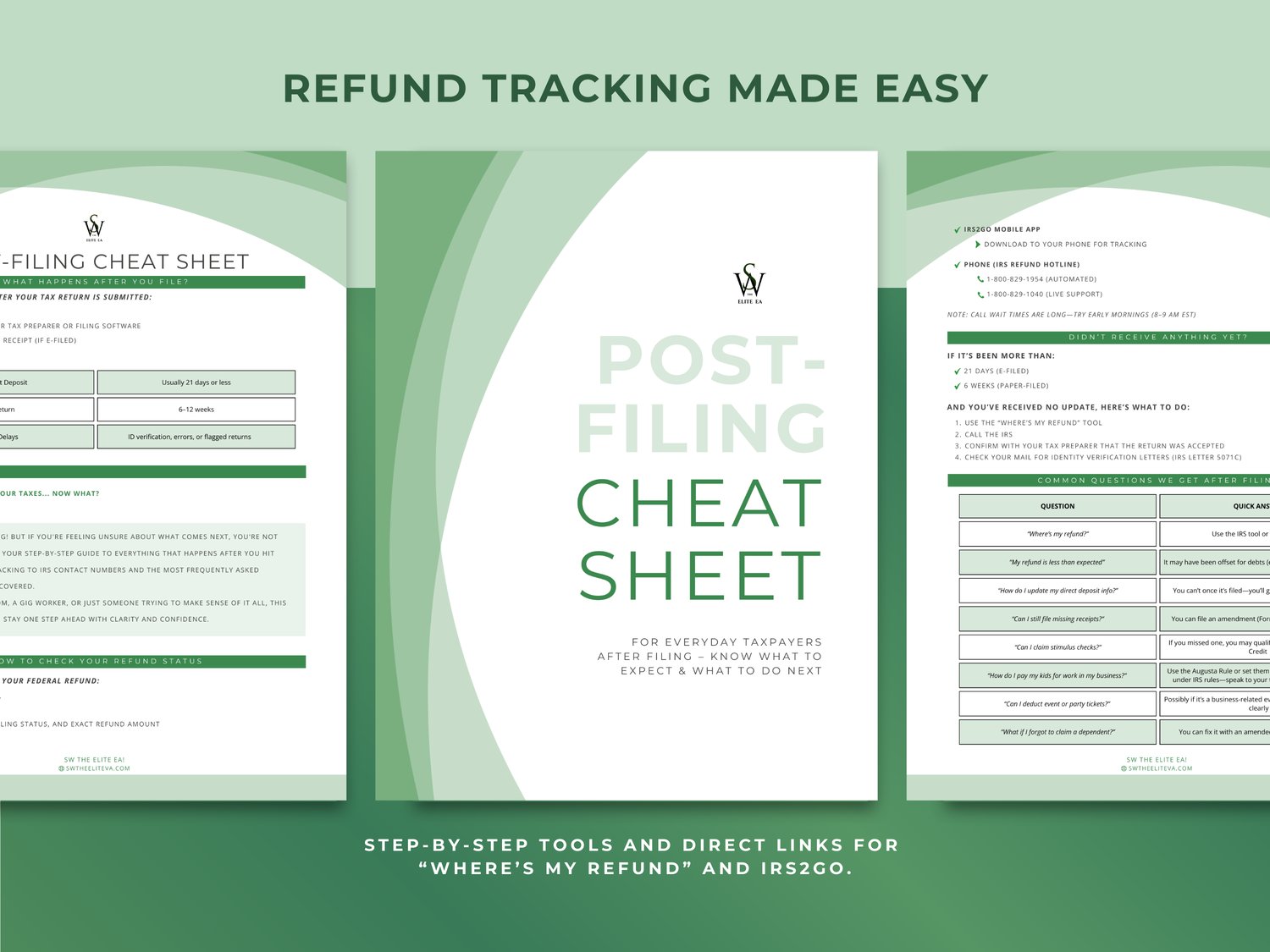

✅ Refund Tracking Tools: Direct links to “Where’s My Refund,” IRS2Go app, and hotline numbers

✅ Common Questions Answered: Refund offsets, missing info, dependents, deductions, amendments

✅ Amendment Guidance: Clear instructions for when & how to file Form 1040-X

✅ IRS Letters Explained: Identity verification (5071C, 4883C) with verification resources

✅ IRS Contact Directory: Hotlines and links in one easy place

✅ Final Notes Checklist: What to save, how to prepare for IRS follow-up, and when to call your tax pro

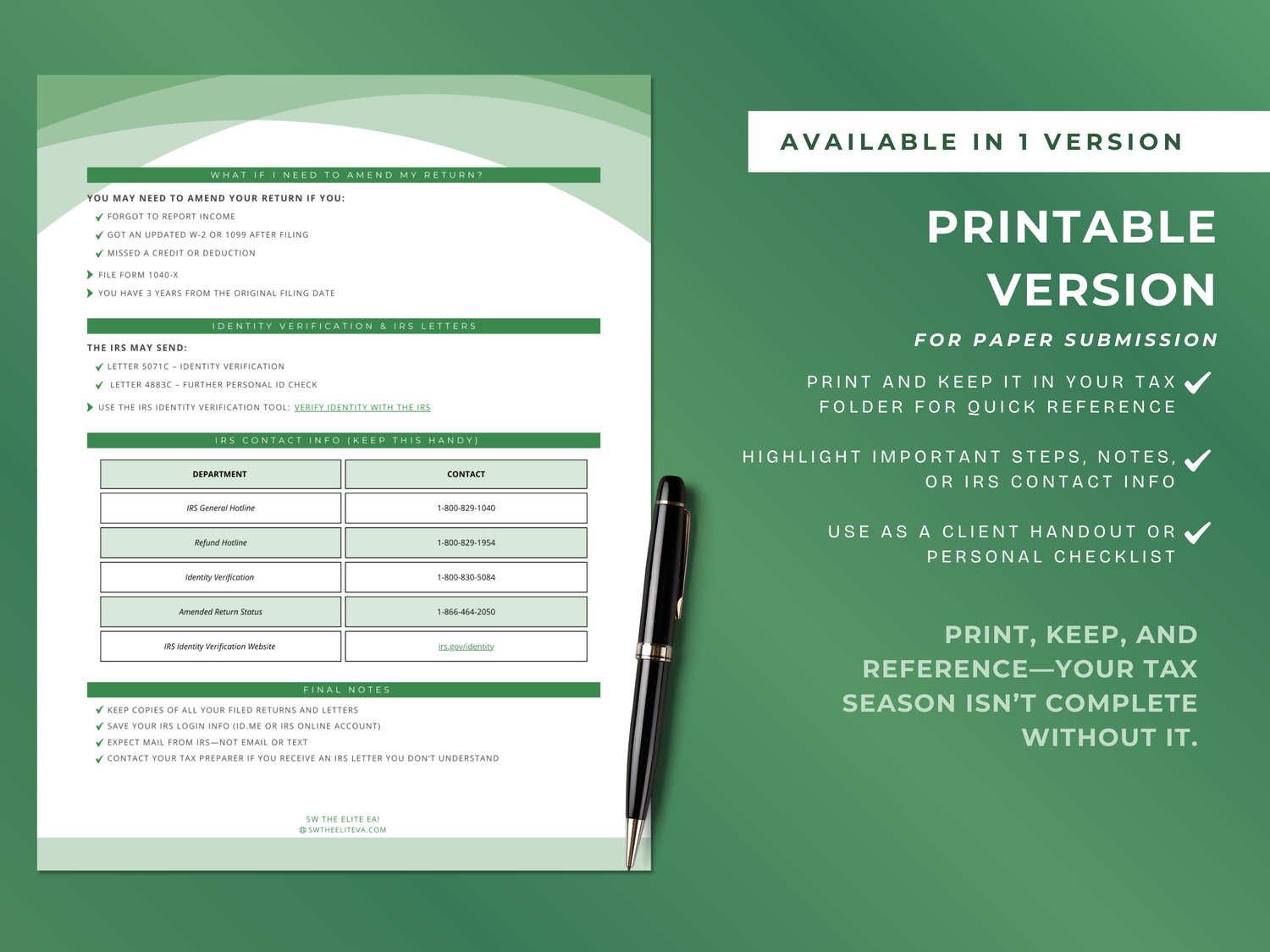

Available in 1 Version:

✅Printable PDF – Print and keep in your tax folder for quick reference year after year

Perfect for everyday taxpayers waiting on refunds, busy families who want clarity, or tax professionals who want to give clients a simple post-filing handout.