Wellness Journal & Monthly Budget Tracker

The Wellness Journal is a beautifully structured, layered system designed specifically for people who live in the digital fast lane but refuse to let it burn them out.

It combines daily presence, weekly rhythm, monthly clarity, and yearly vision into one cohesive practice that protects your energy, sharpens your focus, and keeps creativity flowing.

Key features

- Daily pages: Quick, intentional check-ins: gratitude, mood & energy ratings (physical/emotional/mental), body & movement log, mind/emotions reflection, self-care joy moment, sleep review, and tomorrow's gentle intentions.

- Weekly spreads: Top priorities + clean habit tracker grid (up to 10 habits) with totals that automatically feed into monthly summaries.

- Monthly sections: Focused goals, prioritized habits, calendar overview, end-of-month reflection prompts (progress, highlights, trends, wins, lessons, carry-forward), plus a new financial wellness tie-in section.

- Yearly overview: Theme/word of the year, major focus areas, big goals, year-at-a-glance grid for milestones, and powerful end-of-year reflection to celebrate growth and set the next chapter.

- Modern Minimalist Aesthetic — Sleek black & silver design with signature red accent dot — clean, tech-inspired, and distraction-free

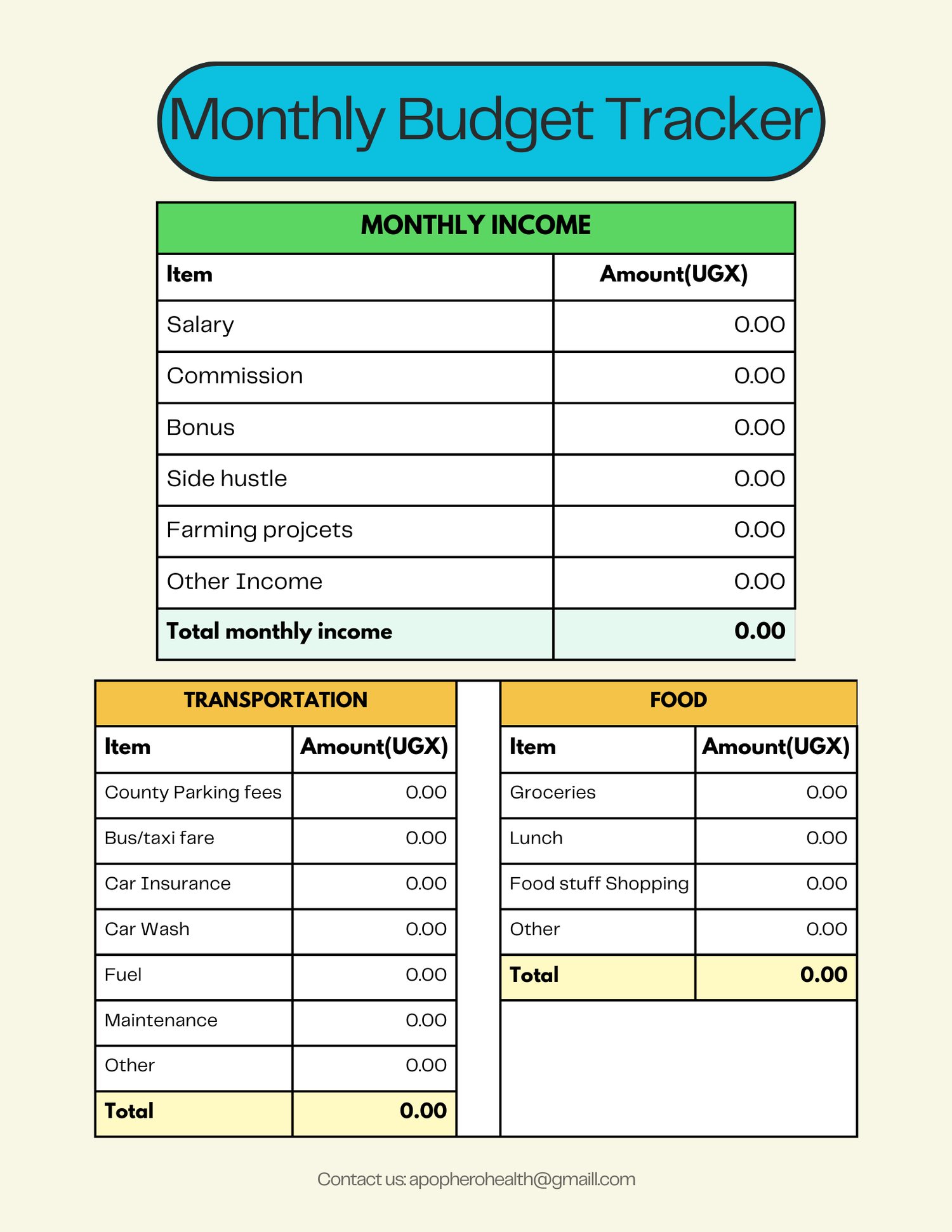

You will also get a free bonus that is Monthly Budget Tracker. The tracker provides a clear, well-organized single-sheet layout that makes monthly budgeting straightforward and visual.

- Income Section

- Easily record all sources of monthly income (e.g., Salary, Commission, Bonus, Side hustle, Farming projects, Other).

- It auto-calculates your Total Monthly Income.

- Detailed Expense Categories (with sub-items for granularity).

- The template covers the most common real-life spending areas tailored to everyday needs.

- Transportation (bus/taxi fares, fuel, maintenance, etc.).

- Food (meals, groceries, food shopping).

- Housing (rent, utilities like electricity, water, gas, phone/airtime).

- Personal Care (gym, hair/nails, clothing).

- Entertainment (movies, events, outings).

- Insurance (life, health, education).

- Loans (bank, mobile, personal borrowings).

- Savings or Investments (money market funds, SACCO, personal savings).

- Projects (building, farming, other long-term goals).

- Gifts and Donations (weddings, funerals, medical appeals).

- Each category has space for multiple line items + an "Other" field, with automatic subtotals per category.

- Summary Table

- A clean overview pulls together:

- Total Monthly Income.

- Individual category totals.

- Grand Total Expenses.

- Final Cash at Hand (Income minus Expenses — ideally aiming for positive or zero in a balanced/zero-based budget approach).

Buy it now.