IRS Notices - CP Letters - Topic Codes - Letter Notices Training with Q & A section

IRS Letters and Notices Training for Tax Professionals

Equip your tax office with the knowledge and confidence to handle IRS letters and notices with this comprehensive training program. Designed specifically for tax professionals looking to enhance their team's expertise, this 35-page course provides step-by-step guidance on understanding, interpreting, and responding to various IRS communications.

Key Features:

- Understanding IRS Correspondence: Learn the types of IRS letters and notices, their purposes, and common triggers.

- Interpreting Notices Effectively: Break down complex language to identify key details, deadlines, and required actions.

- Q&A Section Test: Assess your team's understanding and retention with an end-of-training test designed to reinforce learning and ensure readiness.

Course Format:

This 35-page training guide includes in-depth explanations, real-world examples, and practical tools to ensure your team is fully prepared to handle IRS communications with confidence and professionalism.

Outcomes:

By the end of this training, your team will be equipped to confidently navigate IRS communications, resolve issues effectively, and provide exceptional client support, enhancing your office's reputation and efficiency.

35 Page PDF can be used as PowerPoints Training - Does not come with templates

Comes with Tons of

*Topic Codes

*CP Letters

*Letters

*Audit response Letters

*433A

*POA's

*CP504

*CP11

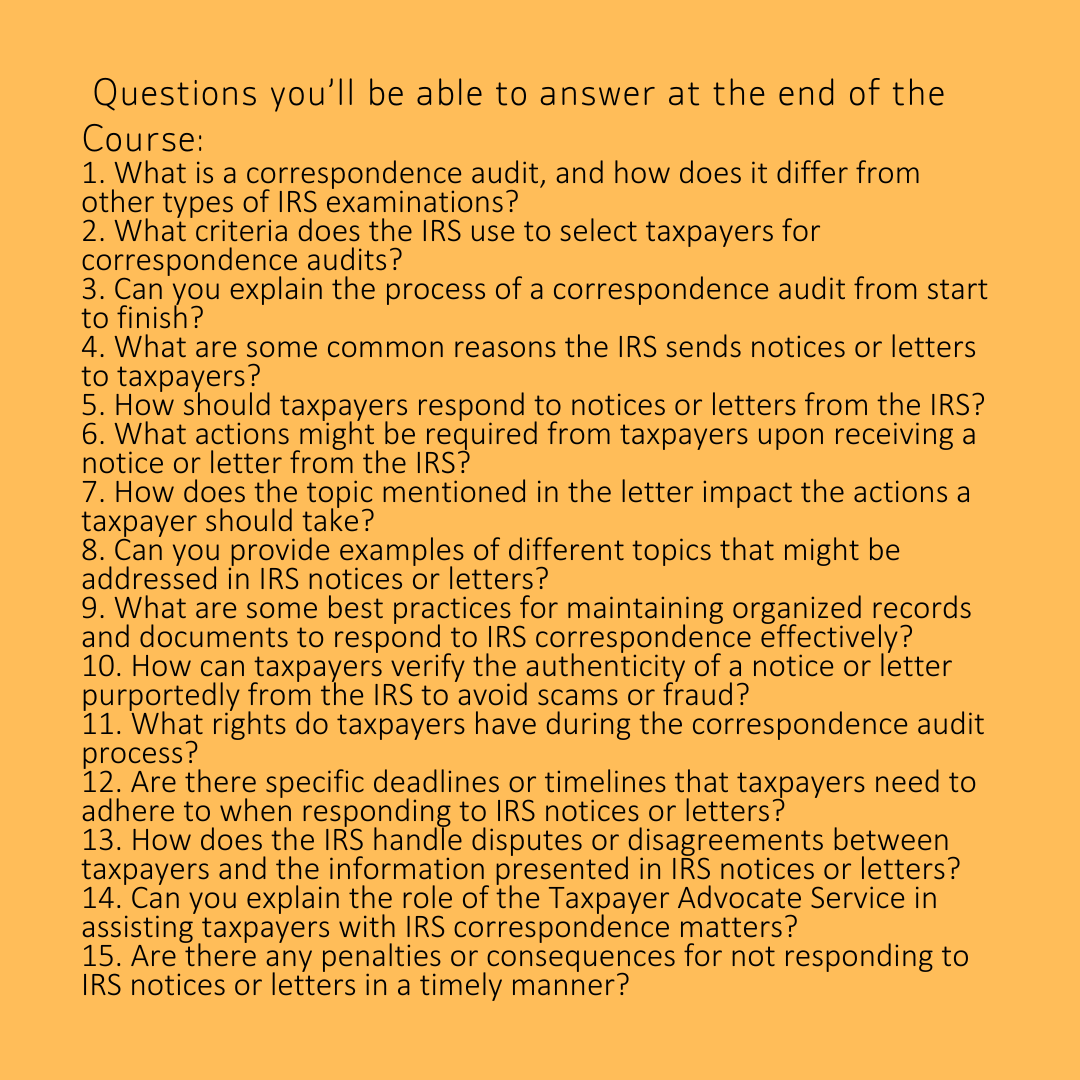

Questions and Answer Section for Review and Training

Over 25 Letters Topic Codes and CP letter information to cover

Pamphlet Format