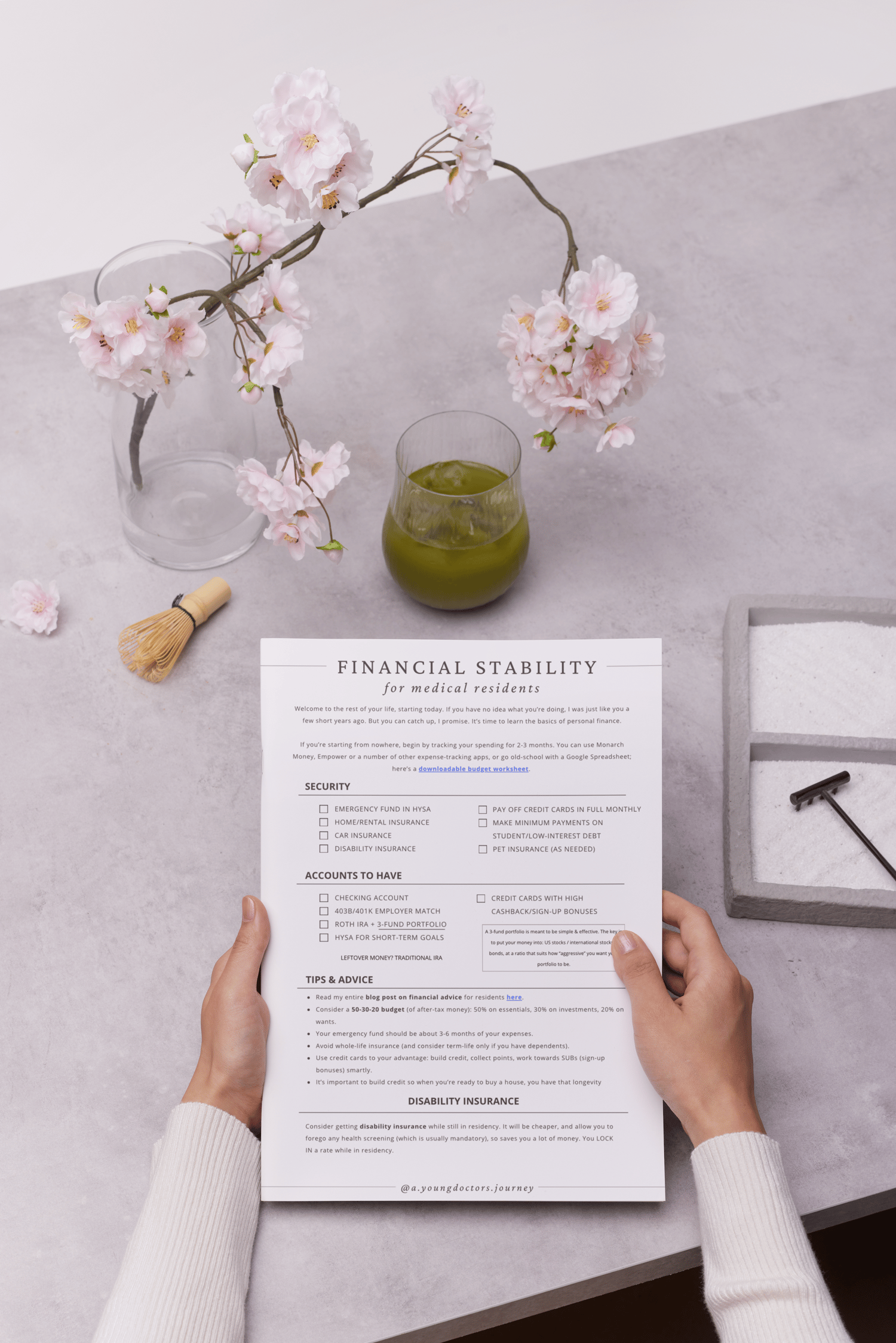

Financial Stability Checklist (free)

I wanted to create something that was easy to use, because personal finance can get overwhelming. Tap here to download, and use it as a printout or on your iPad/laptop to track your progress for 2025. Completely free, no sign-up needed!

Make sure you read my blog post about personal finance (everything from credit cards & travel hacking, to buying a car and getting a mortgage),

Before you get into all the fancy things in this blog post (points hacking, credit card bonuses, investments and more), make sure that you have the basics of financial literacy down.

Here are my tips:

- Track your spending for a few months going forward (or look back on what you’ve spent the last 3 months), and really analyze where your money goes.

- Create a budget: based on your current spending, figure out what your spending goals are and if you’re not meeting them, create a budget for yourself for the upcoming months. [I personally don’t follow a strict budget but some people find it helpful.]

- Create an emergency fund: this should be approximately 3-6 months’ worth of your expenses. Put this money aside, preferably in a HYSA (high-yield savings account, more on that later).

An interesting term to become familiar with is FIRE: “financial independent, retired early”. This is the goal for many people, and the FIRE community has tons of educational content, all for free.