Making Tax Digital (MTD) & Self-Employment Guide - Therapist Collective Co.

The Therapy Business Framework

Structured guidance to help therapists set up, grow, and run a professional, sustainable practice.

Making Tax Digital (MTD) & Self-Employment Guide

Confidently manage your finances and HMRC obligations with this clear guide:

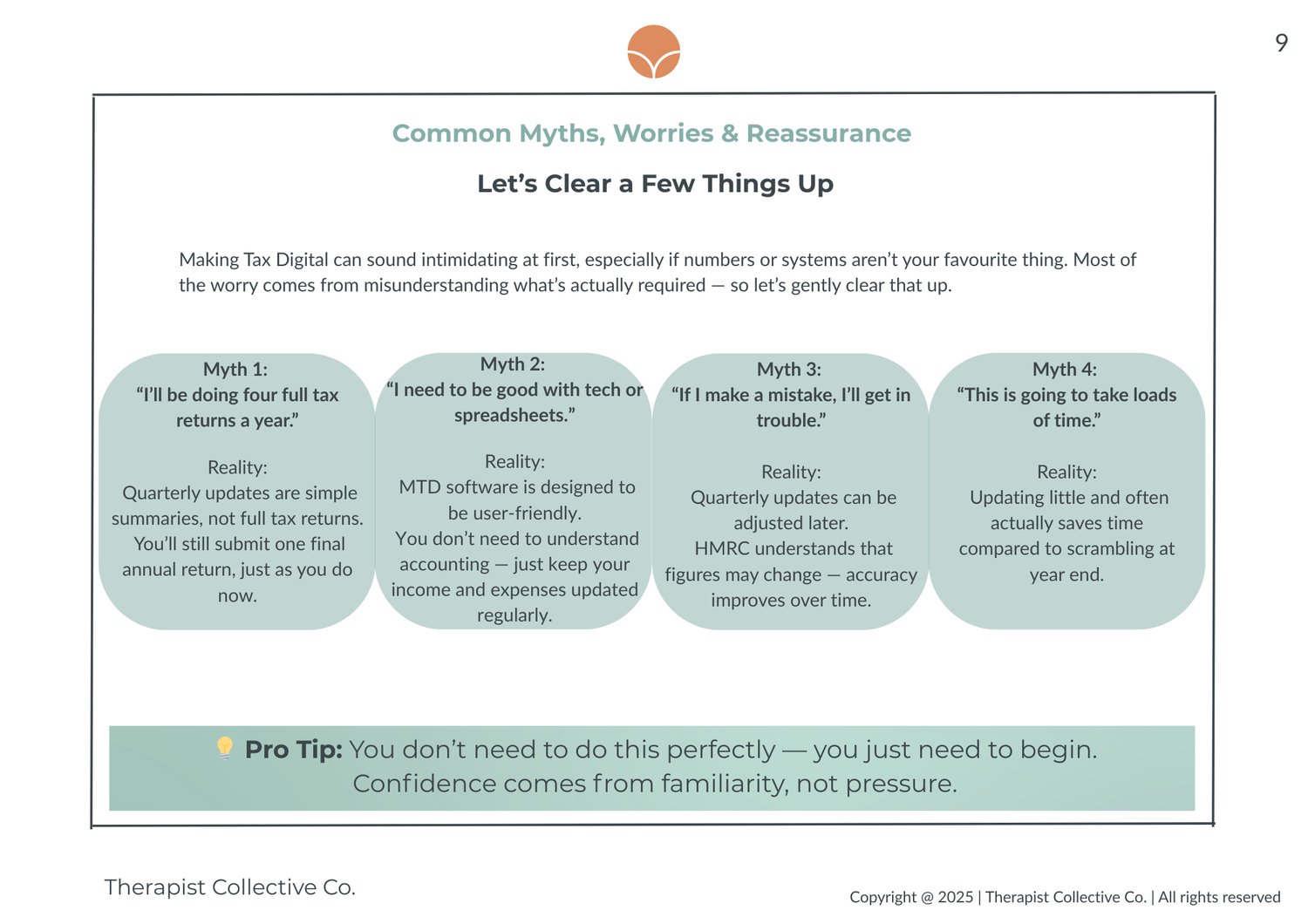

- Understand Making Tax Digital (MTD) rules for sole traders

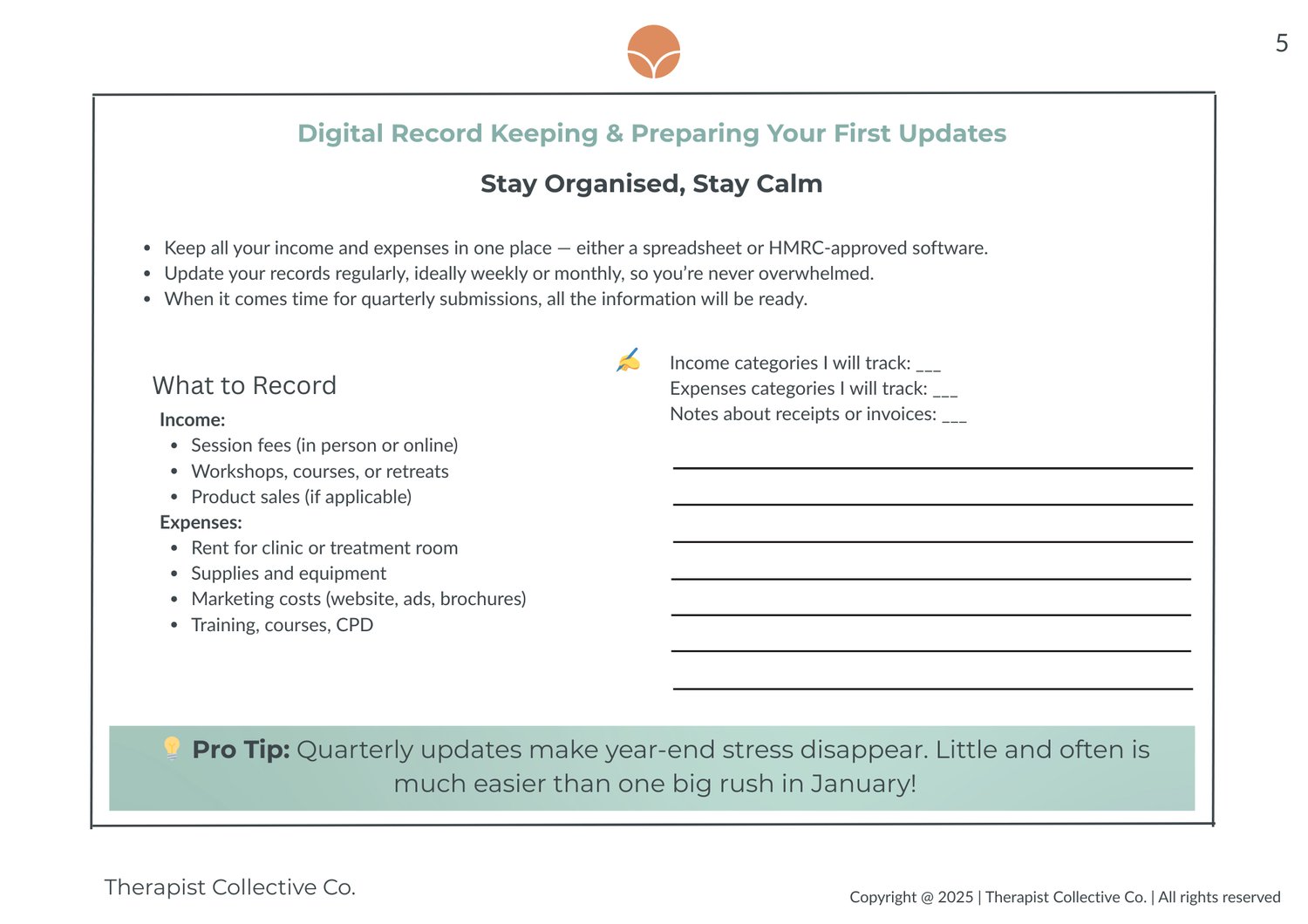

- Learn what to track and when to submit quarterly updates

- Use HMRC-approved software to simplify reporting

- Practical tips for managing income, expenses, and profit

By the end of this guide, you’ll feel confident managing your business finances, tax obligations, and HMRC reporting.

This guide is available on its own, or as part of the Therapist Essentials Toolkit, which includes three core resources designed to support therapists at the early stages of practice. Or for those who want the full collection, its included in the Complete Therapy Business Toolkit.

Created by Rachel - a therapist, educator and Examiner, Tutor & Digital/Business Support at the School of Bodywork. She supports students and qualified therapists with business, systems and practice development.