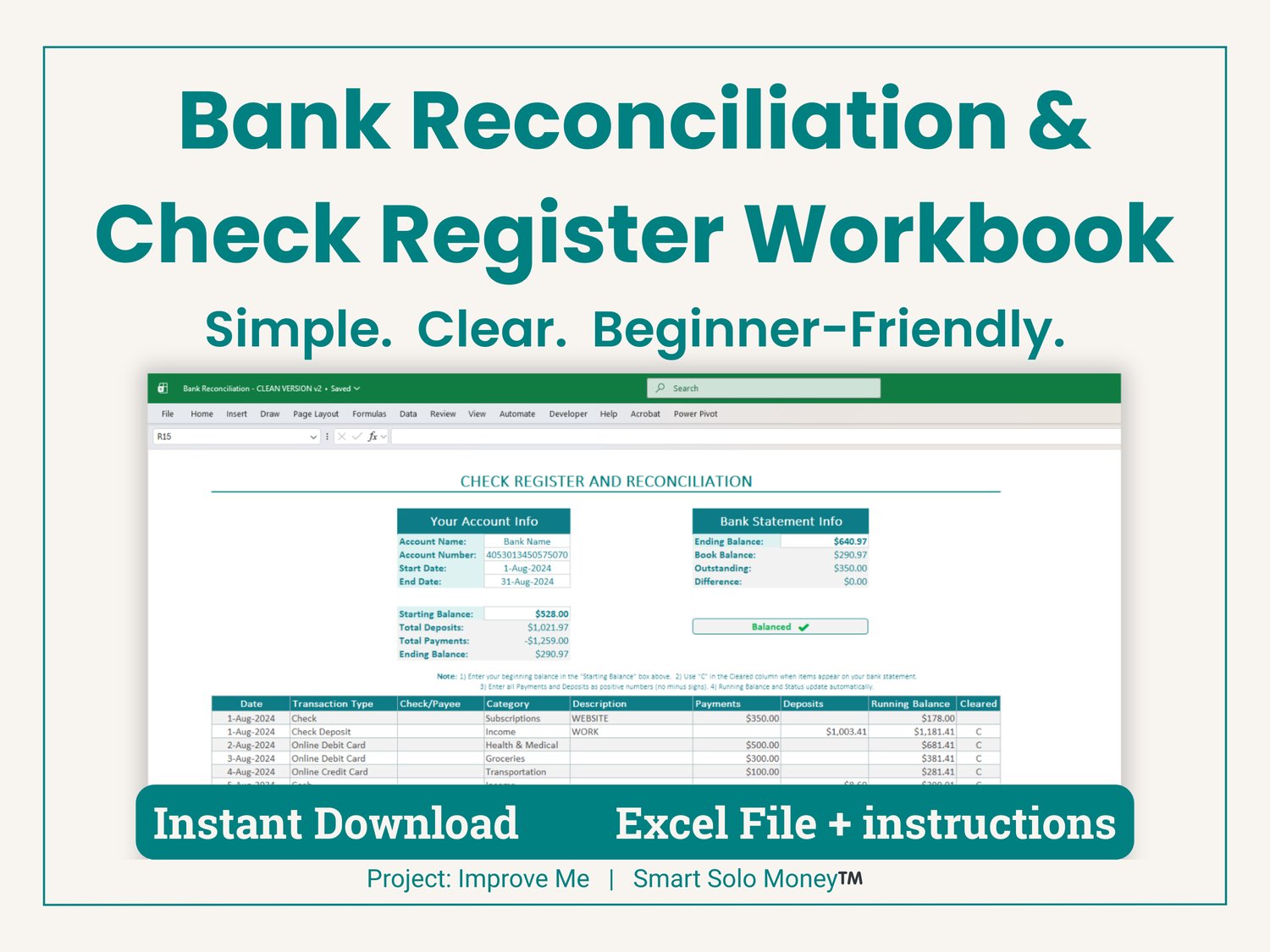

Bank Reconciliation & Check Register Workbook (Excel) [Simple, Beginner-Friendly Monthly Money Tracker]

Bank Reconciliation & Check Register Workbook (Excel)

A simple, clear way to keep your money organized — without stress or confusion.

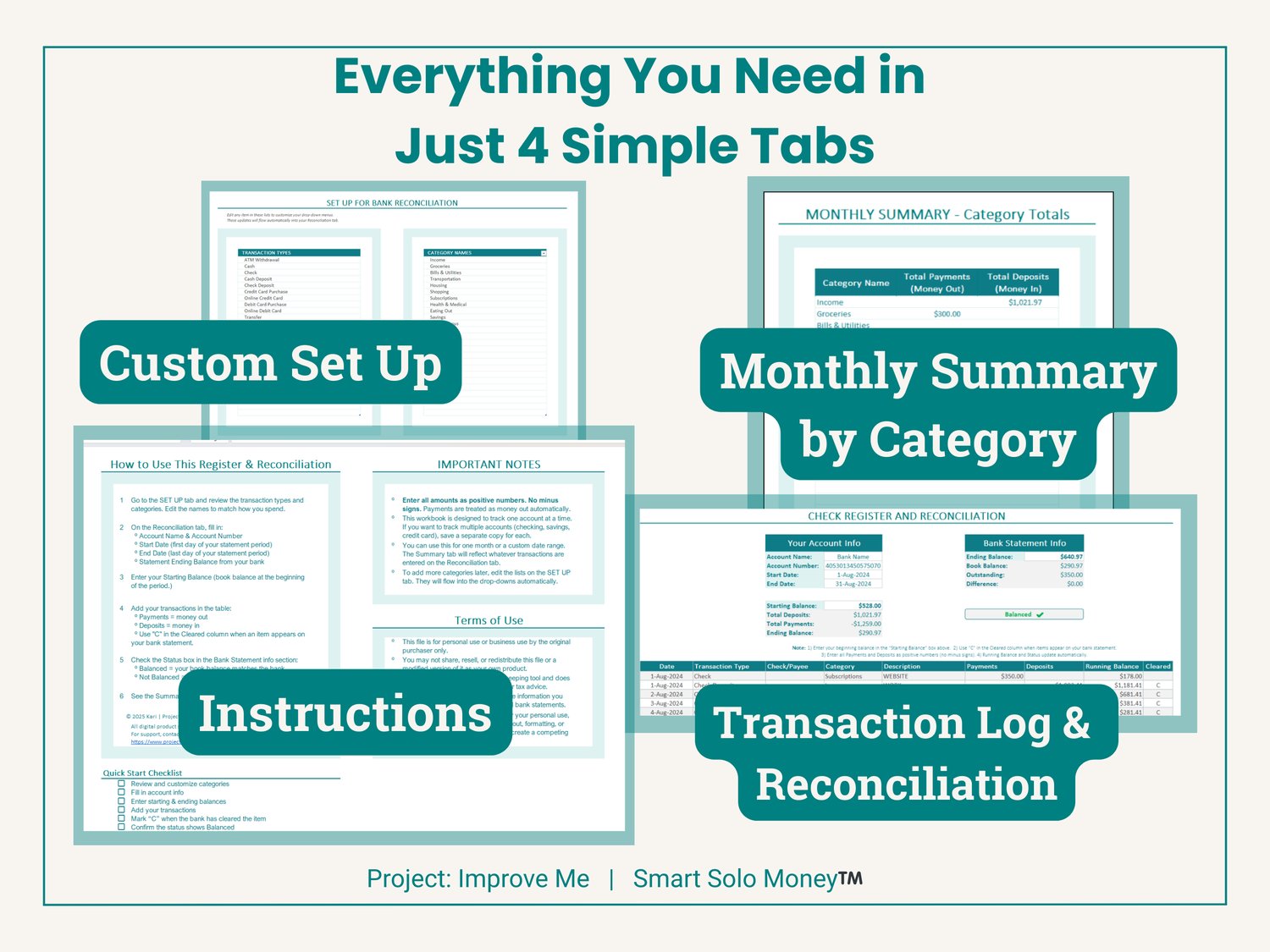

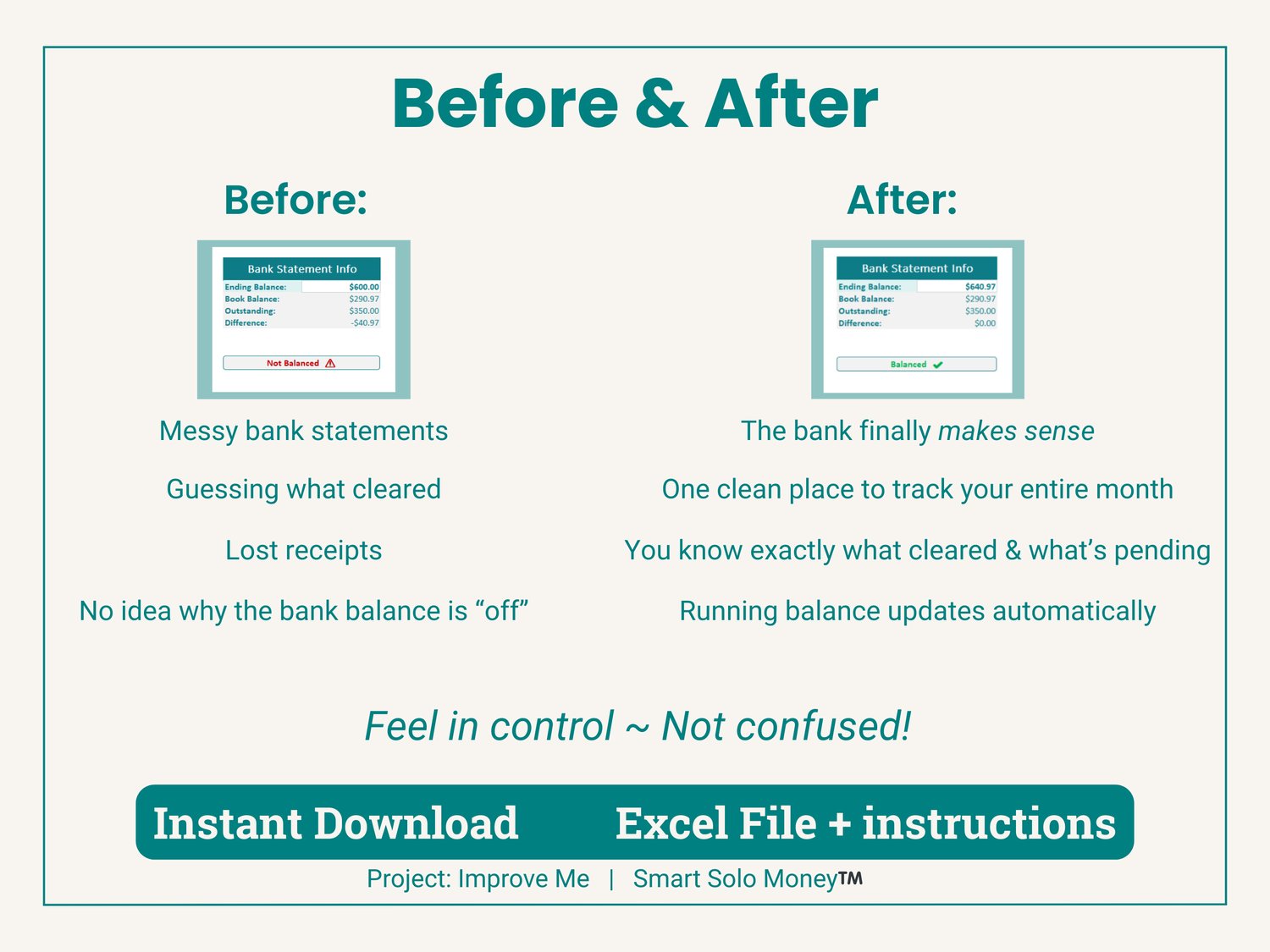

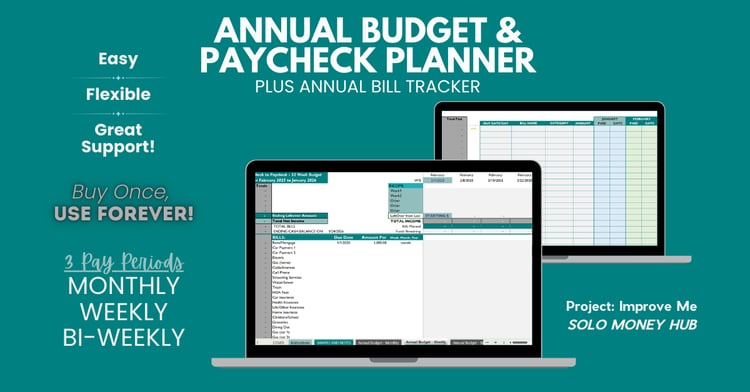

This beginner-friendly workbook helps you track your deposits, payments, cleared items, and running balance each month. Everything updates automatically so you can see exactly where your money stands at any moment.

Perfect for anyone who wants a calm, easy system to stay on top of their finances.

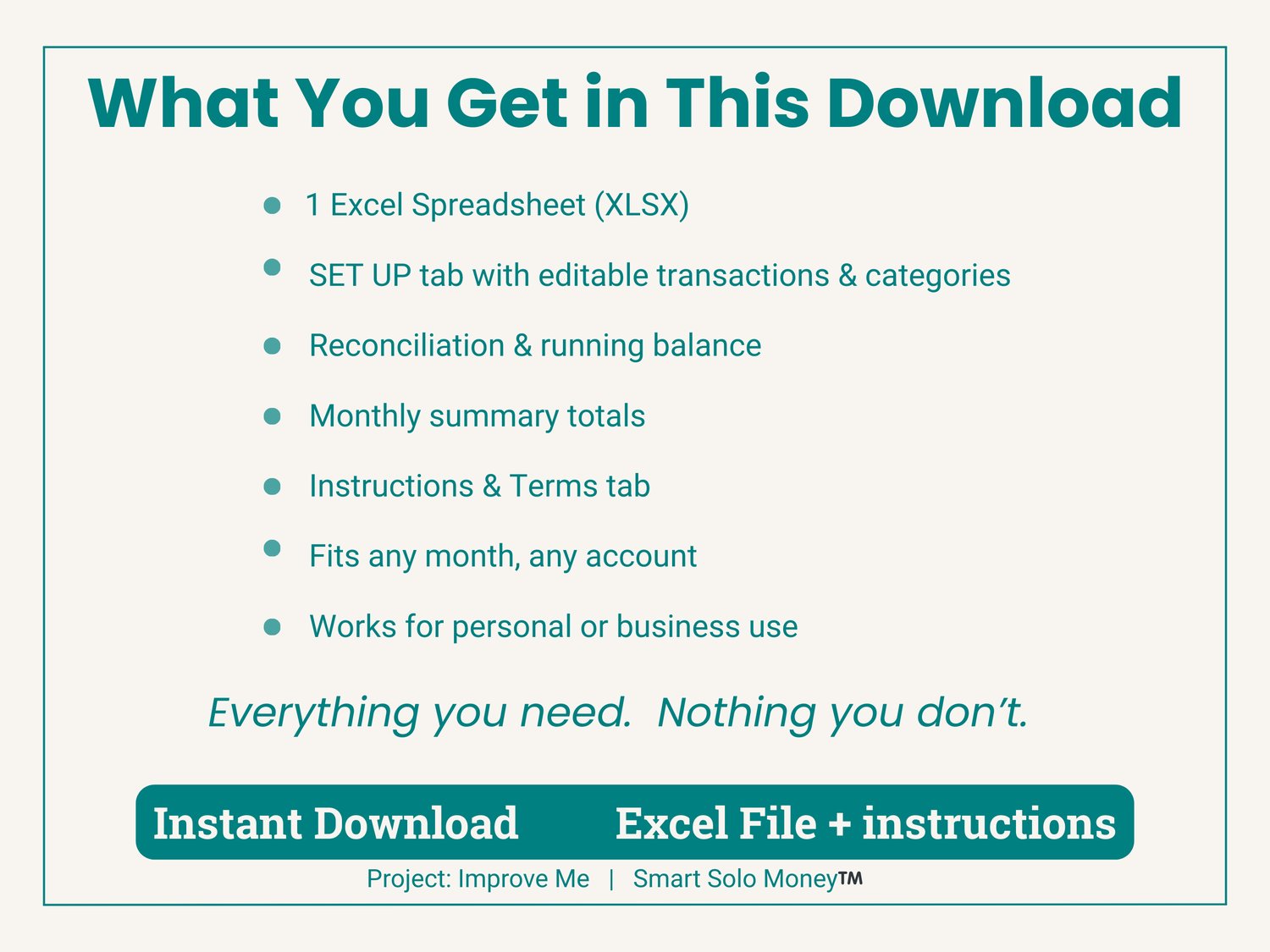

✨ What You’ll Get

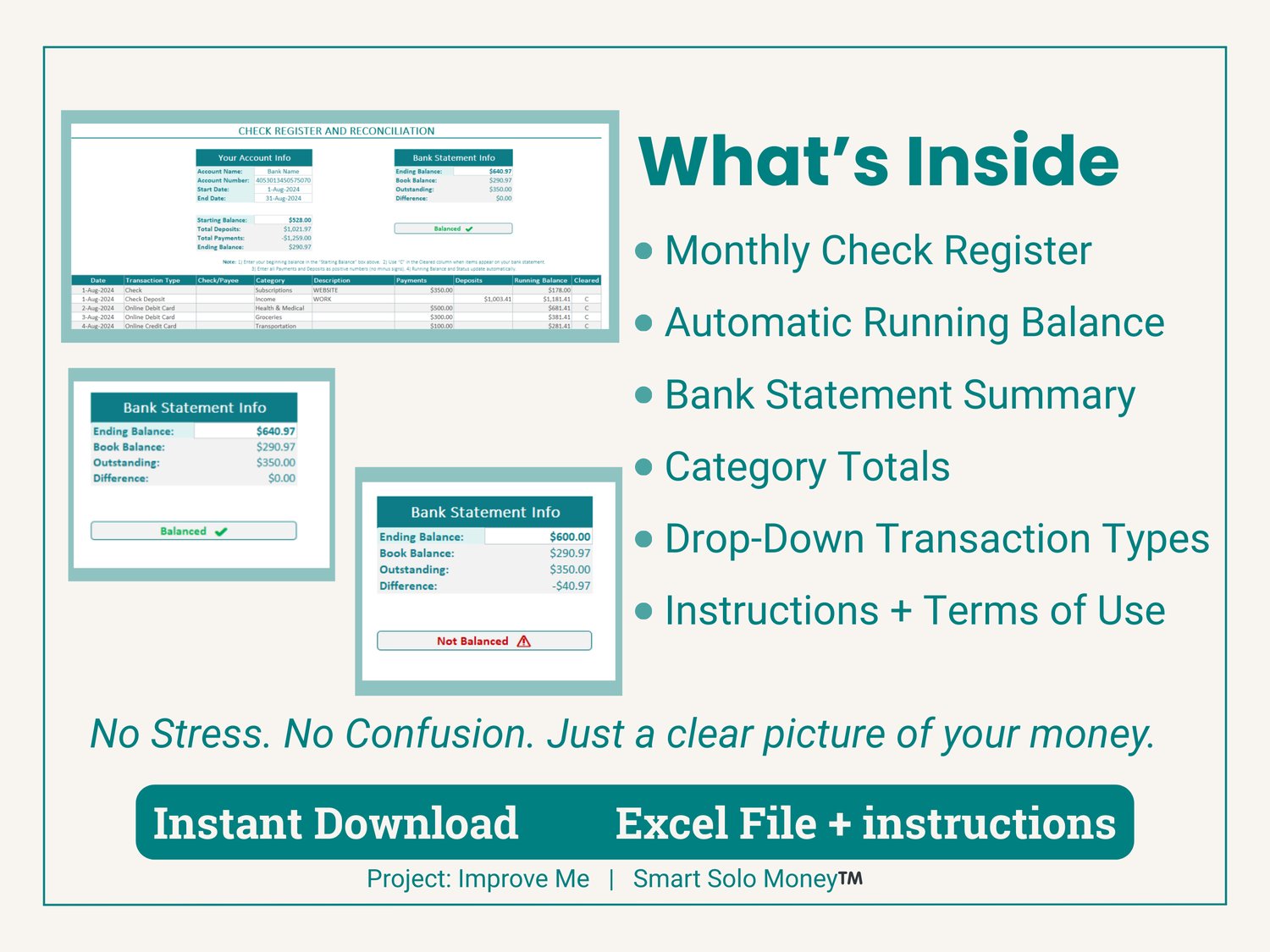

- ✔ Monthly Check Register

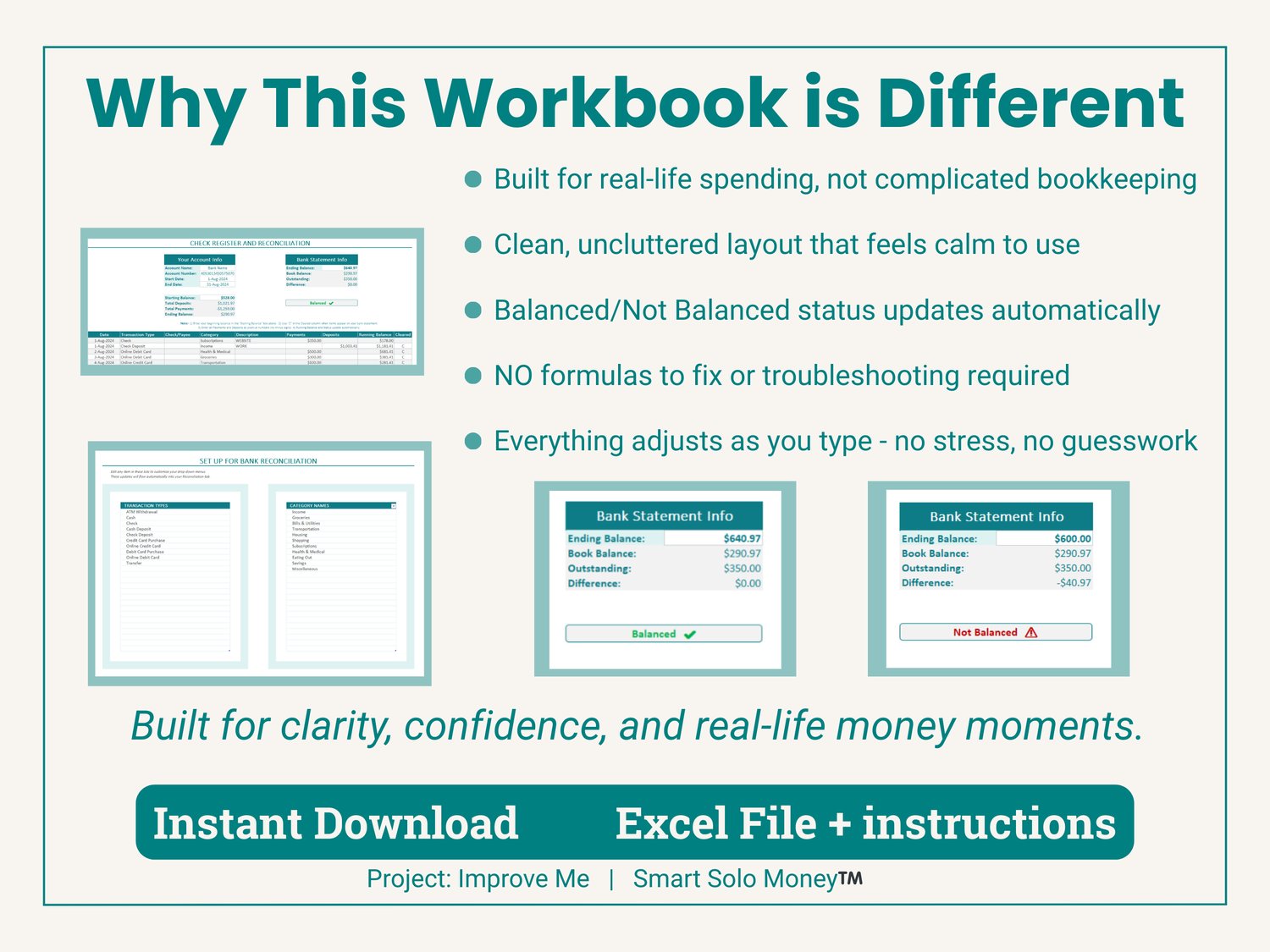

- ✔ Automatic Running Balance (no formulas needed)

- ✔ Bank Statement Summary (see balanced vs. not balanced instantly)

- ✔ Category Totals for the month

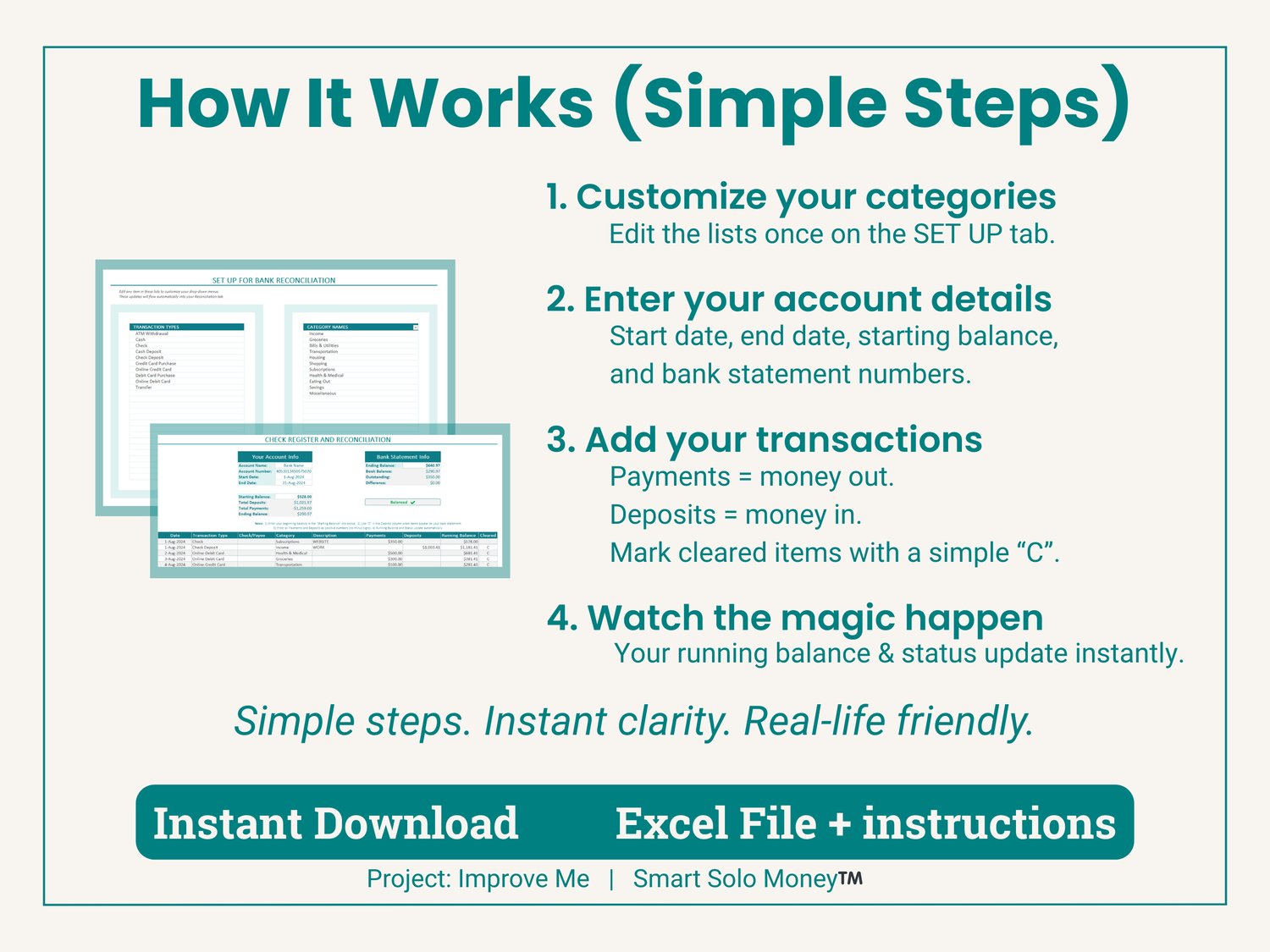

- ✔ Drop-Down Lists for transaction types + categories

- ✔ Instructions + Terms of Use included inside the file

- ✔ Clean, easy layout designed for real-life money clarity

✨ Who This Is For

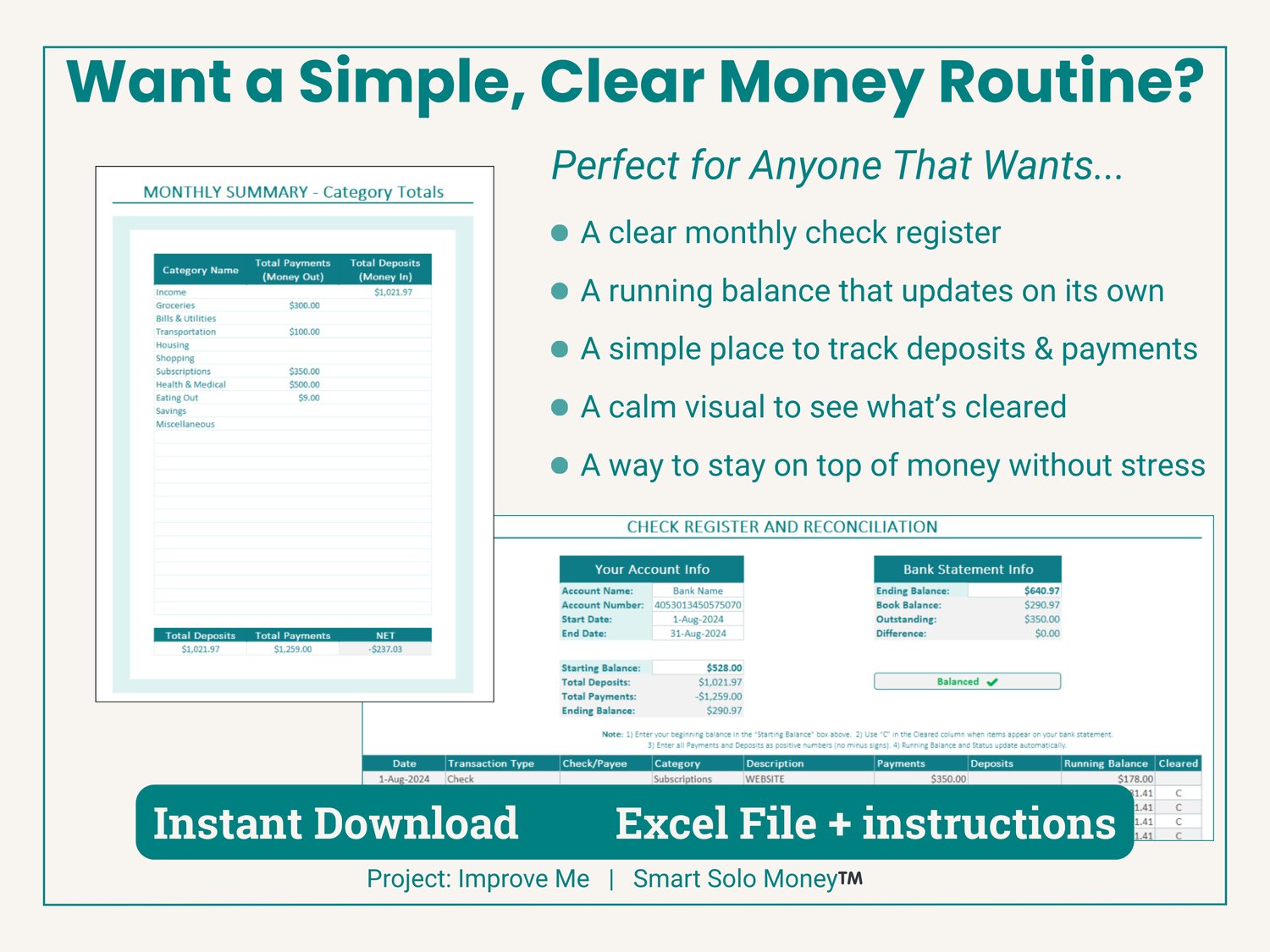

Perfect if you want:

- A simple check register you’ll actually use

- A clear way to track deposits & payments

- A calm visual to see what’s cleared

- A running total you don’t have to calculate

- A stress-free way to stay on top of your money

✨ File Format

- Microsoft Excel (.xlsx)

- Works on PC and Mac with desktop Excel

- Also works in Excel Online (some visual differences may occur)

✨ Important Notes

- Enter all amounts as positive numbers

- Payments = money out

- Deposits = money in

- Running balance updates automatically

- For multiple accounts, save a copy for each account

📌 Terms of Use

This product is for personal use or business use by the original purchaser.

You may not share, resell, or redistribute this file or any modified version.

All results depend on the information you enter. Always compare to your official bank statements.

❤️ Created For Real-Life Money Clarity

By Project: Improve Me | Smart Solo Money™

Need help? Contact: https://www.projectimproveme.com/contact-pim