Creating Automated Compound Interest Calculators in Excel

Introduction Calculating compound interest for different scenarios can become repetitive, especially if you need to adjust variables like interest rates, time periods, or compounding frequency. Thankfully, Excel allows you to automate these calculations by creating dynamic calculators. excel compound interest formula This article will guide you through building a user-friendly compound interest calculator in Excel, enabling you to handle multiple scenarios effortlessly.

Step 1: Plan Your Calculator Layout Start by organizing your Excel worksheet for clarity:

Input Section: Create fields for input variables, including Principal (P), Interest Rate (r), Frequency (n), and Time (t).

Output Section: Add a field to display the calculated Future Value (A).

Interactive Elements: Use input cells for user-defined values to make the calculator dynamic.

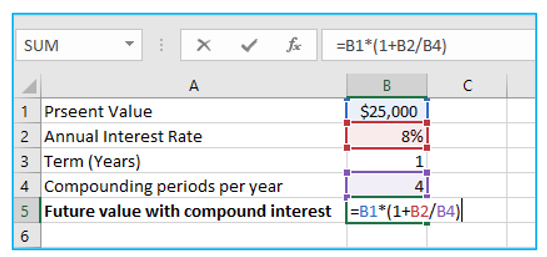

Step 2: Enter Sample Data For simplicity, input initial values in the respective cells:

Principal: $5,000 (cell B2)

Interest Rate: 4% (cell B3)

Frequency: 4 (quarterly, cell B4)

Time: 10 years (cell B5)

Step 3: Add the Compound Interest Formula Use Excel to automate the calculation of Future Value.

Select the output cell (e.g., B6) and enter the formula:

=B2*(1+B3/B4)^(B4*B5)

Replace the placeholders with your cell references.

Example: For the data above, the result will be $7,403.29.

Step 4: Make It Dynamic with Data Validation Enhance the calculator’s usability with drop-down menus and error checks:

Data Validation: Add drop-down lists for Frequency to select options like Monthly (12), Quarterly (4), or Annually (1).

Go to Data → Data Validation → List.

Enter options: 1, 4, 12.

Error Alerts: Set alerts for invalid data inputs to ensure calculation accuracy.

Step 5: Use Conditional Formatting Highlight important fields dynamically:

Apply conditional formatting to make the output cell stand out (e.g., bold text or color shading).

Go to Home → Conditional Formatting → Highlight Cell Rules.

Step 6: Save and Share Your Calculator Once complete, save your Excel workbook. Share the calculator with colleagues or friends to help them analyze compound interest scenarios effortlessly.

Conclusion Creating an automated compound interest calculator in Excel is not only practical but also empowers you to explore different financial scenarios with ease. By combining formulas, data validation, and conditional formatting, you can build a tool that’s both functional and user-friendly. Mastering such skills enhances your ability to make informed financial decisions.