HOW TO BECOME AN ERO!

Why Become an ERO?

💡 Why Work for Someone Else When You Can Keep 100% of Your Profits?

As an ERO, you’re not just a tax preparer—you’re a tax business owner. Instead of splitting fees or working under someone else’s brand, you’ll:

✔️ Own your tax business

✔️ Set your own prices

✔️ Keep ALL your earnings

Stop making someone else rich! It’s time to boss up and take full control of your financial future.

If you’ve ever wondered how tax professionals are making $50K-$100K+ per season, here’s the answer: They’re EROs.

🔑 What EROs Do Differently:

✔️ They own their tax business and set their own fees

✔️ They build teams and get paid from others’ tax filings

✔️ They offer bank products to increase profits

✔️ They keep 100% of their tax prep fees

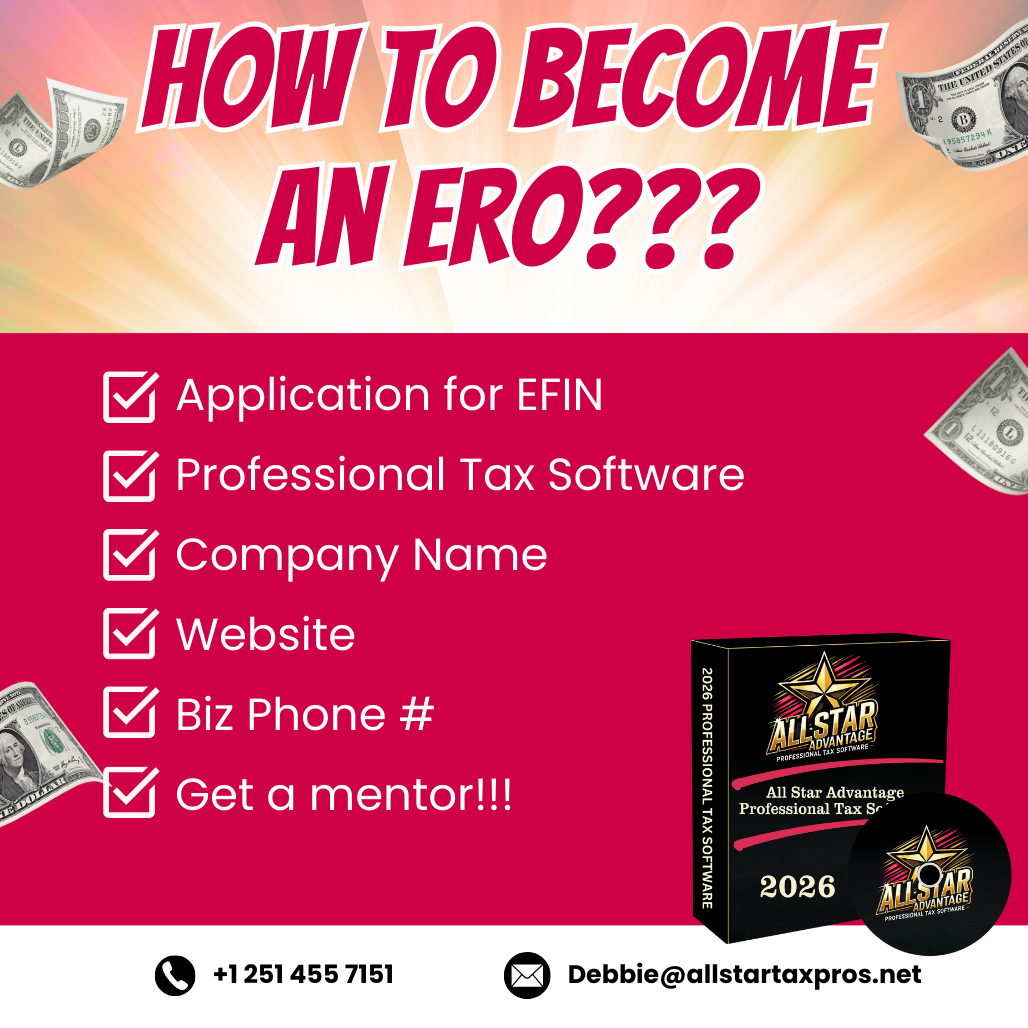

🛠 Every ERO Needs the Right Tools to Win!

To run a smooth & profitable tax office, you need:

✅ Professional Tax Software – Fast, accurate, and bank-integrated

✅ EFIN & IRS Registration – Official approval to file returns

✅ Marketing Strategies – To attract & retain clients

✅ A Strong Team – To scale your business beyond yourself

Don’t just wing it. Set yourself up for success!