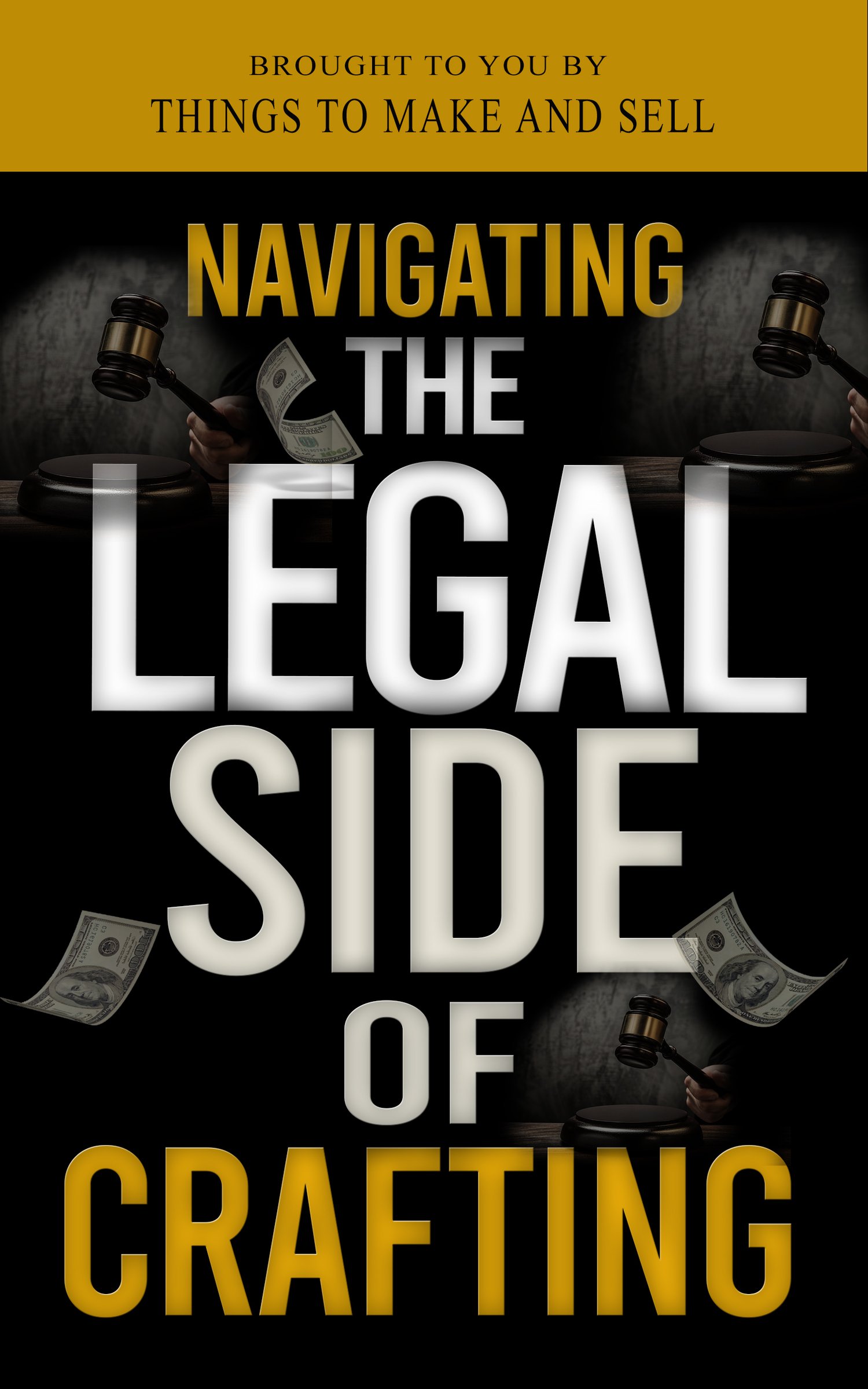

Navigating the Legal Side of Crafting

Turn Your Craft Passion Into a Legally Protected, Profitable Business Without the Overwhelm

Are you tired of losing sleep over legal questions that could make or break your craft business?

You started crafting because you love creating beautiful things.

But now that friends are begging to buy your work and strangers are discovering your talent, you're facing a maze of legal questions that keep you up at night:

- Do I really need a business license to sell at the farmer's market?

- What happens if someone gets hurt using something I made?

- Am I accidentally stealing someone's design by utilising that pattern I found online?

- Could I actually go to jail for messing up my taxes?

- How do I protect my original designs from being copied?

You're not alone. Every successful craft entrepreneur has faced these same fears. The difference between those who thrive and those who give up isn't talent—it's having the legal foundation to build with confidence.

What Happens When Creative Passion Meets Legal Reality

Sarah thought she was being careful. Her handmade jewellery business was growing beautifully until a customer claimed her earrings caused an allergic reaction. Without proper insurance or legal protection, one complaint turned into thousands in legal fees and nearly destroyed everything she'd built.

Marcus discovered too late that the woodworking patterns he'd been using weren't licensed for commercial use. A cease-and-desist letter forced him to remove dozens of products from his shop and start over with original designs.

Jennifer's pottery business was booming until the IRS caught up with her. Years of treating craft sales as "hobby income" resulted in penalties, back taxes, and interest that consumed most of her profits.

These disasters were completely preventable. Each of these entrepreneurs needed the same thing: a clear, practical guide to the legal side of crafting that doesn't require a law degree to understand.

Introducing "From Hobby to Business: Navigating the Legal Side of Crafting"

The Only Legal Guide Written Specifically for Creative Entrepreneurs Like You

This isn't another dry legal textbook filled with incomprehensible jargon.

This is a practical, step-by-step guide written in plain English by someone who understands that your passion is creating, not deciphering legal documents.

What Makes This Book Different:

✓ Real-World Examples from Actual Craft Businesses

Learn from the florist who discovered she needed special licensing, the jewelry maker who successfully defended her designs, and the woodworker who saved thousands through proper business structuring.

✓ Plain English Explanations

No legal jargon or confusing terminology. Every concept is explained clearly with practical examples you can actually use.

✓ Actionable Checklists and Templates

Don't just read about what you should do—get the exact steps and documents you need to implement immediately.

✓ Industry-Specific Guidance

Unlike generic small business books, this guide addresses the unique challenges facing makers, crafters, and creative entrepreneurs.

What You'll Discover Inside:

Chapter 1: Making the Transition - From Crafter to Business Owner

- The invisible line that turns your hobby into a business (and why crossing it without preparation can be costly)

- How to shift your mindset while keeping your creative passion alive

- Essential mindset changes that separate successful creative entrepreneurs from struggling hobbyists

Chapter 2: Choosing Your Business Structure

- Simple breakdown of LLCs, corporations, and sole proprietorships in language you can understand

- Which structure protects you best from liability while minimizing taxes

- Real examples of how the wrong choice can cost thousands (and how to avoid these mistakes)

Chapter 3: Licenses, Permits, and Registration Requirements

- The exact licenses you need (and which ones you don't) based on your specific situation

- State-by-state guidance for the most common craft business requirements

- How to avoid the most common compliance mistakes that shut down businesses

Chapter 4: Understanding Taxes for Your Craft Business

- Everything you can legally deduct (you'll be surprised how much you're missing)

- How to handle quarterly payments without cash flow disasters

- Simple record-keeping systems that make tax time painless instead of panic-inducing

Chapter 5: Protecting Your Creative Work - Intellectual Property Basics

- When and how to protect your designs legally

- How to use other people's patterns without getting sued

- The difference between copyright, trademark, and trade secrets (and which ones matter for your business)

Chapter 6: Product Liability and Insurance Considerations

- The types of insurance that protect your business and personal assets

- How to minimize liability risks without sacrificing creativity

- Real scenarios showing when insurance saved businesses from bankruptcy

Chapter 7: Online Sales and E-commerce Legal Requirements

- Navigate the complex world of sales tax for online sellers

- Privacy policies and terms of service that actually protect you

- International shipping legal requirements made simple

Chapter 8: Working with Suppliers, Contractors, and Employees

- How to avoid expensive misclassification penalties

- Protecting your business when working with suppliers and contractors

- Employment law basics that keep you out of trouble

Chapter 9: Customer Relations and Contract Basics

- How every sale creates a legal contract (whether you realize it or not)

- Handling custom orders and deposits professionally

- Preventing small customer issues from becoming expensive legal problems

Chapter 10: Growing Your Business - Legal Considerations for Expansion

- How to scale without triggering new legal requirements you're not prepared for

- Partnership and investment legal basics

- When to upgrade your business structure as you grow

Here's What Other Creative Entrepreneurs Are Saying:

"I wish I'd had this book when I started my pottery business. It would have saved me thousands in legal fees and so much stress. Every crafter should read this before they sell their first piece."

- Michelle K., Ceramic Artist

"Finally, someone explains business law in a way that makes sense for makers! The intellectual property chapter alone was worth the price of the book."

- David R., Woodworker

"The tax chapter helped me find deductions I'd been missing for years. This book literally paid for itself in the first month."

- Amanda S., Fiber Artist

The Real Cost of Not Having This Information

Consider what just ONE legal problem could cost you:

- Legal consultation: $300-500 per hour

- Business lawsuit defense: $10,000-50,000+

- Tax penalties and interest: Thousands of dollars

- Product liability claim: Potentially everything you own

- Trademark infringement settlement: $5,000-25,000+

This book costs less than one hour of legal consultation but gives you the knowledge to prevent most legal problems before they start.

Special Bonuses When You Order Today:

See the images for the two bonus books I added.

Your Investment in Legal Peace of Mind

Complete Package: Just $9

(Less than most people spend on craft supplies in a week)

Digital Download - Start Reading in Minutes

✓ 250+ pages of practical legal guidance

✓ 2 bonus resources included

✓ Instant access to digital download

✓ Works on any device - phone, tablet, computer

Don't Let Legal Confusion Hold Back Your Creative Dreams

Every day you delay getting proper legal protection is another day you're putting your business and personal assets at risk.

You've already invested countless hours perfecting your craft and building your reputation. Don't let preventable legal problems destroy everything you've worked to create.

Your passion deserves professional protection.

The most successful craft entrepreneurs aren't just the most talented—they're the ones who combine their creativity with smart business practices. This book gives you both the knowledge and confidence to join their ranks.

Order Now and Start Building Your Legally Protected Creative Business Today

[GET INSTANT ACCESS NOW - $9]

P.S. Remember, this isn't just about avoiding legal problems—it's about having the confidence to pursue bigger opportunities, charge what you're worth, and build the creative business you've always dreamed of. Legal protection is creative freedom.