•Taxit Tax Scenario Practice Lab™

📥 Instant Download

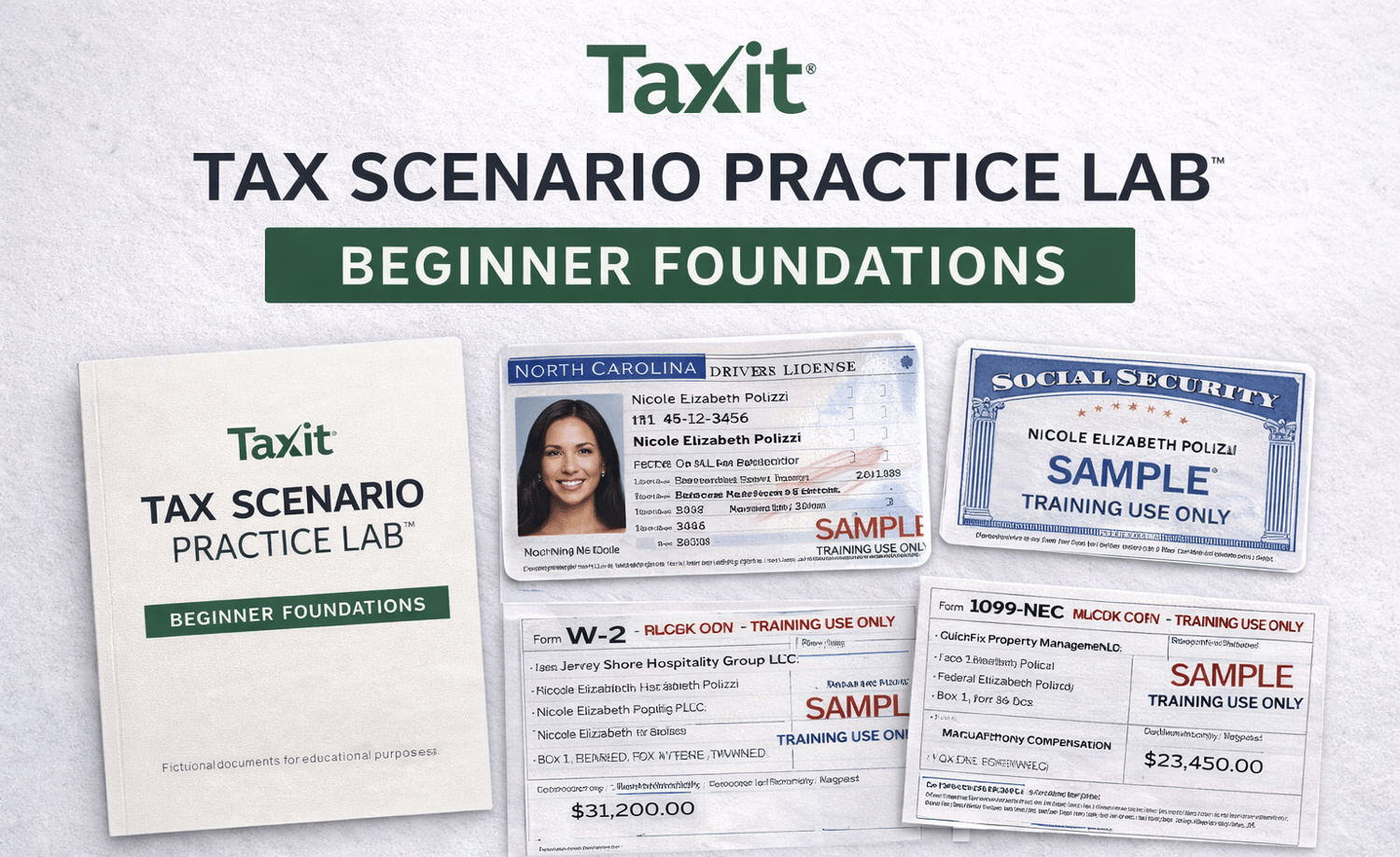

Taxit Tax Scenario Practice Lab™: Beginner Foundations

Realistic Individual Tax Scenarios for Hands-On Tax Prep Training

If you’re new to tax preparation — or you want real practice before working with real clients — this was built for you.

The Taxit Tax Scenario Practice Lab™: Beginner Foundations is a hands-on, scenario-based training kit designed to help you understand how tax returns actually work in real life — not just memorize rules from a book.

This is not tax software.

This is real-world tax preparation practice — without the risk of using real client data.

What This Practice Lab Is (and What It’s Not)

✔ A guided, skill-building practice experience

✔ Realistic client scenarios that mirror actual tax prep work

✔ A safe environment to learn, practice, and make mistakes

✘ Not a multiple-choice quiz

✘ Not a tax software tutorial

✘ Not a generic “fill-in-the-blanks” worksheet

This lab is about thinking like a tax preparer

What’s Included

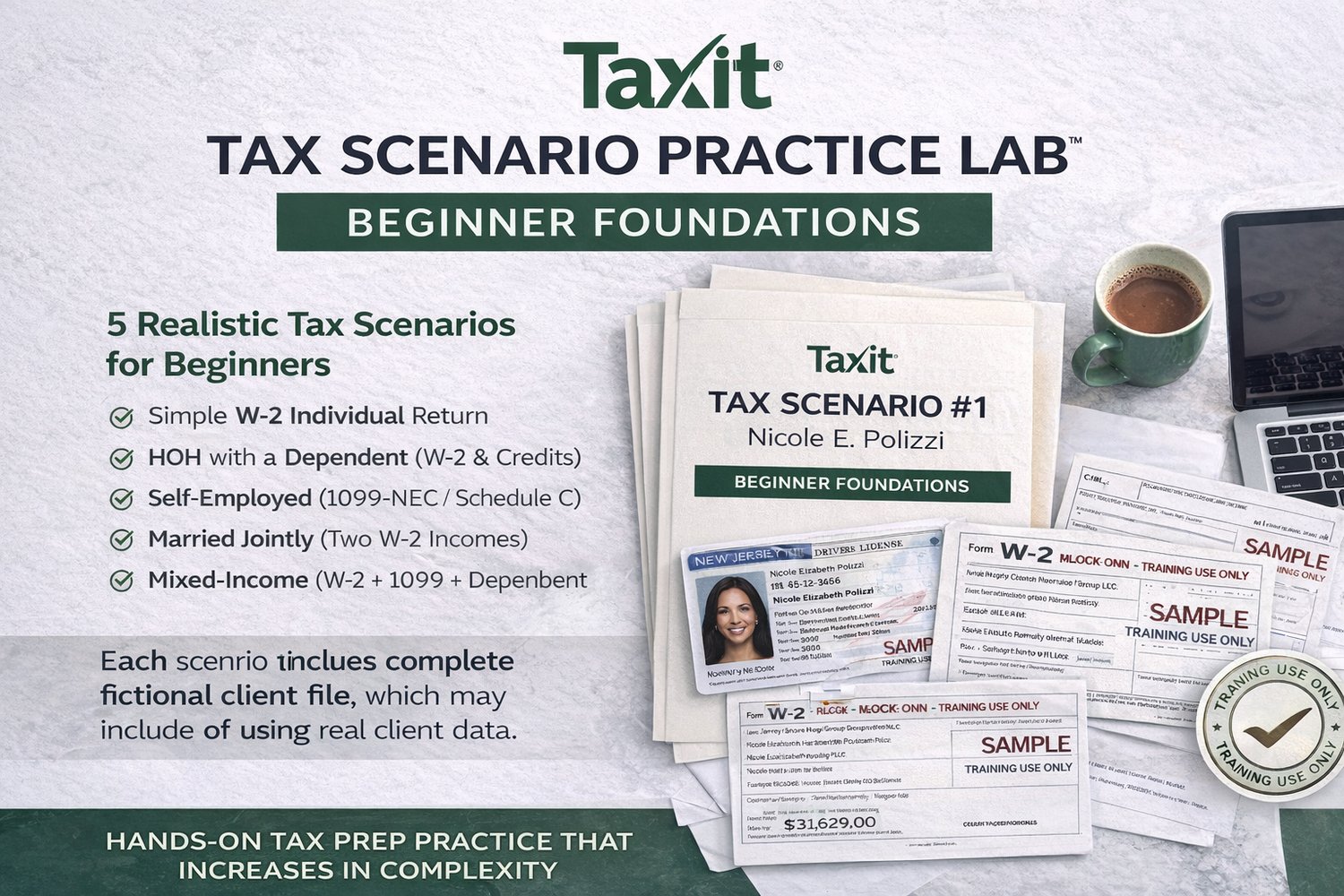

This Beginner Foundations edition includes five carefully structured tax scenarios, designed to build progressively in complexity:

• Simple W-2 individual return

• W-2 taxpayer with a dependent (Head of Household & credits)

• Self-employed taxpayer (1099-NEC & Schedule C)

• Married Filing Jointly household with two incomes

• Mixed-income household (W-2, 1099, and dependent)

Each scenario includes a complete fictional client file, which may include:

• Client background and scenario overview

• Mock identification documents (sample driver’s license & Social Security cards)

• Mock income documents (W-2s and 1099-NEC forms)

• Business expense summaries (when applicable)

• Childcare and dependent documentation (when applicable)

• Assignment instructions and guided review questions

• Answer key with coach notes and training insights

• Legal & training disclaimer

All documents are clearly labeled for training use only..

Why This Practice Lab Is Different

Most beginner tax courses focus on rules, definitions, and theory.

This practice lab focuses on application.

You’ll practice:

- Reading realistic tax documents

- Interpreting client information

- Identifying filing status and credits

- Recognizing red flags and common mistakes

- Thinking through a return step-by-step — like a real preparer

This lab bridges the gap between learning tax concepts and preparing tax returns.

It’s not your average scenario pack.

It’s skill-building training.

Who This Is For

✔ Aspiring tax preparers

✔ New or future PTIN holders

✔ Career changers exploring tax preparation

✔ Tax students and bootcamp participants

✔ DIY learners seeking a deeper understanding of Form 1040

✔ Instructors training entry-level preparers

No prior experience required.

Format & Access

• Delivered as a downloadable PDF training kit

• Includes a separate Certificate of Completion (non-certification)

• Use digitally or print for practice

• Lifetime access — no expiration

Important Training Notes

All names, Social Security numbers, employer details, addresses, and documents included in this product are fictional and created solely for training and educational purposes.

This product does not provide legal, tax, or accounting advice and is not intended for filing actual tax returns.

Part of the Taxit Tax Scenario Practice Lab™ Collection

This product represents the Beginner Foundations level and is designed to lead into future intermediate and advanced practice labs, due diligence scenarios, and real-world tax training tools inside the Taxit Digital Vault.

New training resources are added regularly as the collection grows.