Corporate Supermarket Exit Strategy

Are you thinking of exiting your business? Why South African Franchisee Supermarket Owners & Managers Must Download the FREE

“Corporate Supermarket Exit Strategy”

1. Because Exiting a Supermarket Is Now Harder Than Ever

The manual makes it clear:

In 2026, selling a supermarket is no longer about “good turnover”.

Buyers demand:

- Clean, auditable financials

- Zero labour disputes

- Energy independence

- Predictable EBITDA

Owners who don’t prepare 12–24 months in advance lose massive value— often 30% or more.

2. Because Corporates Are Actively Buying Back Franchises

Chains like Checkers, Spar, Pick'n Pay and others are:

- Aggressively buying back successful franchises

- Protecting supply chains

- Using their balance sheets to dictate terms

This guide explains:

- How corporates structure buyouts

- Where they squeeze value

- How owners can counter-position to protect themselves

Selling to Head Office without preparation is expensive and ruthless.

3. Because Lease Length Can Destroy Your Business Value

One of the most dangerous truths in the manual:

If your lease has less than 5 years remaining, your business value is close to zero.

The guide explains:

- Why buyers won’t touch short leases

- When to renew before selling

- How lease timing directly impacts valuation multiples

Many owners only discover such effects when it’s already too late.

4. Because Energy Independence Now Commands a Premium

Load shedding has permanently changed buyer behaviour.

The manual shows that stores with:

- Full solar

- Backup power

- Water redundancy

They are currently trading at approximately 15% higher multiples.

Energy resilience is no longer an “upgrade” — it’s a valuation lever.

5. Because Buyers Only Care About EBITDA — Not Your Effort

The guide brutally resets expectations:

- Your emotional attachment has zero value

- Buyers buy future sustainable earnings

- “Busy stores” without clean profit don’t sell well

It shows how to:

- Add back legitimate owner expenses

- Present “true net profit” correctly

- Avoid common valuation traps

This alone can materially change the sale price.

6. Because Hidden Problems Kill Deals Instantly

The manual is very clear:

- CCMA cases

- Tax disputes

- Casual staff without contracts

- Missing compliance certificates

👉 You cannot hide these.

They will surface in due diligence and kill deals instantly.

The guide shows what must be cleaned before you go to market.

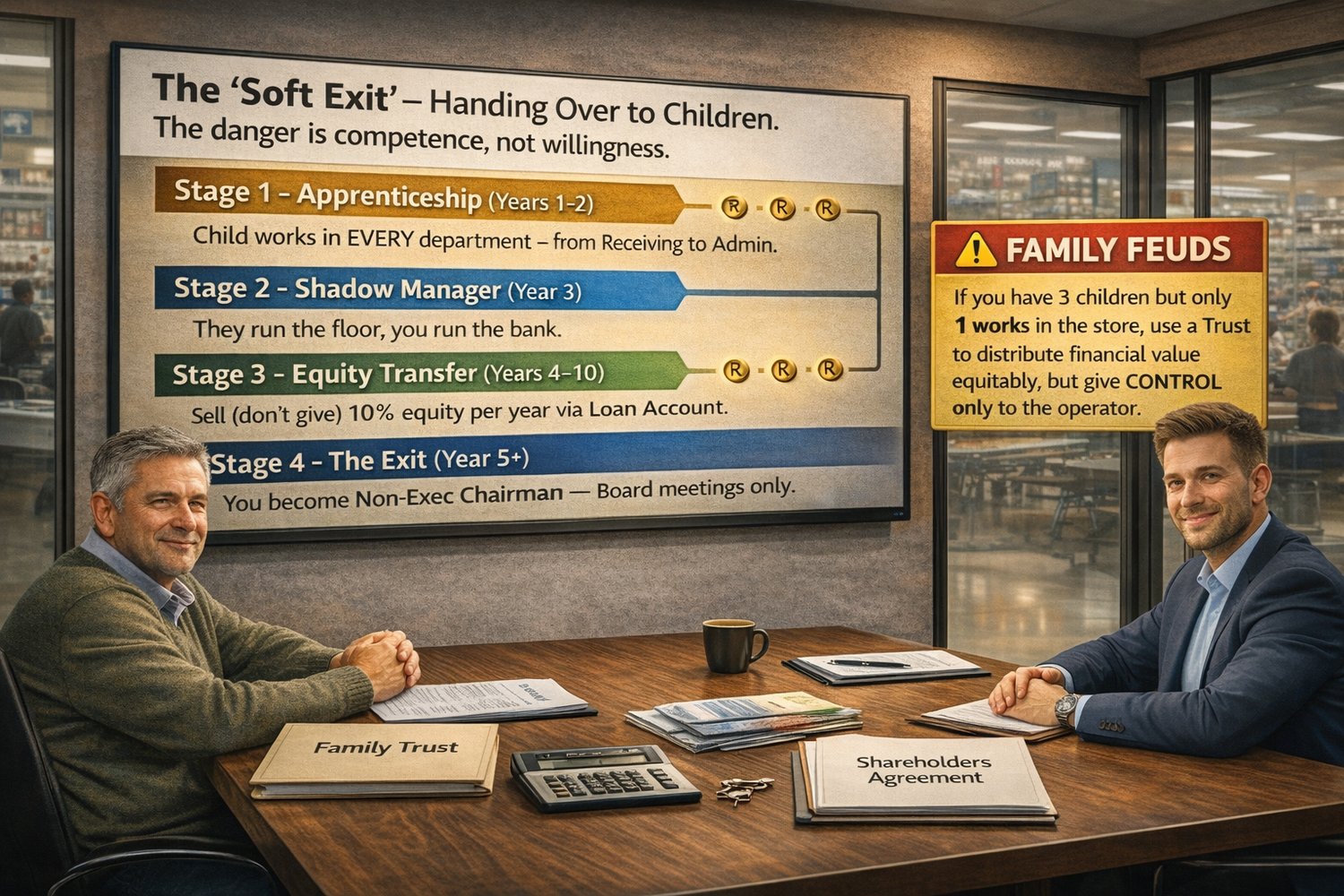

7. Because There Are Multiple Exit Paths — and Each Has Risks

This guide doesn’t assume one exit.

It covers:

- Corporate buyouts

- Partner or management buyouts

- Vendor finance structures

- Family succession (“soft exits”)

- The last resort is business rescue and liquidation.

Each option includes:

- Risks

- Timelines

- Legal traps

- Cash-flow realities

Owners learn what fits their situation — not a generic fantasy.

8. Because Section 197 (LRA) Is Non-Negotiable

Many owners still believe they can:

“Just retrench everyone and sell clean.”

This manual explains clearly:

- Staff automatically transfer with the business

- Leave pay calculations

- Union consultation requirements

- What liabilities move to the buyer vs seller

Getting Section 197 wrong can cost millions.

9. Because Tax Can Wipe Out Years of Work

The guide breaks down:

- Capital Gains Tax

- Dividends tax traps

- VAT implications

- “Going Concern” structuring

It also warns against:

- Dividend stripping

- Last-minute cash extraction

- Structuring errors SARS actively targets

Good structuring can save life-changing money.

10. Because Retirement Is a Calculation — Not a Feeling

One of the most sobering sections:

“You don’t exit when you’re tired. You exit when the business is ready.”

The guide forces owners to ask:

- Can I live on the interest?

- Have I priced medical inflation?

- Do I need a post-sale consulting income?

This is real planning — not wishful thinking.

11. Because If You Can’t Sell, You Must Close Correctly

The manual doesn’t avoid uncomfortable realities.

If selling isn’t possible, it explains:

- Business rescue vs compromise vs liquidation

- Director liability risks

- Reckless trading warnings

- How to protect personal assets legally

This section alone can prevent personal financial ruin.

12. Because This Knowledge Is Rare — and It’s FREE

Most owners only learn these lessons:

- Too late

- From expensive advisors

- Or after value is already lost

This guide puts strategic exit knowledge in the owner’s hands — early enough to act.

Final Word — Why RIDBS

This manual reflects the RIDBS philosophy:

You don’t build a supermarket to work forever.

You build it to exit well.

If you are:

- 5–10 years from selling

- Tired but unsure what’s next

- Wondering what your business is really worth

- Exposed to hidden risks you can’t see

Then this guide gives you clarity, leverage, and control.

👉 Download the FREE “Corporate Supermarket Exit Strategy”

👉 Learn more about disciplined, owner-focused retail strategy at https://ridbs.co.za

RIDBS doesn’t sell hope.

RIDBS prepares owners for reality — and protects value before it’s lost.