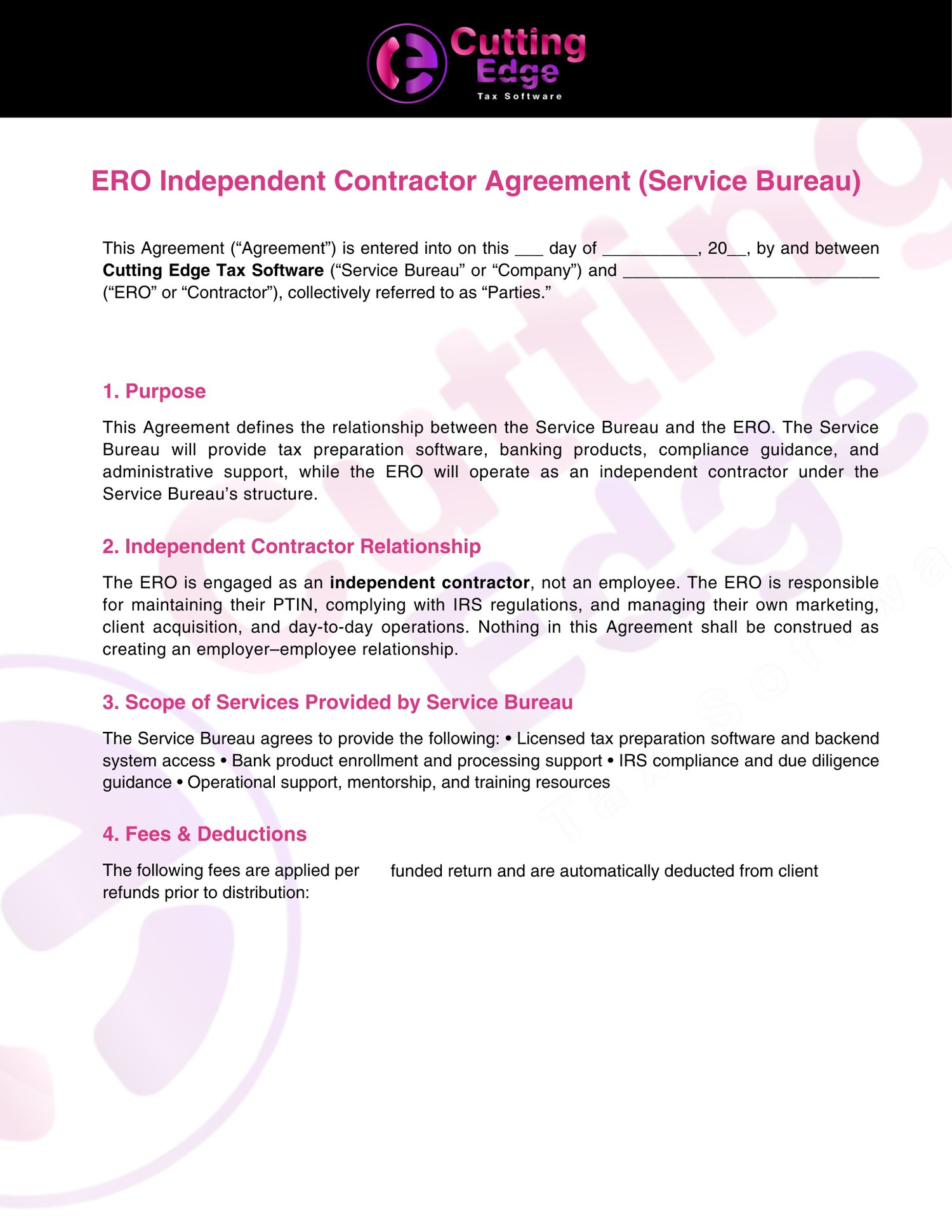

ERO Independent Contractor Agreement

On Sale

$29.99

$29.99

Key Sections of an ERO Independent Contractor Agreement (Cutting Edge Version)

1. Parties & Purpose

- Identifies the ERO business and the independent contractor.

- States that the contractor will assist with tax preparation, filing, and related services.

2. Independent Contractor Status

- Clarifies that the contractor is not an employee.

- Contractor is responsible for their own taxes, insurance, and licensing.

- No benefits, unemployment, or workers’ comp from the ERO.

3. IRS & Circular 230 Compliance

- Contractor must follow IRS rules for EROs, preparers, and tax professionals.

- Acknowledges compliance with Circular 230 standards.

- Requires maintaining active PTIN (Preparer Tax Identification Number).