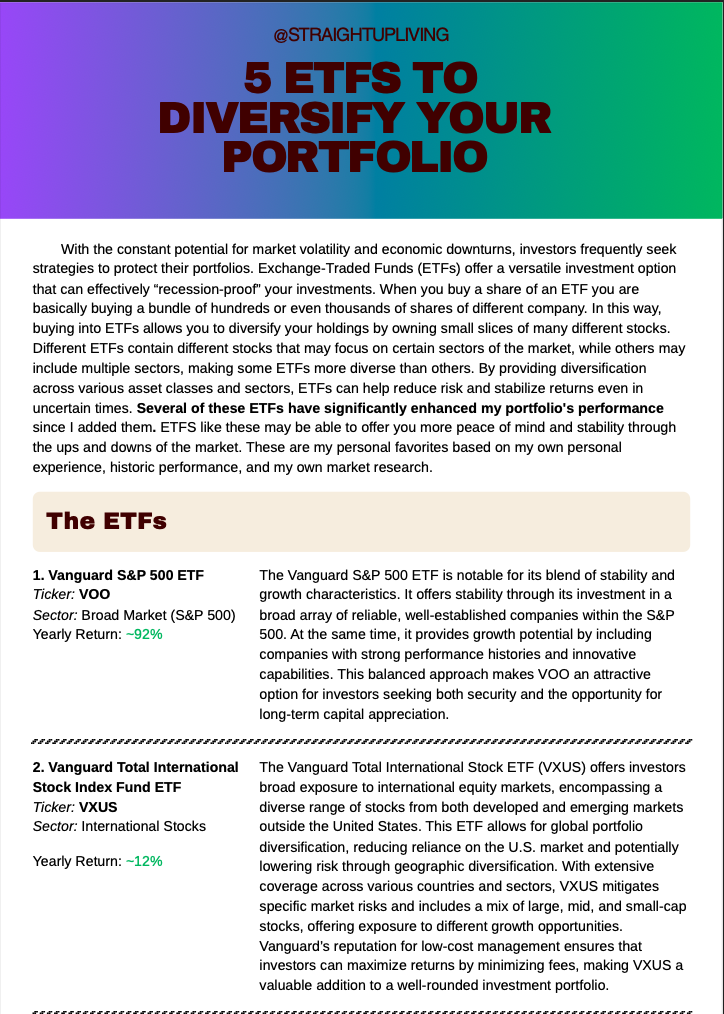

5 ETFS to Diversify your Portfolio

The beauty of ETFs is that they allow investors to capture total market growth instead of trying to predict winning stocks. With the constant potential for market volatility and economic downturns, investors frequently seek strategies to protect their portfolios. Exchange-Traded Funds (ETFs) offer a versatile investment option that can effectively “recession-proof” your investments. When you buy a share of an ETF you are basically buying a bundle of hundreds or even thousands of shares of different company. In this way, buying into ETFs allows you to diversify your holdings by owning small slices of many different stocks. Different ETFs contain different stocks that may focus on certain sectors of the market, while others may include multiple sectors, making some ETFs more diverse or high risk than others. By providing diversification across various asset classes and sectors, ETFs can help reduce risk and stabilize returns even in uncertain times. Several of these ETFs have significantly enhanced my portfolio's performance since I added them. ETFS like these may be able to offer you more peace of mind and stability through the ups and downs of the market. These are my personal favorites based on my own personal experience, historic performance, and my own market research.