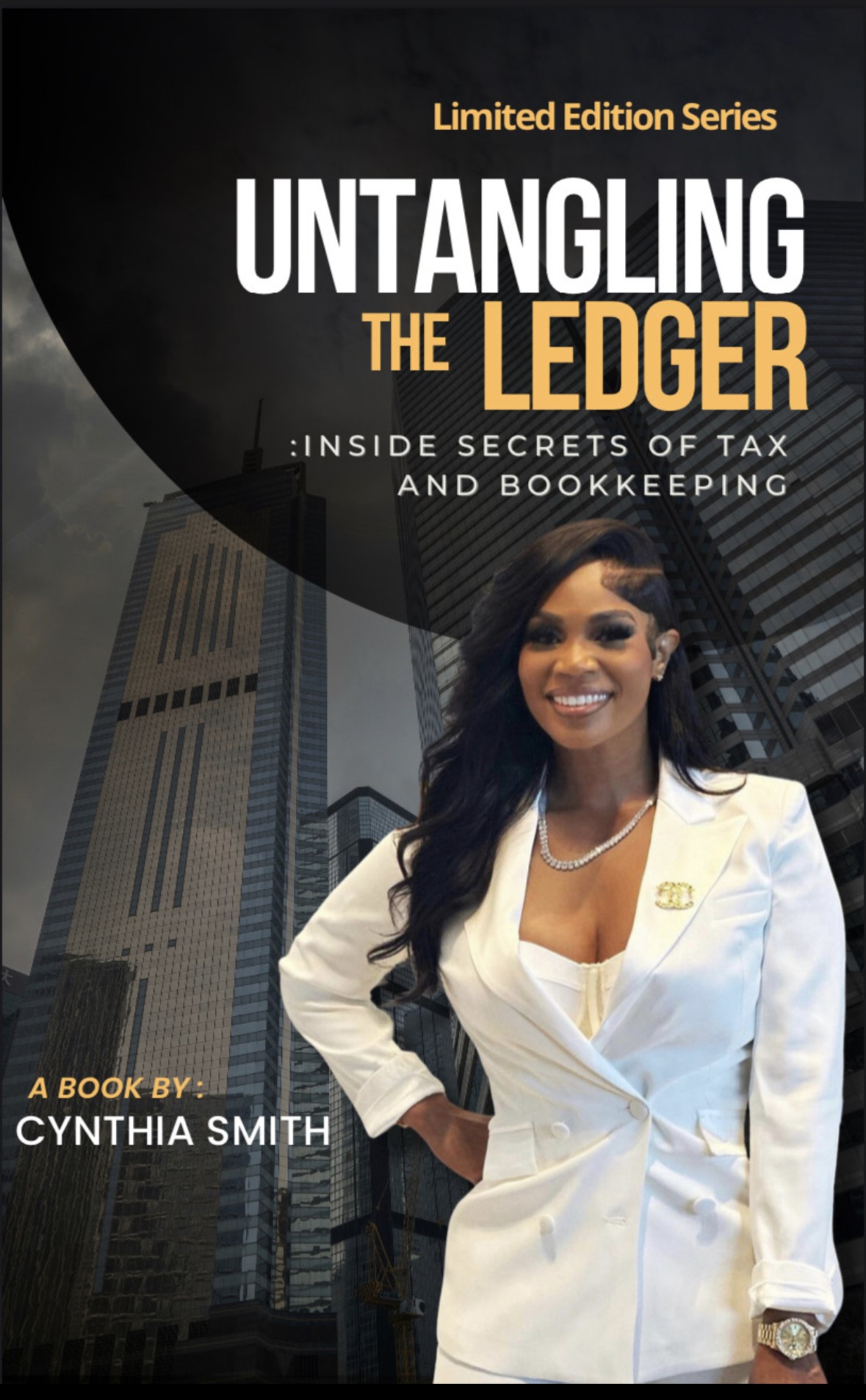

Untangling The Ledger: Inside Secrets of Tax and Bookkeeping Ebook

"Your time is limited, so don't waste it living someone else's life." - Steve Jobs

Are you interested in increasing your income, refining your tax preparation skills, and transforming a part-time hobby into a lucrative business? I understand your aspirations. You desire to generate sufficient funds to spend quality time with your family while maintaining your current lifestyle. You want to be your own boss and retain all the earnings from your hard work during the tax season and during off season.

You are already knowledgeable about tax preparation. What you seek is the essential information on successfully operating a profitable tax preparation business, without any unnecessary details. If that resonates with you, my friend; you have come to the right place.

I can relate to people’s situation. I used to find myself in a job, which did not give me the flexibility I needed as a single mom, spending countless hours each day with little financial reward or recognition. I made minimal progress in other ventures, only to see others reap the benefits. I longed to discover a substantial opportunity, that I could transform into a full-time business without feeling overwhelmed by the process.

But then, COVID came and change many lives forever.

I developed a system that actually works, allowing me to convert my seasonal tax preparation company into a remarkably successful business that stayed open year around. In a few tax seasons, I was able to quit my day job, eliminate my debts, and transition to running my tax/bookkeeping business full-time.

In this comprehensive resource, I have compiled all my most valuable lessons and strategies, presented in a step-by-step format. You will gain insights into:

*The qualifications required to become a tax preparer.

*Detailed instructions on obtaining your EFIN (Electronic Filing Identification Number)

*How to acquire your business EIN (Employer Identification Number) and register with your state.

*Real estate secrets for success in the industry.

*Choosing the right tax software and affiliating with a tax bank.

*Effective methods for attracting new clients, including when, where, and how to do so.

*Client onboarding and office management.

*Business Tax 101

*Basic Bookkeeping

In addition, I will share all the tips and tricks I have accumulated over the years to effectively --- manage a growing tax business.